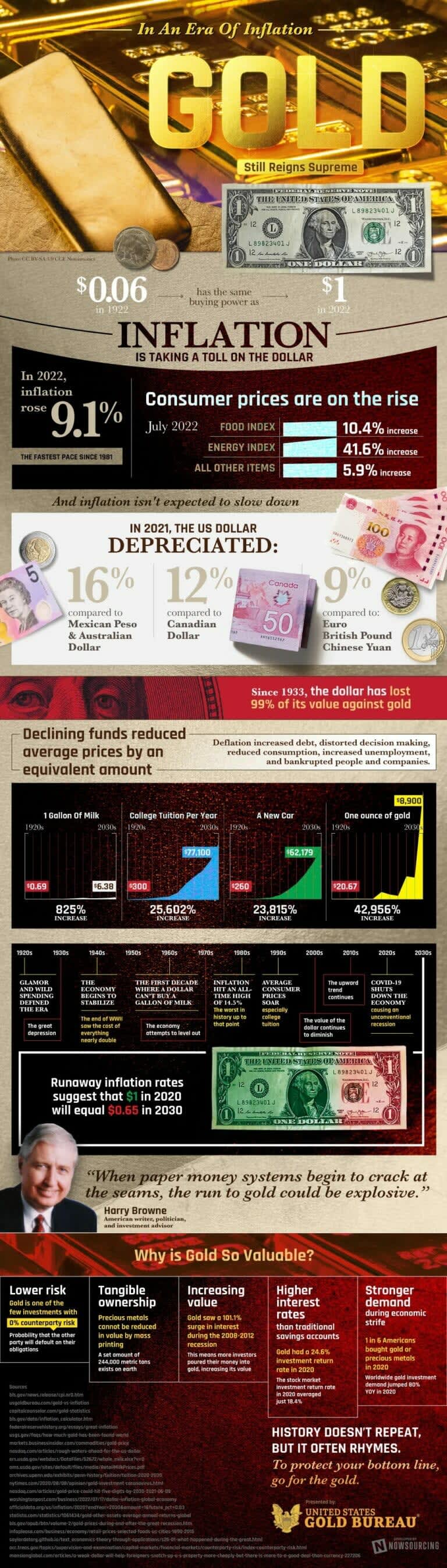

Inflation has been increasing since the onset of the pandemic. In 2020, inflation rose over 9%, the fastest pace the United States has experienced since 1981 when inflation was at its highest.

Consumer prices are on the rise with the food index increasing 10.9%, the energy index increasing 32.9%, and all other items nearly 6%.

The Dollar’s Value Decreases

This high increase of prices is known as runaway inflation and it is having an effect on the value of the dollar.

Q2 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

In the past 100 years, the value of money has decreased significantly due to inflation. Less than 100 years has seen the US dollar lose 99% of its value.

In 1922 $.06 had the same buying power as $1 today. In 2021, the US dollar has depreciated greatly, even up to 16% compared to the Mexican peso.

Since inflation is at such a high rate, it is estimated that the dollar will depreciate even further and $1 in 2020 will only equal about $.65 in the next ten years.

Along with that it is expected that the price of nearly everything will continue to increase significantly.

Increase In Gold's Value

With the US dollar losing its value, investors have been looking towards other avenues. In the 2008-2012 recession, investors put more money into gold which raised its value significantly.

They chose to do this because gold has a more tangible ownership, less risk, and more return on investment than other investments.

Gold even has more security overall than the stock market. Today, investors are turning to gold again since it has held its value over the years.

With gold holding its value so well, the public has also started to gain interest in precious metals. In 2020 1 in 6 Americans bought gold or another precious metal after seeing how successful it was for investors in the past. Worldwide gold investment increased by 80% during this time.

Inflation has been a part of the United States for centuries, and there is no chance it will be different anytime soon.

While prices rising can be a large source of stress for many people, there are ways to deal with economic struggle. Choosing investments that are more secure and can hold their value over time can be more beneficial in the long term.

Investors in the past took advantage of the value of gold, and if history repeats itself, we can expect another increase in gold's value during this recession. Learn more in the infographic below:

Brought to you by: usgoldbureau.com