By Millie Turner

The UK’s upcoming semiconductor strategy must make it easier for overseas talent to work in the country, the boss of British computer chip designer Arm has said today.

Speaking to The Times, chief executive Rene Haas said that policy which makes it “easier for engineers to move across borders to be hired” would be “hugely beneficial” to the UK’s computer chip industry.

“There’s only so much talent in the world that knows how to do this work. So making it easy for those folks to come into the UK to deliver the work would be hugely beneficial,” said Haas, who succeeded Simon Segars in the top role in February.

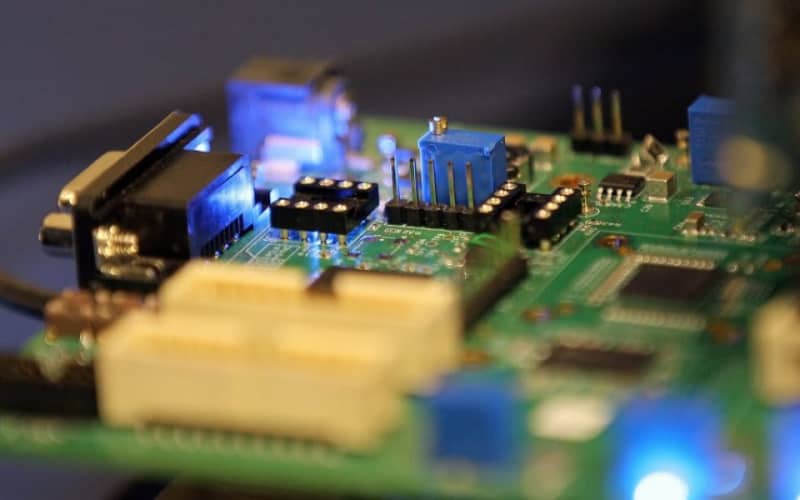

Semiconductors, used in most of today’s electronics and of particular demand in the electric vehicle industry, have been subject to two government inquiries which are expected to be published this autumn.

Haas described the chips as “the lifeblood to everything we do”, lending an explanation as to why the takeover of the UK’s largest chip manufacturer Newport Wafer Fab by part-Chinese-owned Nexperia has raised national security concerns.

“The pandemic showed the importance of having resilient supply chains. A shutdown in one part of a geographic region could suddenly stop a shipment of a key product. And then the world is not as flat as it was ten years ago in terms of regional conflicts. So when you add all of that up, a diversified supply chain around semiconductors is a must-have,” he continued.

His comments follow the signing of critical so-called Chip Acts in Europe and the US, which risk tempting British chip firms overseas.

Chasing incentives

Bosses of other UK-based semiconductor companies have previously urged that the country must ready its semiconductor strategy if it is to compete with Europe, the US and China.

While giving evidence to the Commons’ business select committee’s inquiry into the industry in July, CEO of British chip manufacturer Simon Thomas revealed he had been approached by an American governmental body trying to lure his business to relocate Stateside.

Days later, Thomas told City A.M. that the risk of this happening to other British companies is “huge”.

It would take hundreds of billions in capital on average to build a business to the size of TSMC in Taiwan, one of the world’s biggest semiconductor producers, Thomas noted.

Thomas explained that it is “not possible” for the UK to match that scale of funding, but that “if investors know we’re supported by government we can attract that [capital] from other sources.”

The lack of an advisory board and government figure spearheading the industry is among the UK’s largest pitfall in making itself a leader in the semiconductor sector.

“We don’t really have industrially focussed leaders [in the UK]…That’s where we have a key missing point – having key commercial and industrial points to government is something the US is very good at doing,” Thomas said, just days before the $52bn bill passed.

CEO of fellow UK-based semiconductor firm IQE, Americo Lemos, called the US’ investment a “statement of intent” as governments across the world realise they “must take meaningful steps to secure their technology supply chains.”

“Given the proper support from government we could accelerate the creation of a more complete ecosystem for these semiconductors to serve the global industry,” Lemos told City A.M. at the time. “We hope that the actions of governments like the US will serve as a catalyst for decision-makers here in the UK.”

The post Arm CEO: UK’s semiconductor strategy must make it easier to hire overseas talent appeared first on CityAM.