By Michiel Willems

Over 55s have benefited from £1bn worth of property growth every day between the start of the pandemic and June 2022.

Analysis of statistics obtained via a request to the ONS shows the extent to which over 55s have managed to exploit the growth in property value since the start of the pandemic.

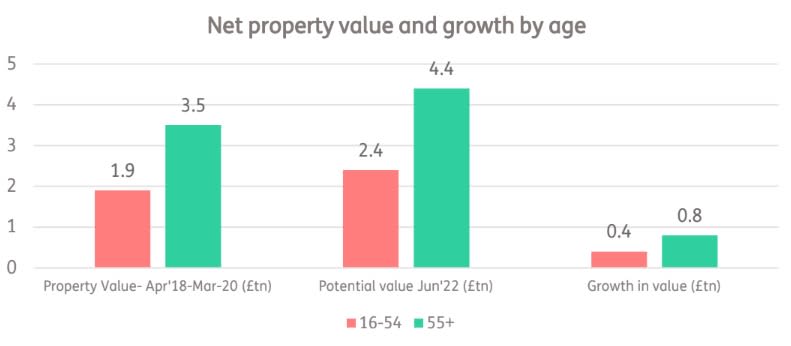

The ONS figures – analysed by retirement firm Just Group, show that in March 2020, over 55s owned more than £3.5 trillion of housing equity, accounting for just under two-thirds (65 per cent) of the UK’s total housing wealth.

Much of this wealth sits with ‘Boomers’ (those aged 55-74) who own nearly half (47 per cent) of the nation’s housing wealth.

Rising property values

Since the start of the pandemic, the average property has increased in value by 23.08 per cent.

This has largely been driven by pent-up demand from the first lockdown, the race-for-space as people hunted for properties outside major cities and the stamp duty cut that further stimulated the market.

It means that over 55s could now be sitting on net property wealth of £4.4 trillion, benefitting from a

pandemic-fuelled windfall of over £815bn equivalent to nearly £1bn of added value every single

day between March 2020 and June 2022.

Stephen Lowe, group communications director at Just Group, shared with City A.M. this morning the figures were a reminder of the vast wealth held in property by those in, or near, retirement and the key role it can play in personal finances, commenting.“

Evidently, many homeowners will have benefitted from the property price rises that have driven the market to record highs since the start of the pandemic,” Lowe explained.

“Given over 55s hold the majority of net housing wealth in the UK, it is unsurprising that they will have reaped the biggest rewards from the growth in the market.”

“But as we enter a new economic cycle, this vast storage tank of wealth they have accumulated will inevitably play an important role in their future finances.”

Lowe added: “With inheritance tax thresholds frozen until 2026, rising house prices will likely tip more estates into paying inheritance tax. Using property wealth to make living inheritances could provide homeowners with a means of mitigating the impact of inheritance tax as well as providing loved ones with financial support.

The post Older Brits benefit from £1bn-a-day windfall as over 55s sit on £4.4 trillion in property wealth appeared first on CityAM.