By Kimberly Butler

Bitcoin has been bouncing around a little over the last week, but always within its well established range around $22,000.

As ever, there’s a whole world of activity going on that completely belies that headline number so many of us use as the main indicator.

The Lightning network capacity continues to grow and anew high was reached just yesterday of 4,398 Bitcoin. There is real, active deployment of Lightning applications right now across the UK, especially in the Isle of Man where organisations such as CoinCorner and Bridge to Bitcoin have been extremely active.

My Twitter feed is now filled daily with announcements of new businesses now accepting Bitcoin directly, the most visible this week being, of course, Oxford Football club, covered by theBBC here.

Meanwhile an announcement between Coinbase and Blackrock didn’t quite get the coverage I expected it to since this is a significant development. Blackrock, after all, has over $10trn under management and has just offered Bitcoin trading to its client base. Think about that for a moment.

I am not personally involved with large volume BTC trading, but I do know people who broker these sorts of deals. Whilst I’m not permitted to provide details, I can reveal there has been a significant uptick in demand from new very large buyers especially in the last six weeks via OTC channels for Bitcoin. Make of that what you will.

I was also caught off guard this week bythis post that somehow made its way into my Twitter feed. As most of you know I have been Bitcoin mining for years and have always known that the UK and Ireland produce almost zero hashrate, something I covered in this article a couple of months ago. However, perhaps that’s about to change as Irish firm Scilling Mining begins to offer complete (and fully green and renewable) solutions. Great to see such innovation and growth.

In legal news, “Dr” Craig Wright was awarded a total of £1 in damages in his libel case against Peter McCormack and received ascathing dressing down from the judge for his continued and blatant disregard for “truth” a theme that is bizarrely common for the failed Bitcoin fork (BSV) leader. Of course, as always, his cronies passed it off as a victory while Twitter did its thing.

Economically, things continue to go from bad to worse. The Bank of England raised interest rates again by an eye watering 50 basis points to 1.75%, the first time it has done so for 27 years. Of course, standard economic argument says that in times of inflation you raise interest rates to cool demand, but the reality is that I doubt this is demand driven inflation.

More likely, this is energy, supply line and monetary policy driven inflation and since the cost of living is accelerating faster than at any time in recent history in real terms, it will simply do even greater damage to the economy. Recession absolutely confirmed.

Thank goodness we have Bitcoin as a lifeline.

And look, I got through the whole thing without mentioning Solana or Slope once.

Well, nearly.

Have a great weekend! Wantto learn more about what’s going on in our global financial system and how Bitcoin fits in to it? Come to my next free webinar on August 10 July at 6pm to find out, ask any questions, and grab some free Bitcoin .* Click here to register.

Would you like to help spread the adoption and education of Bitcoin in the UK and even stack some Sats while you’re doing it? Well, now you can!

The Bitcoin Pioneers community, backed by Barry Silbert’s Digital Currency Group, was created to introduce Bitcoin to a mainstream audience in a meaningful way and now has members right across the UK.

We share tips, stories and ideas on how to encourage others to try Bitcoin for the first time. And, thanks to support from Luno, each Pioneer gets £500 of Bitcoin a month to share with beginners, helping them get started.

So, if you’re passionate about Bitcoin, why not join today?Click here to find out more!

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com 🙏🏻

Yesterday’s Crypto AM Daily in association with Luno

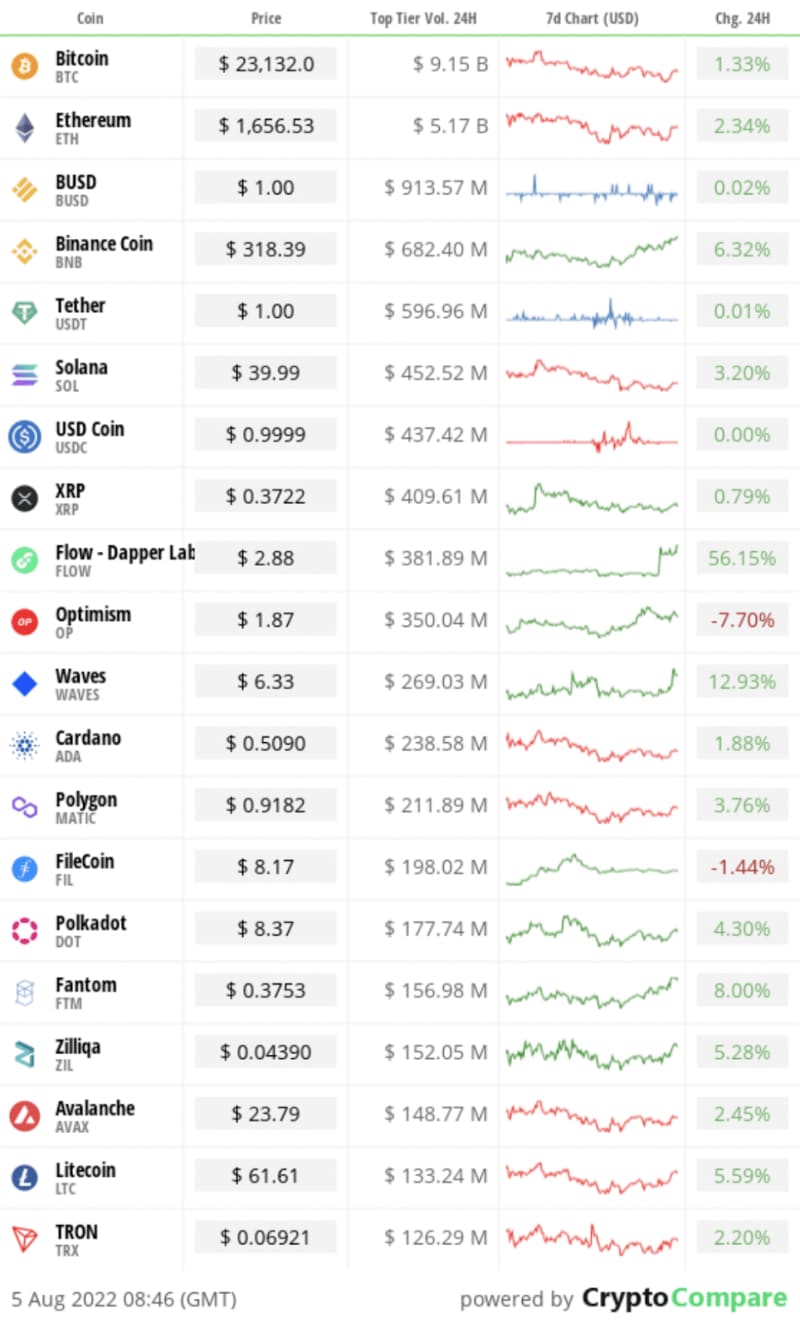

In the markets

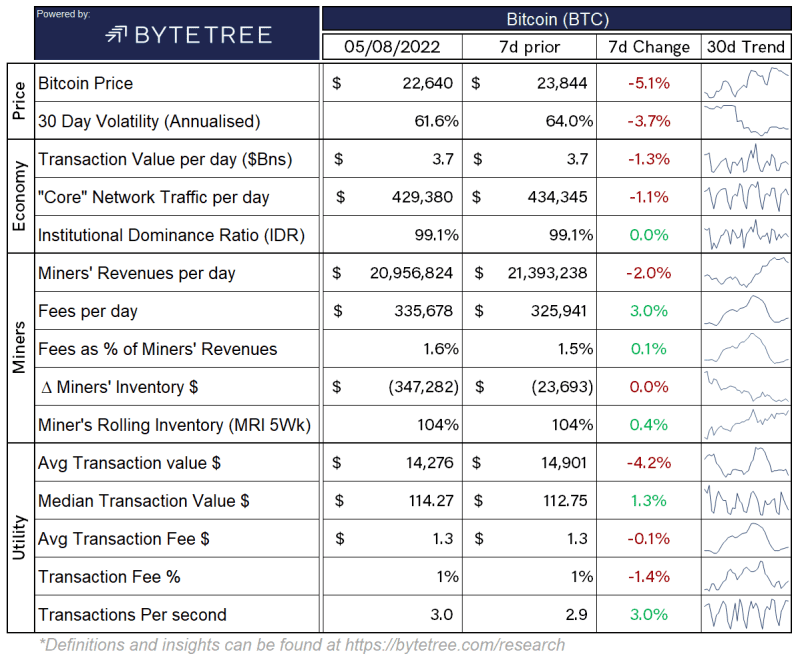

The Bitcoin economy

*Definitions and insights can be found at https://bytetree.com/research

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently

$1,085 trillion.

What Bitcoin did yesterday

We closed yesterday, August 4 2022, at a price of$22,630.96. The daily high yesterday was $23,198.01 and the daily low was $22,485.70.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $442.17 billion. To put it into context, the market cap of gold is $11.892 trillion and Tesla is $967.09 billion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $26.284 billion. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 54.93%.

Fear and Greed Index

Market sentiment today is 31, in Fear.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 41.62. Its lowest ever recorded dominance was 37.09 on January 1 2018.

Relative Strength Index (RSI)

The daily RSI is currently 54.27.Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“[Institutional organisations] have been looking at this for a long time because the fundamental technology can be a huge enabler for them.”

- Todd Lenfield, Chainalysis country manager

What they said yesterday

They’re beginning to believe

Bitcoin flows

Some shade on Elon

Crypto AM: Editor’s picks

Crypto AM: Spotlight

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Contributors

Crypto AM: In Conversation with James Bowater

Crypto AM: Tomorrow’s Money with Gavin S Brown

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Visions of the Future, Past & Present with Alex Lightman

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Taking a Byte out of Digital Assets with Jonny Fry

Crypto AM: Parliamentary Special

Part one of two – April 2021

Part two of two – April 2021

Five Part Series – March 2021

Day one…

Day two…

Day three…

Day four…

Day five…

Crypto AM: Events

For those of you who missed the Crypto AM DeFi & Digital Inclusion online summit 2021 – you can now watch the event in two parts via YouTube

Part One

https://www.youtube.com/watch?v=dvqNMNZTIDE

Part Two

https://www.youtube.com/watch?v=WXhX_-Tr5j0

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:00 BST

The post The Week in Review appeared first on CityAM.