By Darren Parkin

Friday round-up

with Darren Parkin

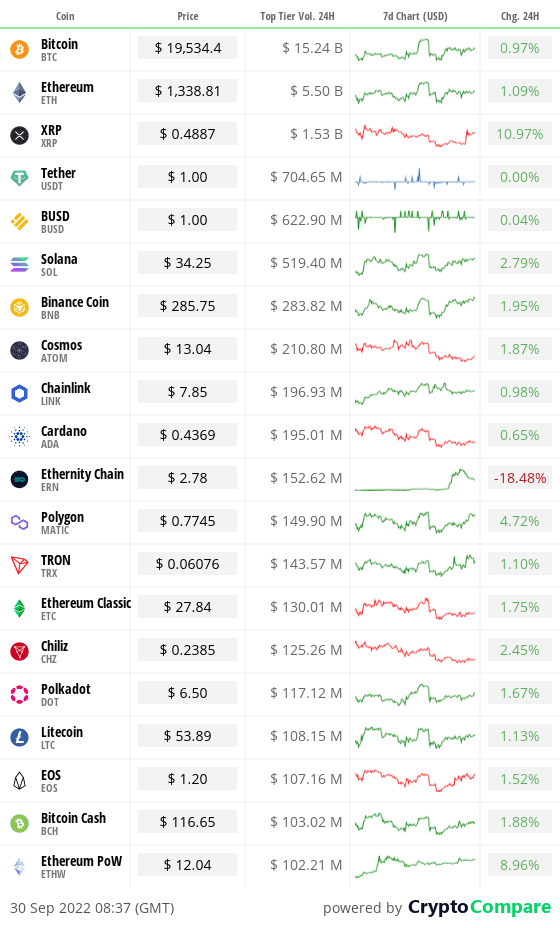

You could be forgiven for thinking your screen has frozen as you stare into the cryptocurrency charts this morning. There has been little movement in any direction for all major crypto assets.

While this lack of short-term volatility will be mostly welcomed by those who dream into a future where crypto price charts don’t look like erratic heart monitors, there is something quite unnerving about sideways movement – a rarely seen thing in the last three years.

It may be that the likes of Bitcoin and Ethereum are waiting on a narrative before we see any significant price action.

Bitcoin was holding the line just above $19,500 this morning – barely half a per cent above yesterday, and just two per cent up from last week. Ethereum was showing an equal lack of enthusiasm and, at $1,340, was pretty much the same as yesterday, although up three per cent over seven days.

In the US, stocks are rapidly heading into notching the longest run of quarterly declines in 14 years. Wall Street had a brutal Thursday that saw a 2.1 per cent fall on the S&P 500, and the Nasdaq Composite take a near-three per cent hit when the Bank of America gave Apple a ‘neutral’ rating rather than ‘buy’.

We’ll see how the US responds later today as markets open after 2.30pm UK time.

Whatever backdrop the narrative takes, it will be heartened by something of a comeback for the British Pound. Sterling was at $1.12 against the US Dollar this morning, and closing in on where it was prior to last Friday’s catastrophic mini-budget.

Prime Minister Liz Truss and Chancellor Kwasi Kwarteng have met with Richard Hughes – chairman of the Office for Budget Responsibility – at Downing Street. The OBR is the UK’s independent financial forecaster.

News that even just a meeting has taken place has already lifted the markets where many have their fingers crossed for a U-turn on some of last week’s financial moves.

It is hoped the Chancellor can keep the battered HMS Sterling in these calmer waters long enough to sail her towards the harbour of his medium-term fiscal plan on November 23.

I’m sure it’s no coincidence that Kwasi Kwarteng has chosen this date because it sits slap bang in the middle of the Crypto AM Summit and Awards, and he knows full well that some of the brightest financial minds in the UK will be gathered down the road at the Royal Leonardo Hotel, St Paul’s.

It’s a good job you’ve already got your ticket, isn’t it?

DP

PS: It may have easily escaped your notice, but the march of Binance continues. While we were sleeping, Binance quietly slipped into New Zealand… Binance officially registered in New Zealand (cityam.com)

Have you booked your tickets for the Crypto AM Summit and Awards? Click here… Crypto AM Summit & Awards 2022 – CityAM

Yesterday’s Crypto AM Daily in association with Luno

In the markets

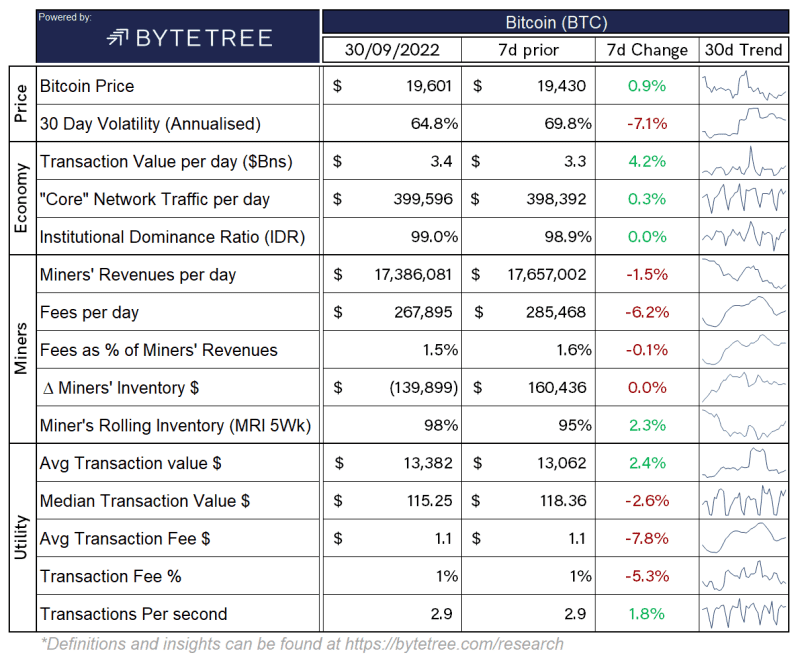

The Bitcoin economy

*Definitions and insights can be found at https://bytetree.com/research

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently$943.712 billion.

What Bitcoin did yesterday

We closed yesterday, September 29 2022, at a price of $19,573.02. The daily high yesterday was $19,589.27 and the daily low was $18,924.35.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $374.73 billion. To put it into context, the market cap of gold is $11.083 trillion and Tesla is $834.4 billion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $39.605 billion. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 46.49%.

Fear and Greed Index

Market sentiment today is 21, in Extreme Fear.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 41.08. Its lowest ever recorded dominance was 37.09 on January 1 2018.

Relative Strength Index (RSI)

The daily RSI is currently 48.35.Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“The crisis the central bankers are trying to avert is the free functioning of markets delivering fair interest rates. In these times of financial repression the rational response is to opt-out and embrace non-sovereign store of value assets like Bitcoin.”

Michael Saylor, executive chairman and a co-founder of MicroStrategy

What they said yesterday

Recycle, reuse, reduce…

Evolution or revolution?

She gets it…

Barry Silbert’s Digital Currency Group, was created to introduce Bitcoin to a mainstream audience in a meaningful way and now has members right across the UK.

We share tips, stories and ideas on how to encourage others to try Bitcoin for the first time. And, thanks to support from Luno, each Pioneer gets £500 of Bitcoin a month to share with beginners, helping them get started.

So, if you’re passionate about Bitcoin, why not join today? Click here to find out more!

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com 🙏🏻

Crypto AM: Editor’s picks

Three-in-four wealth managers are gearing up for more cryptocurrency exposure

Crypto.com granted FCA licence to operate in UK

Q&A with Duncan Coutts, Principal Technical Architect at IO Global

Jamie Bartlett – on the trail of the missing ‘Cryptoqueen’

MPs are falling silent over potential of cryptocurrency

Erica’s ‘Crypto Wars’ handed honours in Business Book Awards

‘Let people invest’: Matt Hancock makes case for liberal crypto rules

Explained: Why the Treasury is so sold on stablecoins

Fears crypto is used to avoid sanctions ‘misplaced,’ says Matt Hancock

The cryptocurrency fundraisers behind Ukraine’s military effort

Crypto crazy couple name baby after favourite digital asset

Crypto AM: Features

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Contributors

Crypto AM: In Conversation with James Bowater

Crypto AM: Tomorrow’s Money with Gavin S Brown

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Visions of the Future, Past & Present with Alex Lightman

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Taking a Byte out of Digital Assets with Jonny Fry

Crypto on the catwalk

Crypto AM: Events

For those of you who missed the Crypto AM DeFi & Digital Inclusion online summit 2021 – you can now watch the event in two parts via YouTube

Part One

https://www.youtube.com/watch?v=dvqNMNZTIDE

Part Two

https://www.youtube.com/watch?v=WXhX_-Tr5j0

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:00 BST

The post Crypto markets flat as US stocks continue descent while Sterling recovers appeared first on CityAM.