For weekend reading, Gary Alexander, senior writer at Navellier & Associates, offers the following commentary:

Indexes are setting new annual lows. In my previous column, I predicted (based on the history of mid-term election year markets) that we would likely see lower lows in the fall, if history is any guide.

It may happen sometime in early to mid-October, but then we’re likely to see a dramatic year-end rally – probably starting before the actual November 8 election results are in. After all, markets tend to anticipate news.

Q2 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

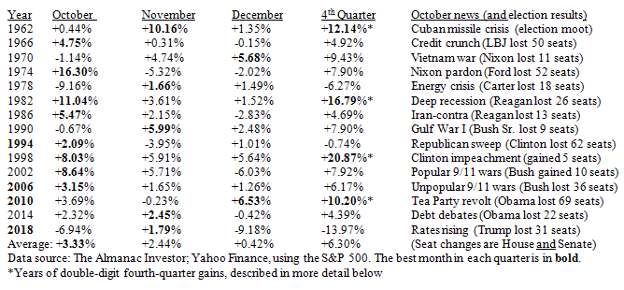

Below is a month-by-month look at the last 15 fourth quarters of mid-term election years, since 1962. Going into this study, I thought that the late-year gains would be strongest in November, after the election results were in, but that was not the case.

As you can see from this table, the majority of the gains came in October, before the elections. What’s more, October was the best-performing fourth-quarter month in 8 of the last 15 mid-term cycles:

There are some interesting stories here. Among double-digit fourth-quarter gains, these four lead the pack:

- In 1962 (+12.1%), the Cuban Missile Crisis was resolved in late October, which gave JFK an election boost. His Party lost only two seats (-4 in the House and +2 in the Senate) after pundits once expected he would lose far more. In addition, November delivered a nice double-digit 10.2% market gain.

- In 1982 (+16.8%), we still suffered from our worst postwar recession, and the once-popular Ronald Reagan sported a 42% approval rating, but Fed Chair Volcker had broken the back of inflation and was busily lowering interest rates by giant steps, so that delivered an 11% market boost in October.

- In 1998 (+20.9%), October gained 8% even though President Clinton was subject to impeachment investigations. His popularity soared to 65% and stayed there through the mid-term election, as most people thought the charges were fairly trivial. After the previous 10 Presidents (going back to FDR) had lost seats in mid-term elections, Clinton actually gained 5 House seats and lost no Senate seats.

- 2010 (+10.2%) is the most recent double-digit gain, when Tea Party voters delivered what columnist Charles Krauthammer called a “restraining order” to the Obama Administration’s ambitious plans. The 2010 election resulted in the largest swing since 1938: +63 House seats and +6 Senate seats.

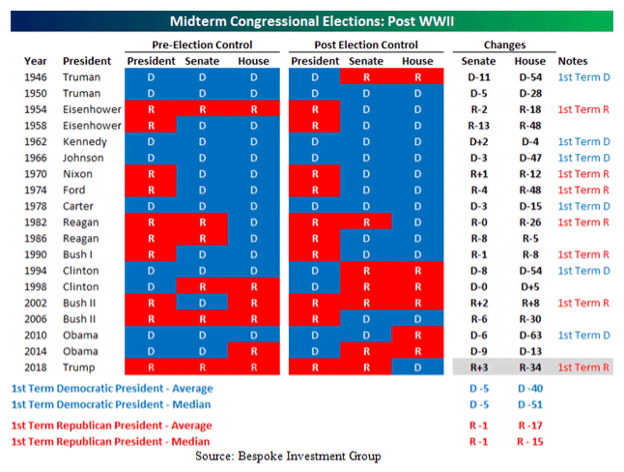

This table from Bespoke Investment Group shows a summary of the mid-term election results since 1946:

Will 2022 Be An "Inflation Election" or Will We See an October Surprise?

Last April, The Wall Street Journal called the coming mid-terms, “The Inflation Election”. Since then, each time the Biden team says inflation has peaked, some uncomfortably high inflation numbers emerge, partly caused by Biden’s blunders, like limited fossil fuel exploration or pushing more costly electric vehicles (EVs).

We are already suffering from electricity shortages, even with a small percentage of EVs on the road. In the last 12 months, through August 31, electricity prices are up 15.8% and utility prices, including natural gas, are up 33%.

Groceries are up 13.5%, which is the fastest rise since 1979. Wages aren’t keeping up, as real average hourly earnings are down 2.8% from August 2021 to August 2022, so inflation remains the #1 issue for most voters this year.

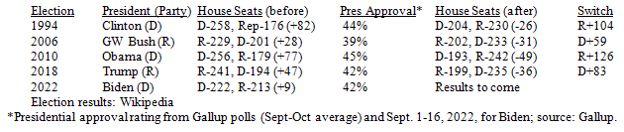

Each of the past four Presidents suffered a reversal of their Party’s Congressional majority during a mid-term election: Clinton in 1994, Bush in 2006, Obama in 2010, and Trump in 2018 – two Democrats and two Republicans.

President Biden has a much narrower margin in both Houses than the previous four Presidents, and he has a low popularity rating, so he will likely suffer the same fate this November.

With Democrats barely holding 50-50 in the Senate and 51-49 in the House, that’s the narrowest plurality going into a first-time mid-term, and Biden’s latest approval rating is the same 42% as Trump’s in 2018.

The Fed isn’t doing the President any favors. Following the Federal Reserve’s latest hawkish inflation-fighting game plan, we’re liable to see a 0.75% rate increase just six days before the election, so a big swing in Congress this fall – how much is anyone’s guess – is a likely bet.

The current real-money odds in Las Vegas are about 6-to-1 (put up $6 to win $1) that the Republicans will take control of the House.

The war in Ukraine is important, but out of touch to most Americans. Inflation in food and energy prices – exacerbated by that war (but not caused by it) – are closer to home for most voters.

With inflation stubbornly higher than the “transitory” predictions of the Fed last year, and only one more monthly data point to report for the Consumer Price Index (CPI) before the elections, there is not much time for the Biden team to turn around inflation expectations among millions of voters suffering these high prices.

There’s always the chance for an October or early November surprise, like a sudden solution to the war in Ukraine, but even in that arena, the blundering Biden team seems more intent on unconditional surrender and regime change in Russia than in negotiations.

There’s also talk of more regulations and higher taxes, while flooding the economy with cash-machine, vote-buying schemes like college loan debt forgiveness.

Incumbents seldom win re-election for their Party when they take a bustling 6.3% GDP economy down to “stagflation” (zero growth plus inflation), even if they come up with spending plans disguised as Inflation Reduction Acts, so get ready for Gridlock, unless the Biden team can pull a miracle out at the last minute.