By Jack Barnett

The US jobs market is still steaming despite the world’s biggest economy wobbling under the weight of soaring inflation and higher interest rates, figures published last week showed.

America added 528,000 jobs in July, pushing the unemployment down to 3.5 per cent, below pre Covid-19 levels, according to data from the US Labor Department.

The print smashed Wall Street’s expectations by around 300,000 jobs.

The shock jobs gain indicates the US Federal Reserve has more wiggle room than thought to keep hiking interest rates steeply to tame the biggest inflation surge in a generation without dealing unnecessary damage to the economy.

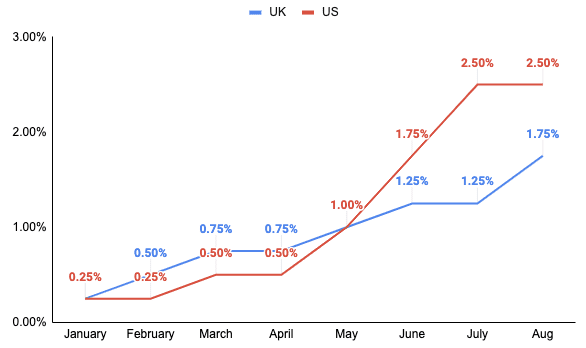

Fed chair Jerome Powell and co have lifted borrowing costs 75 basis points two months in a row.

Collectively since March, rates have jumped 225 basis points, one of the fastest tightening cycles since former Fed chief Paul Volcker led the charge against price rises in the 1980s.

US living costs are up 9.1 per cent annually, the quickest acceleration in four decades.

Analysts have fretted over the Fed engineering a recession by sending rates to around 3.5 per cent.

UK and US interest rates

US GDP shrank in the first and second quarters of this year, meaning the country is in the teeth of a technical recession.

A continuation of the Fed’s rapid rate hike cycle may embolden rate setters at the Bank of England to lift UK borrowing costs by 50 basis points again, analysts said after last week’s historic rate move.

But, governor Andrew Bailey told investors not to assume the Bank will sign off another jumbo rate rise in September.

UK inflation is currently running at a 40-year high of 9.4 per cent, but could top 13 per cent in October when another energy price cap rise lands.

The post Steaming US jobs market raises risk of another jumbo Fed rate hike appeared first on CityAM.