Third Point commentary for the second quarter ended June 30, 2022.

Dear Investor:

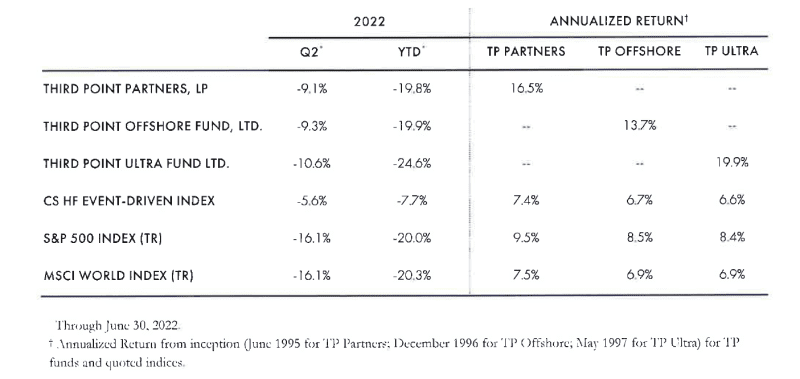

During the Second Quarter, Third Point returned -9.3% in the flagship Offshore Fund and -10.6% in the Ultra Fund. Assets under management on June 30, 2022, were approximately $13.8 billion.

Q2 2022 hedge fund letters, conferences and more

The top five winners for the quarter were Short A, Macro A, Macro B, Short B, and Short C. The top five losers for the quarter were SentinelOne Inc (NYSE:S), PG&E Corporation (NYSE:PCG), Amazon.com, Inc. (NASDAQ:AMZN), Crown Holdings, Inc. (NYSE:CCK), and Danaher Corporation (NYSE:DHR).

Portfolio Review And Outlook

During the second quarter, we significantly reduced risk and took steps to protect capital in a tumultuous market with an uncertain economic backdrop driven by inflation pressures, the prospect of significantly higher interest rates, geopolitical instability, supply chain disruptions, a likely recession in Europe, and a possible recession domestically. Energy and other commodity markets also went parabolic, adding further to concerns about social unrest and the prospect of a sharper than expected economic downturn.

Considering this environment, we de-levered the Ultra funds, and reduced net and gross exposure while increasing our single name shorts and hedges. While this strategy served us well in April and May relative to a sharply lower market, our investments in energy and commodities turned against us in June. We also took mark-to-market losses in structured credit and write downs in our private securities portfolio. Not unexpectedly, the same positioning that protected us from losses in April and May hurt our ability to recover with the market’s move in July. Earlier this month, it seemed that the fever had started to break in inflation, led by the move down in oil and certain commodity prices which, in turn, has resulted in a positive shift in our expectations for resilience in consumer and industrial spending. In hindsight, while it might appear that we erred in some of our sales and not moving more quickly to pick up bargains, we needed to observe data to assure us that we were not heading into the jaws of a deepening recession coupled with ‘70s style inflation.

After taking our exposures to almost zero, in recent weeks we have identified several new positions and covered most of our single name shorts, bringing our current exposure back over 40%. Our largest recent addition has been an investment in Walt Disney Co (NYSE:DIS), which we bought at near its 2022 lows after having exited at the end of Q4 2021 and in the beginning of this year. We are pleased by the strength they are showing across business lines and the progress of Disney’s transformation from “analog” to “digital”, following a blueprint familiar to us from past investments. A letter to management sharing our views about additional value creation measures they should consider is available here.

Q2 2022 hedge fund letters, conferences and more

Private Investments Update

In the private portfolio, we experienced markdowns in several of our late-stage investments in Q2. Although those we own have plenty of liquidity runway, valuations have come in as multiples for comparable public companies have compressed and exit timelines have elongated due to market conditions. We have been working closely with our later stage companies and each has submitted an updated business plan that cuts costs and reduces cash burn such that they can reach profitability.

Most of our private portfolio is invested in earlier stage opportunities in the sectors where we have the most expertise: cybersecurity, enterprise software, and IT infrastructure. We believe that these sectors are more likely to remain resilient in a market slowdown, which adds a further degree of security to the disciplined underwriting we apply to each investment and gives us confidence that the ventures portfolio will weather this market cycle.

Credit Update

While as equity investors, we generally hope for the best, as credit investors we know that should the economy turn for the worse, we are well positioned to invest in the sorts of credit cycles we saw in 2001-2004 and 2008-2011, when credit accounted for the majority of the portfolio. In my experience, credit cycles happen slowly and then all at once, so you must act decisively to deploy capital. Every cycle is different and the sell-off so far has been grinding and slow, but we cannot rule out the possibility that credit spreads will widen once again. Nevertheless, this cycle appears different from prior cycles in several ways that are informing our current strategy.

Q2 2022 hedge fund letters, conferences and more

Structured Credit Update

During Q2, we continued to see a divergence between fundamental credit quality and volatility-induced pricing in structured credit. This was especially pronounced in our residential mortgage (RMBS) exposure, which comprises about 50% of the portfolio and is primarily made up of reperforming mortgage securitizations. This space has experienced mark-to-market declines due to rising rates, widening credit spreads, and a scenario shift pointing to a higher probability of recession. However, in contrast, our monthly remittance data shows elevated mortgage refinancing rates (outside of scheduled monthly principal amortization), delinquencies trending as expected, and low loss severities. The current yield on the RMBS portfolio is in the high teens, and we believe the fundamentals of constrained housing supply, borrowers with 40-50% equity in their homes, and over 10 years of performance history make this a compelling asset class in the wake of the broader market sell-off. While daily headlines trumpet new highs for mortgage rates, these borrowers typically have balances around $150,000-$200,000 and current mortgage rates of 4.5-5.5%. With the significant equity built up in their homes, they can take out a hybrid mortgage potentially below 4% and unlock 10-20% of home equity value. Asa result, we continue to see those elevated refinancing rates.

Business Updates

We will allow investors to add to any of the funds taking into account their existing highwater mark; we made a similar offer to our investors in Q2 2020. Please contact Investor Relations if you are interested in adding capital.

Sincerely,

Daniel S. Loeb

CEO & CIO

Read the full letter here.

Q2 2022 hedge fund letters, conferences and more

Updated on