By Jack Barnett

Brits reining in spending amid a historic inflation surge has steered the UK economy to the edge of “stagnation,” a closely watched survey released today shows.

S&P Global’s flash composite purchasing managers’ index (PMI), which measures activity across the private sector, dropped to 50.9 this month, down from 52.1 in July.

The figures indicate “the economy is already in recession,” Paul Dales, chief UK economist at Capital Economics, warned.

Weaker consumer and business spending in response to a darkening economic outlook hit both the UK’s services and manufacturing industries.

Pubs, bars and restaurants and other service providers notched the shallowest increase in activity in 18 months, sending the industry’s headline PMI slightly lower to 52.5.

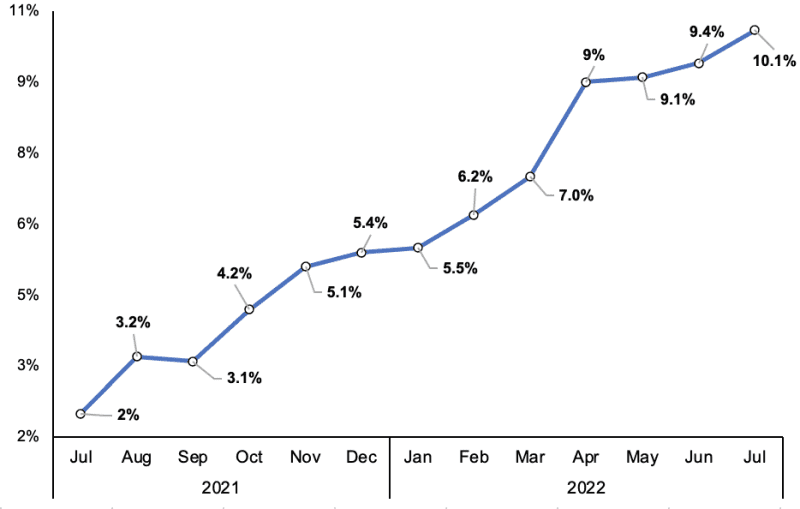

Annual UK CPI inflation

However, manufacturing slumped to 42.4, pushing its headline PMI to 46, meaning the industry is shrinking. A reading above 50 points indicates most firms reported growth.

That reading chimed with data from the Confederation of British Industry, which showed manufacturing orders dropped to minus seven this month, much lower than the City’s expectations.

Experts said firms are being spiked by households cutting back to protect their budgets.

Annabel Fiddes, economics associate director at S&P Global Market Intelligence, said: “The UK private sector moved closer to stagnation in August, as mild growth of activity across the service sector only just offset a deepening downturn at manufacturers.”

“Waning customer demand amid the weaker economic outlook, and shortages of both staff and inputs, were reported to have hit goods producers hard,” she added.

The latest PMI indicates the UK economy is hurtling toward a long slump, caused by inflation surging to levels not seen in generations.

Yesterday, Wall Street investment bank Citi warned inflation will hit 18.6 per cent in January, led by the energy watchdog hiking the cap on bills to over £4,500 and then to over £5,000 in April.

Living costs are rising faster than wages, meaning consumers cannot afford to buy the same quantity of goods and services, likely triggering a future spending slowdown and hitting UK growth.

Citi warned interest rates may have to rise to six or seven per cent to tame inflation, which would take them to the highest level since the turn of the millennium.

The Bank of England expects the economy to slide into a 15-month long recession in the final months of this year.

Bank of England GDP forecasts

Central banks rarely lift borrowing costs amid a recession to avoid heaping even more pressure on businesses and households.

“With CPI inflation still soaring, the Bank of England will have little choice but to continue raising interest rates,” Dales added.

The series of recent downbeat forecasts and figures underscores to size of the challenge either Liz Truss and Rishi Sunak face when one of them enters Number 10 on 5 September.

Economists have warned Britain will suffer tough economic hardship without further government spending to support households through the cost of living crisis.

Truss has argued cutting taxes is the best tactic to help Brits, while Sunak has pledged to step up cash payments to the poorest.

The post Inflation surge pushes UK economy to edge of stagnation appeared first on CityAM.