By Jack Barnett

Consumers reacting to scaling prices by cutting spending is expected to grind the UK economy to a halt, new surveys published today revealed.

Private sector firms think they will squeeze out zero growth over the next three months, according to the Confederation of British Industry (CBI), the country’s largest business lobby group.

Businesses are beginning to feel the effects on their finances from households prioritising essential purchases due to their budgets being gripped by sky-high inflation.

Over the last quarter, activity in the private sector came in at a net eight per cent, up slightly from five per cent, but much lower than May’s net positive 23 per cent reading.

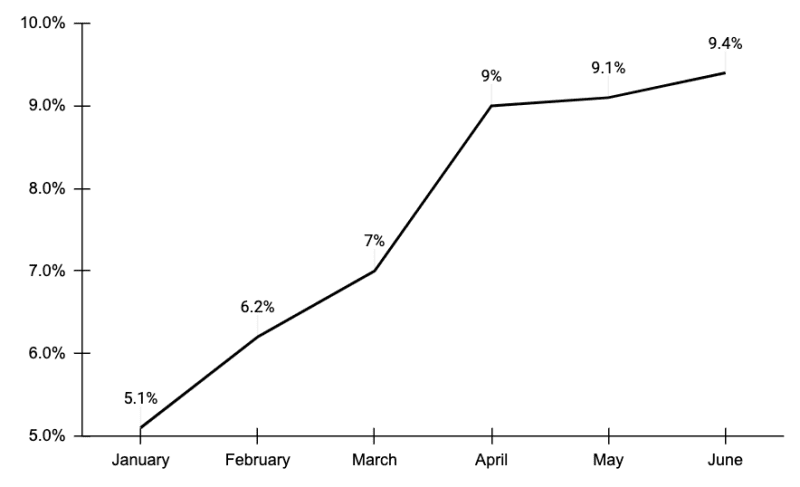

Prices are up 9.4 per cent over the last year, the quickest acceleration since 1982. That has prompted the Bank of England to hike interest rates five times in a row to a 13-year high of 1.25 per cent, adding to the squeeze on households and businesses.

A separate survey published by consultancy BDO chimes with the CBI’s findings that surging inflation is crimping the UK economy.

Over six in 10 firms think the cost of living crisis and higher energy prices caused by Russia’s invasion of Ukraine disrupting the European energy market will damage their performance over the next half year.

“As firms and consumers continue to be buffeted by rising prices, private sector activity has slowed to a near standstill,” Alpesh Paleja, lead economist at the CBI, said.

Paleja added a potential more than 60 per cent rise in the energy price cap in October will tighten the screw on households.

The UK economy has performed much worse than expected at the beginning of the year, mainly driven by inflation hitting the highest level in the G7.

The International Monetary Fund last week downgraded its UK growth projections in 2023 to 0.5 per cent, also the lowest of any rich country.

“Consumer spending isn’t going to restart the engine on growth this time,” Paleja said, recommending “boosting business investment will help to fill the void left by households, but incentives need to be bold, or they won’t scratch the surface.”

“Consumer spending isn’t going to restart the engine on growth this time,” Paleja said, recommending “boosting business investment will help to fill the void left by households.”

The CBI wants Tory leadership hopefuls Rishi Sunak and Liz Truss to implement a permanent successor to the 130 per cent business investment tax relief that ends next April.

Truss has promised to reverse the planned six percentage point corporation tax hike. Sunak believes tax reliefs are a more effective way to stimulate business investment.

Both Liz Truss and Rishi Sunak’s campaigns did not respond in time to a request for comment.

The post Sky-high inflation slows UK private sector economy to ‘standstill’ appeared first on CityAM.