Autozone (NYSE:AZO) is slated to report FQ4 earnings in mid-September and the price action is correcting ahead of the news.

The stock is down more than 10% from the latest all-time high, which suggests that Autozone stock is setting up for a buying opportunity in light of the long-term uptrend in price action.

The problem is there are factors weighing on the stock that could keep the price action moving lower and point to Advance Auto Parts (NYSE:AAP) as a better buy for investors.

Among them are valuation, dividends, and the analyst’s outlook which favors the one over the other. The takeaway for investors is that Autozone is indeed setting up for a buying opportunity but it’s not a good time to buy it now.

Q2 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

As far as the valuation and the yield go, Autozone is trading at 18X its earnings outlook while paying a 0% dividend which Advance Auto Parts beats with ease.

Advance is paying out 3.5% in yield while trading at only 13X its earnings outlook and the company has committed to dividend growth.

As it is now, Advance Auto Parts is paying out only 40% of its earnings and it has been increasing at a very aggressive 83% CAGR over the past couple of years.

Autozone does repurchase shares so it’s not like there is no capital return. The offset is that Advance Auto Parts also repurchases shares, if at a slower rate.

The takeaway is that buy-and-hold income investors are likely to choose Advance Auto Parts over Autozone in the current economic environment.

The Analysts Rate Auto Parts Stores A Moderate Buy

The analysts rate the auto parts stores a Moderate Buy, even O’Reilly Autoparts (NASDAQ:ORLY) although it has the highest valuation at 22X and also pays no dividend.

The takeaway here is that Advance Auto Parts is looking at roughly 37% of potential upside even after its post-release series of price target reductions and Autozone and O’Reilly are both trading very close to fair value.

Considering the fact Autozone is yet to report for the corresponding period, and Advance both missed its estimates and received price target reductions because of it, there is a great chance of the same happening to Autozone.

Bank of America singled out Autozone as a potential underperformer in Q3 way back in early July and then doubled down on that sentiment in early September.

Analyst Elizabeth Suzuki noted the two companies' different operating styles and Autozone’s dependence on DIY sales. DIY sales were already slipping in Q2 and the DIY channel was 75% of revenue in Q2 compared to only 40% for Advance Autoparts.

"With AZO shares trading at close to its peak 1-year forward P/E multiple at above 18x vs. its long-term average of 15x, we see downside risk to the stock heading into its 4Q earnings release,” she says.

The institutional activity is about the same with both companies but there is a difference. The institutions have been net buyers of both stocks over the last year and activity turned mildly bearish for both in calendar Q3 but total ownership stands at nearly 99% for Advance Auto Parts compared to a lesser 93% for Autozone.

The insider activity is minimal in both names as well but also favors Advance over Autozone because Autozone’s insiders have been selling for the last 8 consecutive quarters while Advance Auto Parts insiders haven’t made a sale in over a year.

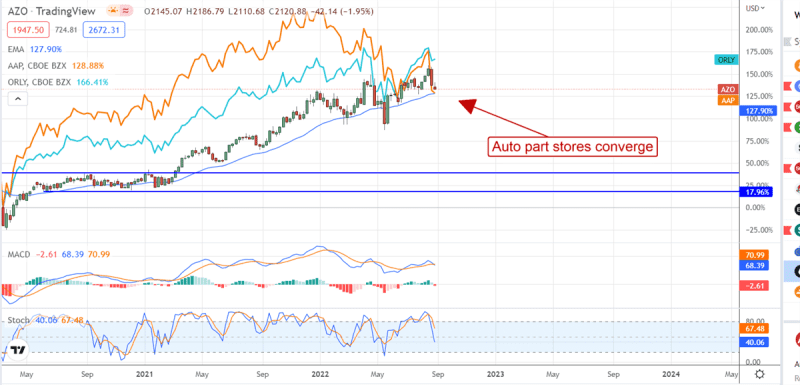

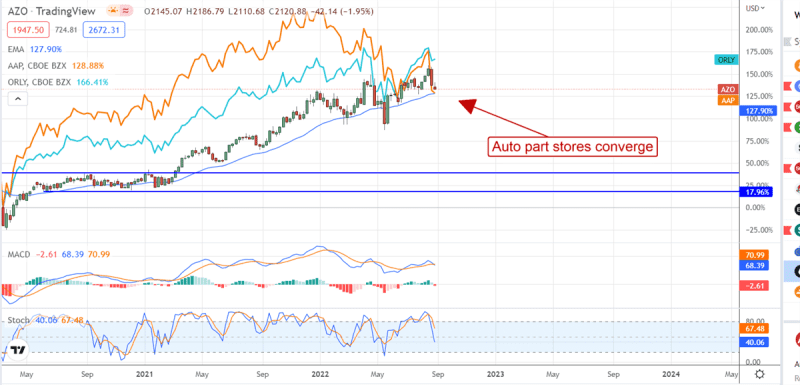

The Technical Outlook: Autoparts Stores Converge

Both O’Reilly Autoparts and Advance Autoparts outperformed during the peak of the pandemic but the auto parts market appears to be converging at about 125% upside from the 2020 lows.

Moving forward, however, there is a chance the market will continue to correct and be led lower by Autozone and then O’Reilly in turn. In this scenario, Advance Autoparts should outperform its peers with ease.

Should you invest $1,000 in AutoZone right now?

Before you consider AutoZone, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AutoZone wasn't on the list.

While AutoZone currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

Article by Thomas Hughes, MarketBeat