By Darren Parkin

We’ve all heard of parallel universes. The many-worlds theory proposes that every time one quantum state, or outcome, is observed, there is another “world” in which a different quantum outcome becomes reality.

But if such exists as has been postulated by physicists, certainly we know that while history may not exactly repeat, it does rhyme. So on a timeline, parallel “worlds” can exist. History teaches.

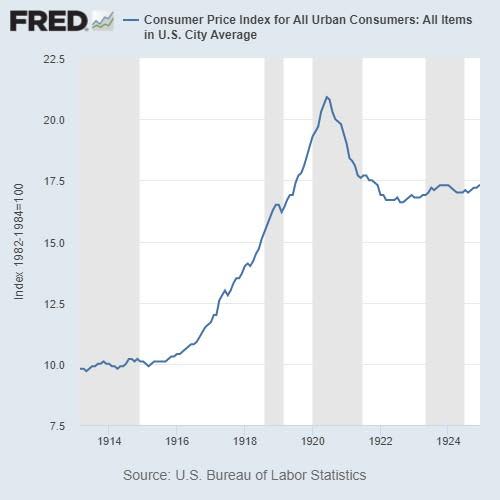

The last major global pandemic was called the “Spanish” flu of 1918-1920. It was the second deadliest pandemic after the black death bubonic plague with a global death toll of 2-3%. It broke out near the end of World War I.

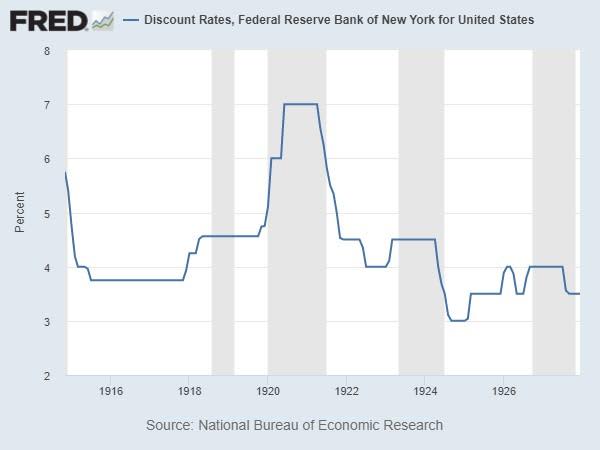

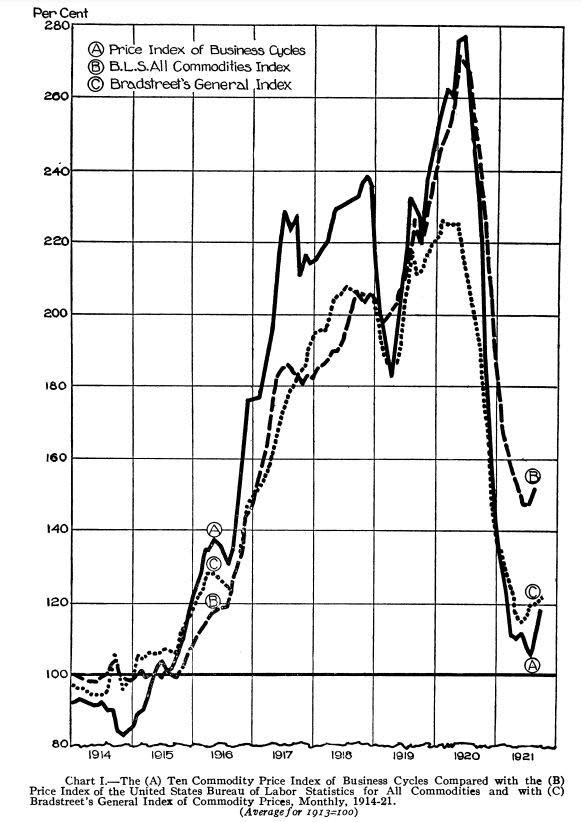

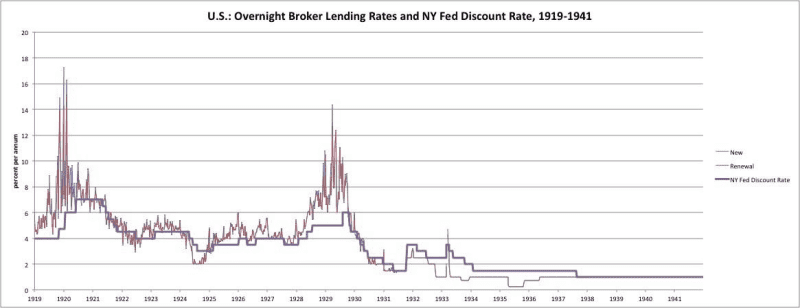

After the end of the war, demand temporarily dropped pushing commodities about 5% lower, but by the spring of 1919, enormous foreign demand for goods pushed commodity and stock prices much higher. This demand was due to easy money rates left over from the war. The central bank had kept rates unusually low after the war because commercial banks had bought loads of liberty bonds during World War I.

But then the Fed stepped in and started to hike rates in late 1919 to quell demand and temper inflation which had more than doubled since 1913.

The price of commodities then peaked in the spring of 1920 after the Fed raised the discount rate to 6% then quickly raised it again to 7%. Yet, business activity had already topped earlier. What should have been a mild recession turned into a depression. Prices fell 22% between 1920-1922 while bank failures soared. The Dow Jones Industrials lost about -47% from Nov-1919 to Aug-2021 (22 months) while unemployment shot to 12%.

The Fed was then pressured to lower rates which quickly came down from 1921-22 spurring the “roaring” 1920s, a decade of economic prosperity like few others. The Dow Industrials began a new bull in Aug-1921.

Recession today

In today’s market, there are parallels. In both cases, unusually easy money due to unusual circumstances as followed by aggressive rate hikes which cratered markets. The recession then was unusually harsh. The 1920-21 bear was due to tight money. A couple of months after the Fed started to lower rates in 1921, the

bear market found its major low and a new bull market began.

That said, just because the Fed starts to lower rates does not guarantee a major low in the stock markets. For example, this did not occur in the early 1930s even after the Fed started to aggressively reduce rates.

Instead, the Dow didn’t find its major low until Jun-1932.

This also happened in the 2000-2002 bear market where the NASDAQ Composite had its largest decline ever of -78% despite the Fed aggressively reducing rates from 6% to 0.75%. Note, the reduction in rates before the financial collapse in late 2008 did not prevent the bubble from bursting as other major factors were at play.

In both cases which had to unwind massive market bubbles, rates had to be reduced several times before the market found its major low. Today’s market also sits atop a massive bubble so it’s possible that after the Fed is done raising rates, markets continue to fall.

At present, more than a few rate hikes are planned as the Fed seeks to lower inflation back down to 2%. The markets are likely to stage deeper corrections before rates reach 425-450 bps which would result from the current CME Fed Funds Futures predictions of two 75 bps and one 50 bps hike by year end, up from the

current 225-250 bps.

Unemployment has yet to soar but weekly jobless claims are on the rise. History shows such increases in claims precedes jumps in unemployment. Corporate earnings are still soaring, but this too will correct sharply as the recession takes hold.

The supply of homes on the market has also spiked which historically coincides with recessions.

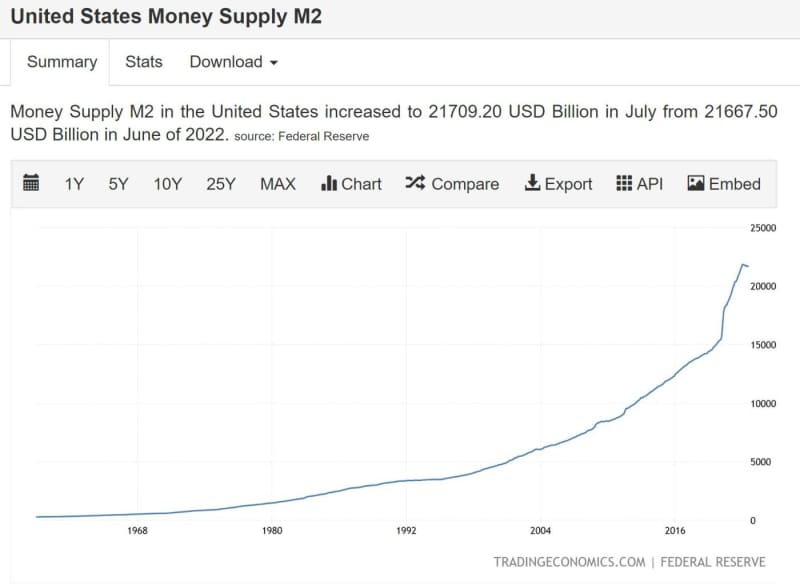

Other metrics are likely to surface later this year or early next year that show the recession worse than expected. The Fed will then likely halt the hikes or, if warranted, fire up the printing presses once again if another black swan crisis emerges. Otherwise, because of high inflation, money printing sponsored by QE5

won’t likely begin until late 2023.

This would of course eventually reignite inflation which is unlikely to have dropped to the targeted 2% but to the “new norm” that the Fed will set of maybe 4.5-5%. Ray Dalio of Bridgewater had an informative view on this target range. M2 will then start to reaccelerate after having dropped by an immaterial amount.

A second roaring 20s?

If we are to rhyme with the 1920s, the bubble will have to have unwound to some extent which suggests materially lower stock and crypto markets even from current levels. Think Bitcoin $10k. QE5 will also have to have been launched spurred by another crisis, or from the recession turning out to be far worse than expected. Either situation could result in far deeper market corrections such as during the early 1930s or early 2000s even after the Fed started to aggressively lower rates.

Given record levels of debt, double digit true inflation on a global scale, and interest rates still historically low, central banks are cornered. That said, inflation may be close to peaking in the U.S. due to lower commodity, gasoline, and real estate prices, poor buying conditions not seen since the early 1980s, and the

spiking inventory to sales ratio. While inflation is likely to stay stubbornly higher than expected, YoY inflation is likely to temper. This would give the Fed room to hike less aggressively which could create further dead bat bounces.

Inflation marches higher

On the other hand, soaring rents hit 6.2% YoY accounting for about 40% of the increase in core CPI, surpassing the previous 6.1% high in Aug 1990. This pushed the core CPI to 6.3% vs est 6.1%. Higher mortgage rates are forcing people out of the homebuying market. Meanwhile, the food index jumped 11.4% YoY, the largest increase since May 1979 helping to push the CPI to 8.3% vs est 8.1%.

The PPI came in at 8.7% YoY vs 8.8% est, but core PPI came in at 7.3% YoY vs 7.0% est which was lower than the prior month’s 7.6% due to falling energy prices. Goods costs slipped due to falling gasoline prices while services costs rose.

Fed funds futures readjusted their estimates of a 100 bps rate hike to 18% when the Fed meets later this month. Out to the end of the year, Fed funds futures now expect a target range of 425-450. From current levels of 225-250, futures are pricing two 75 bps rate hikes, and one 50 bps hike. Stock and crypto markets are far more likely now to continue their choppy downtrends.

Million-millions metaverse

The metaverse is the one of the most risk-on assets so expect digital valuations to continue to plummet as interest rates rise. That said, in the coming years, the metaverse will offer vastly superior efficiencies and cost reductions in the way human beings create and transact value so expect crypto space valuations which

currently hover around $1 trillion to soar into the tens of trillions.

(͡:B ͜ʖ ͡:B)

Dr Chris Kacher, PhD nuclear physics UC Berkeley/record breaking KPMG audited accts in stocks & crypto/bestselling author/top 40 charted musician/blockchain fintech specialist. Co-founder of Virtue of Selfish Investing, TriQuantum Technologies, and Hanse Digital Access*\. Dr\. Kacher bought his first Bitcoin at just over $10 in January\-2013 and contributed to early Ethereum dev meetings in London hosted by Vitalik Buterin\. His metrics have called every major top & bottom in Bitcoin since 2011 to within a few weeks\. He was up in 2018 vs the avg performing crypto hedge fund \(\-54%\) \[PwC\] and is up well ahead of Bitcoin & alt coins over the cycles as capital is force fed into the top performing alt coins while weaker ones are sold\. *

Website 1 of 4: Virtue of Selfish Investing Crypto Reports

LinkedIn: https://www.linkedin.com/in/chriskacher/

Company 1 of 3: TriQuantum Technologies: Hanse Digital Access

Twitter1: https://twitter.com/VSInvesting/

Twitter2: https://twitter.com/HanseCoin

Encyclopedia1: https://de.wikipedia.org/wiki/Chris_Kacher

Encyclopedia2: https://everipedia.org/wiki/lang_en/Chris_Kacher

Author: https://www.amazon.com/author/chriskacher

Composer: https://music.apple.com/us/album/teardrop-rain/334012790

Youtube: https://www.youtube.com/user/teardropofficial

Interviews & Articles: https://www.virtueofselfishinvesting.com/news

The post Are you ready for multidimensional metaverses? appeared first on CityAM.