A routing number is necessary for electronic transactions such as bill payments, fund transfers, direct deposits, and digital checks. But what exactly does a Routing Number represents?

A Routing Number is a unique nine-digit code representing your bank’s address. Financial institutions use it in electronic transactions to track your individual account in any bank. The routing number is not written on debit cards. It is usually written on a bank statement or check.

In this post, you’ll learn about Routing Numbers and why it is necessary to know your Routing Number. So, keep reading whether you are new to this term or want to update your knowledge about Routing Numbers.

What is a Routing Number?

Routing Number lets financial institutions track and keep records of your electronic and physical purchases. It is also referred to as RTN and ABA (American Bankers Association) Routing Number.

American Bankers Association developed the idea of a routing number system in 1910 to differentiate one bank from another. This system is spread wide across federal and state-chartered banks and financial institutions that process check transactions in the United States.

US banks must apply their routing number to ABA to represent their institution while sending and receiving money in the United States. Routing Numbers are only used among American Banks. Foreign Banks use IBAN to differentiate the financial institutions apart, which is short for International Bank Account Number.

How many numbers is a routing number?

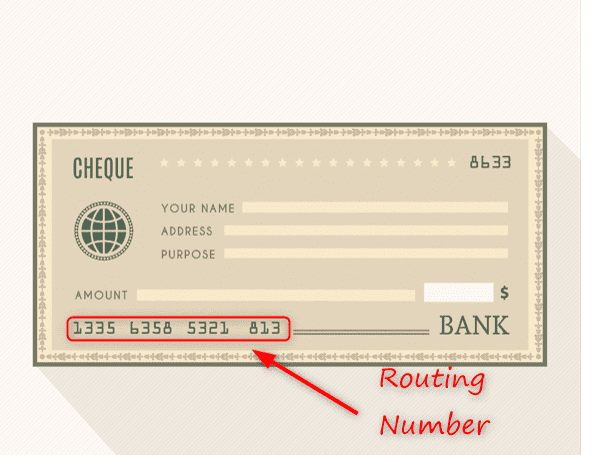

You might be unable to tell apart the routing number on your check or debit card. In such a case, you must know what a routing number looks like. A routing number consists of nine digits, mainly on the bottom left corner of your personal checks.

Note: The routing number is unique for each individual account.

How to Find Your Bank Routing Number?

If you have your personal paper checks, then that’s the best place to look for your bank routing number. You can notice a row of numbers on the front side of the check at the bottom. These numbers must be separated into three groups by spaces or special characters. That’s your routing number.

As for the online method, it would be challenging to find your routing number. Because most banks and financial institutes don’t display routing numbers on websites or mobile apps to prevent fraud and theft.

You might only get the last four digits of the routing number online. However, some banks have their full routing number on the account holder’s website or mobile app. Another most straightforward way is to call your bank’s customer service and tell them you wish to know your routing number. They will verify your identity, and then you’ll get your bank routing number.

Routing Number vs. Account Number

Not sure how to tell routing number and account number apart? Here are the clear differences between both:

Routing Number

A routing number is a unique nine-digit number that distinguishes one bank or a financial institution from another. In other words, the routing number represents the address of your bank in electronic transactions.

Account Number

Account number lets the bank or credit union identify your individual account within a financial institution. Banks assign a unique account number to each bank account holder. Both routing numbers and account numbers are necessary for electronic transactions. They ensure that money is sent or received by the correct bank account.

Where Is the Routing Number on Check?

The easiest way to find your routing number is via checks. Look at the front side of your personal checks. At the bottom, you’ll notice nine-digit numbers separated by special characters and space. The routing number is displayed on checks as three groups of numbers. Take a look at the given example:

How to Find Routing Number Without Check?

Here are two simplest ways to find your routing number without checking:

How to Find a Routing Number Online?

You can simply log in to your online bank account via the bank’s official website. Go to the Account Summary or Account Information option in the menu bar. The routing number should be written within your bank account information.

Some banks list their routing number on their official website homepage. You should consider carefully checking the bank website. Although it is a tricky process, you’ll find it on your bank’s website.

Find Your Routing Number Using Mobile App

Open your bank’s official mobile app. Click on the Account Information or Account Summary option. Read the information carefully, and you’ll find your bank routing number enlisted with it. A quick way to tell apart bank routing numbers is counting. Count the digits, and if the given number consists of nine digits, then it’s undoubtedly your bank routing number.

Find Your Routing Number on a Bank Statement

Open your electronic or paper bank statement. Look carefully at the top right column of the bank statement. The routing number is usually written there. In the case of electronic bank statements, follow the given guideline:

- Log in to your bank account on the official bank website.

- Go to see statements option

- Click on Statement PDF to open it.

- Look in the top right column, and you’ll find your routing number.

FAQs

Do Credit Cards Have Routing Numbers?

Credit Cards don’t have bank routing numbers. Why? Because credit cards don’t need them. Routing numbers are required only for electronic transactions such as direct deposits. So, credit cards don’t have a routing number.

Do All Debit Cards Have Routing Numbers?

Do debit cards have routing numbers? The answer is no. Debit cards do not have routing numbers associated with them. Routing numbers are only found on checks. This is because routing numbers are used to identify the financial institution that issued the check.

Debit cards have an account number and PIN number associated with them instead. These numbers are used to identify the cardholder and allow them to access their account information.

Which Bank Details Are Safe to Give Out?

Most people are aware that they should never give out personal information like their social security number or credit card number to anyone who they don’t know and trust. However, you can give your account number and sort code to companies and people who you do have a relationship with, like your employer, the government, or your bank.

When it comes to giving out your bank details, it’s important to be aware of the risks involved. Hackers and scammers are always looking for new ways to steal people’s money, and they’re becoming increasingly sophisticated in their methods. If you’re not careful, you could easily find yourself a victim of fraud.

Do You Need Both Account and Routing Number?

Most banks will require that you have both an account and routing number in order to set up direct deposit, but there are a few exceptions. If you’re not sure whether or not your bank requires both numbers, it’s best to check with them directly to avoid any issues.

In general, you’ll need both an account and routing number when setting up direct deposit, automatic bill pay, or other types of electronic payments. This is because the routing number is used to identify the financial institution that owns the account, while the account number is specific to your individual account.

Is the Account Number the Same as the Debit Card Number?

Most people believe that their account number is the same as their debit card number, but this is not the case. The sixteen-digit debit card number is completely different and is used for processing payments. You can use your debit card number to withdraw cash from ATMs, but it is not the same as your account number.

Your account number is only used by your bank to identify your account. It is not used to make purchases or withdrawals. Keep this in mind when you are asked to provide your account or debit card number. Make sure you know which one is being requested.

Final Thoughts

A routing number is a nine-digit unique number that differentiates your bank from another during online transactions. It is also necessary for banks or financial institutions to keep track of your online transactions. You can easily find it on your check, official bank account website, or mobile app. The other possible way is to call your bank to get your routing number.