By Jack Barnett

The Bank of England pushed back against the City’s expectations for an emergency rate hike today to stem the pound’s losses against the US dollar.

In a statement issued late afternoon, the Bank’s governor Andrew Bailey said it will “make a full assessment” of the pound’s slide and the government’s borrowing and tax cutting splurge at its next meeting on 3 November and “act accordingly”.

He added the monetary policy committee “will not hesitate” to hike rates steeply to get inflation, running at a 40-year high of 9.9 per cent, back to its two per cent target.

Bailey’s comments open the door for a super-sized rate hike of at least 75 basis points at the next meeting.

Sterling had partially recovered from overnight losses in which it touched a record low against the dollar before the statement, largely driven by investors betting on the Bank lifting borrowing costs.

It tumbled two per cent against the greenback after the announcement and dropped against the euro.

Earlier today, City economists said the Bank needs to hike interest rates by the greatest amount in its independence this week in an emergency meeting to drag the pound from its record low against the greenback.

Economists at consultancy Capital Economics said in an emergency note to clients this morning that Bank governor Andrew Bailey and co should lift borrowing costs as much as 150 basis points to stem the pound’s losses.

“Tough talk supported by a large and immediate interest rate hike [would show] the markets the Bank is writing the script not responding to it,” Paul Dales, chief UK economist at Capital Economics, said.

“The UK will face higher interest rates, continuing concerns about long-term fiscal sustainability and the gradual realisation that period of tighter fiscal policy will be needed further down the line. And all of that will weigh on the economy,” he added.

Analysts at Nomura, an investment bank, said today they expect the pound to fall below parity with the dollar by the end of this year and hit $0.95 in the first three months of 2023.

The MPC has never hiked rates in an emergency meeting since it was created 25 years ago.

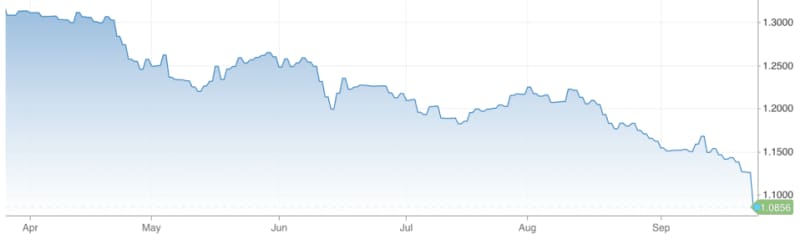

Pound/US dollar exchange rate

The City thinks UK rates will climb to six per cent next year. But, the Bank may have to front-load rises, with traders baking in 175 basis points worth of hikes by November.

Bets on rapidly rising rates have ramped up significantly since Kwarteng’s mini-budget last week.

Markets have ditched sterling in response to chancellor Kwasi Kwarteng last week launching the biggest tax cuts since 1972, unleashing a short-term borrowing splurge.

The chancellor and prime minister, Liz Truss, think the move will jolt the UK economy out of the mire and lift GDP growth.

Sterling lost over three per cent against the US dollar after the mini-budget was unveiled last Friday.

But, sterling’s losses extended into the new trading week, with the pound plummeting as much as four per cent in overnight trading in Asia against the dollar to hit its lowest level ever against the greenback.

The pound has since recovered some ground, but is still down.

Some experts have highlighted the US dollar has been on a tear against the world’s major currencies. The pound is up against the euro today.

Yields on UK government debt fired higher this morning, driven by traders demanding a higher return to swallow the sharp uptick in borrowing.

The government could borrow more than £400bn over the next four years to fund the tax cuts, according to the Resolution Foundation.

Returns on the 2-year gilt climbed nearly 50 basis points to 4.47 per cent, the highest since the financial crisis. At the beginning of the year, rates were under 0.7 per cent on the bond.

The 10-year gilt also scaled higher. Prices and yields move inversely.

Steep rate hikes in America by the Federal Reserve have strengthened the dollar this year. The Fed has raised rates 300 basis points since March, the quickest tightening cycle since the 1980s.

The Bank of England has already hiked borrowing costs rapidly this year from a record low 0.1 per cent to 14-year high of 2.25 per cent.

Bailey and co lifted rates 50 basis points last week for the second time in a row.

However, fears over a tough UK recession and unstable public finances has whacked the pound.

Higher interest rates typically strengthen currencies by incentivising investors to buy assets denominated in said currency.

Inflation in the UK has surged to a 40-year high of 9.9 per cent, forcing the Bank to act.

The post Pound slides after Bank of England bats away emergency rate hike pressure appeared first on CityAM.