By Jack Barnett

The UK jobs market is on course to finally lose some steam, driven by firms cutting staff in response to swelling costs and weaker consumer spending, a new survey published last night revealed.

A historic inflation surge is likely to throw the UK into recession as soon as this quarter, forcing firms to cut costs.

Prices are up 9.9 per cent over the year to August, slower than July’s acceleration, but still hovering near a 40-year high.

Those inflationary pressures have now pushed the UK to the brink of a recession.

Consultancy BDO’s output index dropped to 95.66 points, its lowest level since the third Covid-19 lockdown and close to the 95 point threshold that separates contraction and growth.

Firms are still taking on staff, but “recessionary fears [are] expected to put downward pressure on employment as businesses exercise caution in the coming months,” BDO said.

“Soaring energy costs and inflationary pressures are headwinds we can expect to become more severe in the coming months, exacerbating the economic and political uncertainty both firms and consumers feel this winter,” Kaley Crossthwaite, partner at BDO, said.

Despite the economic softening, the UK jobs market has held up well. Unemployment has dropped to 3.6 per cent, its lowest level since 1974.

BDO’s inflation index jumped to a record high, cutting across the Office for National Statistics’s consumer price index falling for the first time in nearly a year, it announced earlier this week.

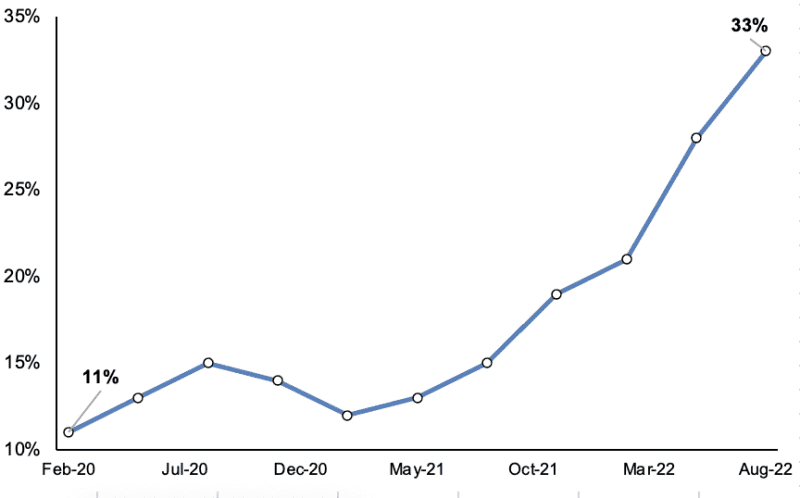

Figures from the Bank of England published today found the proportion of Brits angry at its performance climbed 33 per cent, the highest ever. Inflation is around five times above its two per cent target.

Dissatisfaction with Bank of England’s performance

Prime minister Liz Truss’s decision to freeze household energy bills at £2,500 for two years at a cost of £150bn will prevent inflation potentially topping 20 per cent, likely reducing the severity of the expected recession.

Wall Street firm Bank of America said yesterday inflation is now set to peak at 10.8 per cent in October.

Businesses are still unclear how much help they will get. Truss promised they would get “equivalent support” to the household when announcing the measures last week.

The government today confirmed a mini-budget will take place next Friday. New chancellor Kwasi Kwarteng is anticipated to outline more details on the energy support package and cut taxes.

The post UK jobs market on course to lose steam amid economic slump appeared first on CityAM.