By Nicholas Earl

BP will pay a lower rate of taxes this year than prior to the pandemic, revealed the company’s chief financial officer Murray Auchincloss.

He told investors the energy giant’s tax rate had fallen courtesy of strong results from its refineries and traders.

The FTSE 100 company forecasts its global underlying effective tax rate this year to be around 35 per cent.

This compares favourably with tax rates of 36 per cent in 2019 and 38 per cent in 2017 and 2018.

Auchnicloss reported a 30 per cent tax rate “give or take” for the first six months of the year, and a higher 40 per cent rate for the second half of the year – resulting in a 35 per cent guidance.

He said: ” I suppose what we didn’t plan for at the beginning of the year was a much stronger refining market, nor did we plan for exceptional trading. So, if you take account of those things, that’s what that’s what drives the effective rate lower.”

BP typically pays tax on products sold as they leave its refineries.

These facilities are usually located in lower-tax countries than the wells where it extracts oil and gas from the ground.

It also contrasts with chief executive Bernard Looney’s prediction higher profits would mean higher taxes for the energy giant.

As a word of caution, the finance chief added: “It is possibly the hardest thing to guide on. We never really do seem to get it right.”

Labour: Scrap windfall tax investment relief to protect households from sky-high energy bills

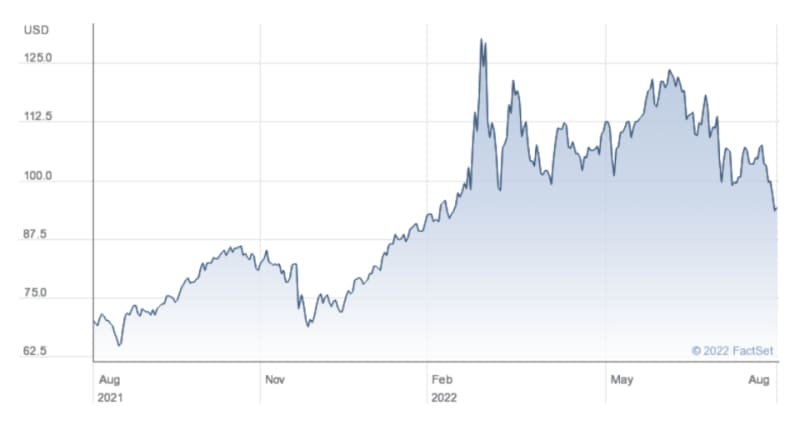

BP unveiled bumper near-record profits of £6.95bn for the second quarter of trading this year, powered by soaring oil and gas prices and refining margins following Russia’s invasion of Ukraine.

This is the energy giant’s highest quarterly profits in 14-years, and is a tripling of earnings compared to 12-months ago.

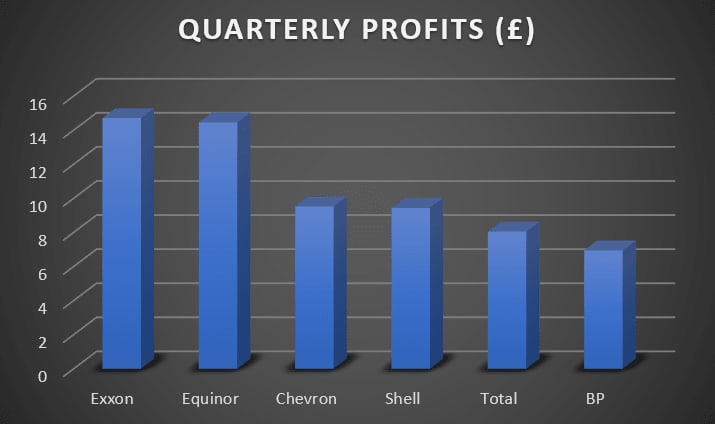

It is not the only energy giant to benefit from the commodity boom, with rivals Equinor, Shell, ExxonMobil, Chevron and Total Energies also unveiling monster profits.

Earlier this year, the Government introduced a windfall tax on North Sea oil and gas producers to help tame spiralling energy bills.

The Energy Profits Levy has brought in a further 25 per cent tax on profits, which was expected to contribute £5bn to a £15bn household support package unveiled by then Chancellor Rishi Sunak.

It also included 91 per cent investment relief, so producers could offset the tax through investment in the UK energy sector.

However, the Labour Party has called for the investment relief to be scrapped and for all windfall tax funds to go toward taming energy bills.

Shadow Chancellor Rachel Reeves said: “People are worried sick about energy prices rising again in the autumn, but yet again we see eye-watering profits for oil and gas producers.”

However, industry body Offshore Energies UK (OEUK) argued continued investment in the North Sea was vital for ramping up supplies and taming bills.

It argued future projects were vital to ensuring the UK was insulated from future market shocks and geopolitical volatility – such as Russia’s invasion of Ukraine and subsequent supply shortages in Europe.

Will Webster, energy policy manager at OEUK, explained: “Our view is that if the UK wants to protect itself against similar future crises, then it must maintain those offshore resources – and that needs investment. The UK’s existing oil and gas fields are depleting so, if we don’t invest, our own supplies will dwindle further. Then we’ll be even more at the mercy of world markets.”

BP expects an $800m hit from the windfall tax over the next three years.

It has pledged £18bn investment over the current decade in UK energy projects – including significant low-carbon investment.

However, it has only spent only $361m worldwide on low-carbon developments this year so far.

The energy giant suffered painful losses during the pandemic, totalling $18.1bn in 2020 and $5.7bn in 2021.

This followed demand plummeting and sustained supply chain issues in trading, with the company not provided hefty financial support from taxpayers – like other industries including hospitality.

Commenting on the results last week, Craig Erlam, senior market analyst at OANDA said: “In much the same way that these firms make huge profits when prices are high, it works both ways. Not that this makes it any easier to accept when we’re experiencing such an extreme example as we are currently.”

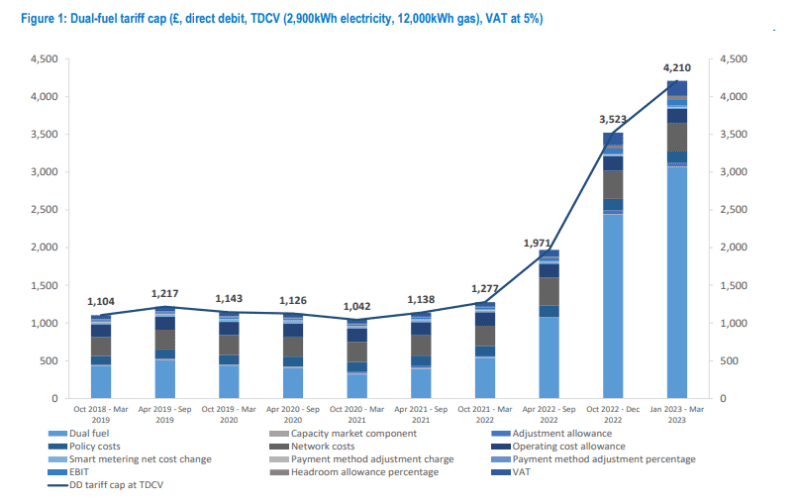

Household energy bills are expected to effectively double this winter, with Investec predicting the price cap will climb to an eye-watering £4,210 per year in January next year when demand is at its peak.

This follows fellow forecasters BFY Group and Cornwall Insight predicting near £4,000 per year bills in October and January – when Ofgem will next update the cap.

The post BP to pay lower taxes than before Covid pandemic despite massive profits appeared first on CityAM.