By Darren Parkin

The week in review

with Jason Deane

This will be my last weekly update for August as I head off to the USA for a few weeks for a much needed family break.

It’s a break we’d been planning for years, long before Covid and the world got drunk on newly printed money. Having been over in Miami and Texas recently I was shocked at just how much prices had risen since my prior visit (and how the tip culture had gotten even crazier than it already was) so, naturally, I was very relieved to learn that US inflation had dropped to “only” 8.5% this week.

Joe Biden, on the other hand, announced this as “zero inflation” in a new definition of zero that comes hot on the heels of the previous White House re-aligning of the word “recession”. As George Orwell pointed out, it’s super-plus-double-good that our leaders are here to provide us with the correct truth. Hurrah!

Of course, Mr B was actually referring to the rate of change in July, a number not often referred to, except where it sounds good. The truth is that the dollar is still devaluing faster than it has done for a very long time.

Market reactions were predictably positive with Bitcoin jumping quite markedly on the day, something I talked about with Coindesk at the time. To me, this proves just how closely aligned Bitcoin still is to traditional markets, despite the slew of independent developments that are unfolding behind the scenes. We are still so early.

Speaking of markets, today, August 12, sees $475m in Bitcoin options expiring and the usual discussion of whether the bulls or the bears will see the upper hand asdiscussed in this article. Personally, I’ve never been into derivatives of any sort as I prefer to hold the underlying asset directly, but there’s no denying these can be influential and indicative market products. I guess we’ll know by the end of the day what the effect will be. If any.

Within just a few days of its announcement of partnership with Coinbase, Blackrock has announced that it is launching a private trust toallow spot trading for its US institutional clients in a move that underlines further market development from the traditional finance sector. There will be so, so many to come.

But a piece of news that escaped the headlines this week concerns Iran’s apparent$10m purchase of undisclosed imports using an undisclosed crypto currency. This was almost certainly done to circumvent dollar denominated sanctions and it was almost certainly Bitcoin that was used since around 4.5% of global Bitcoin hash rate now comes from Iran’s government sanctioned mining operations. This, I suspect, is just the beginning of such activities.

Meanwhile, in Asia, Nancy Pelosi’s visit to Taiwan has annoyed the Chinese to the extent that they just had to show off all their expensive toys as a public reminder that they can take the Island by force anytime they want.

This is the very last thing the world needs right now and, apart from devastating the global economy (especially from a chip production perspective), the fact is the vast majority of citizens consider themselves Taiwanese not Chinese. I’ve spent a bit of time in Taiwan and I can tell you categorically that a Chinese attempt to reintegrate to the mainland will not end well.

Let’s hope common sense prevails.

But, in the meantime, have a fabulous couple of weeks and I’ll see you on the other side!

Want to learn more about what’s going on in our global financial system and how Bitcoin fits into it? Come to my next free webinar on September 14th at 6pm to find out, ask any questions, and grab some free Bitcoin .* Click here to register.

Would you like to help spread the adoption and education of Bitcoin in the UK and even stack some Sats while you’re doing it? Well, now you can!

The Bitcoin Pioneers community, backed by Barry Silbert’s Digital Currency Group, was created to introduce Bitcoin to a mainstream audience in a meaningful way and now has members right across the UK.

We share tips, stories and ideas on how to encourage others to try Bitcoin for the first time. And, thanks to support from Luno, each Pioneer gets £500 of Bitcoin a month to share with beginners, helping them get started.

So, if you’re passionate about Bitcoin, why not join today? Click here to find out more!

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com 🙏🏻

Friday’s Crypto AM Daily in association with Luno

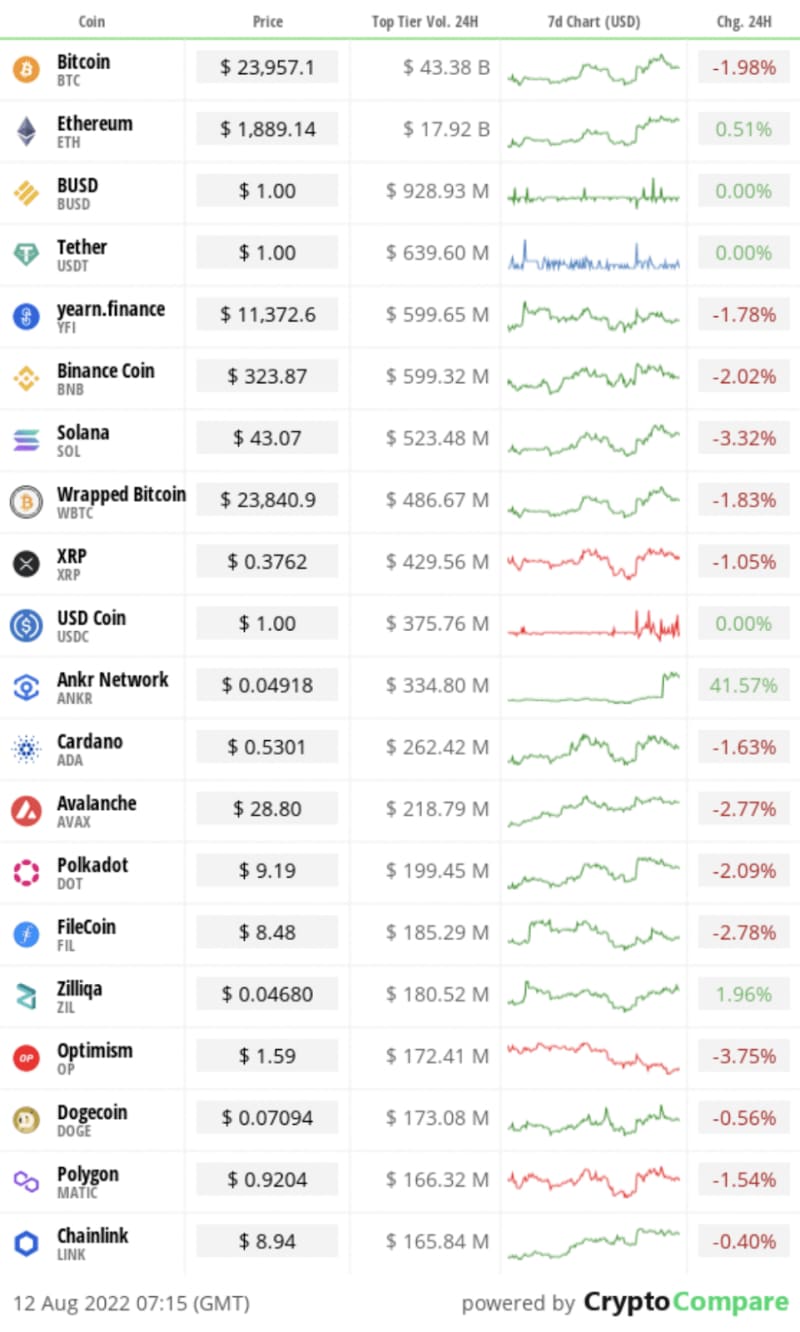

In the markets

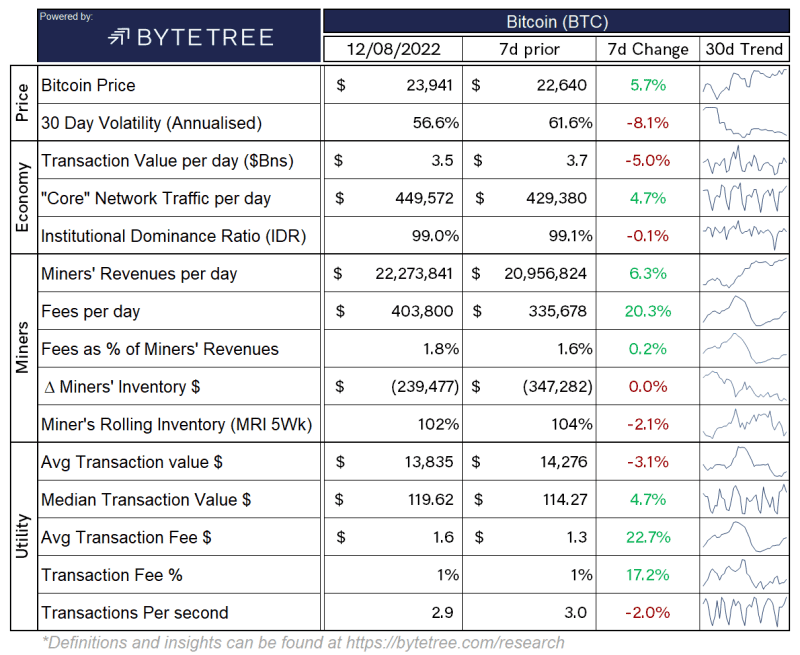

The Bitcoin economy

*Definitions and insights can be found at https://bytetree.com/research

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently $1.143 trillion.

What Bitcoin did yesterday

We closed yesterday, August 11 2022, at a price of$23,957.53. The daily high yesterday was $24,822.63 and the daily low was $23,901.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $457.89 billion. To put it into context, the market cap of gold is $11.93 trillion and Tesla is $898.14 billion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $33.030 billion. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 49.79%.

Fear and Greed Index

Market sentiment today is 42, in Fear.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 40.93. Its lowest ever recorded dominance was 37.09 on January 1 2018.

Relative Strength Index (RSI)

The daily RSI is currently 57.80. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“The hits on BlackRock’s website were: 3,000 hits on COVID, 3,000 hits on monetary policy, and 600,000 hits onbitcoin. This tells usBitcoin has caught the attention and imagination of people.”

Larry Fink, CEO at BlackRock

What they said yesterday

Come on in…

It’s a biggie…

Perspective…

Crypto AM: Editor’s picks

Q&A with Duncan Coutts, Principal Technical Architect at IO Global

Jamie Bartlett – on the trail of the missing ‘Cryptoqueen’

MPs are falling silent over potential of cryptocurrency

Erica’s ‘Crypto Wars’ handed honours in Business Book Awards

‘Let people invest’: Matt Hancock makes case for liberal crypto rules

Explained: Why the Treasury is so sold on stablecoins

Fears crypto is used to avoid sanctions ‘misplaced,’ says Matt Hancock

The cryptocurrency fundraisers behind Ukraine’s military effort

Crypto crazy couple name baby after favourite digital asset

Peter McCormack: Transforming Bedford FC into a global Bitcoin brand

Crypto AM: Features

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Contributors

Crypto AM: In Conversation with James Bowater

Crypto AM: Tomorrow’s Money with Gavin S Brown

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Visions of the Future, Past & Present with Alex Lightman

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Taking a Byte out of Digital Assets with Jonny Fry

Crypto on the catwalk

Crypto AM: Events

For those of you who missed the Crypto AM DeFi & Digital Inclusion online summit 2021 – you can now watch the event in two parts via YouTube

Part One

https://www.youtube.com/watch?v=dvqNMNZTIDE

Part Two

https://www.youtube.com/watch?v=WXhX_-Tr5j0

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:00 BST

The post Convincing evidence that both crypto and traditional markets are aligned appeared first on CityAM.