By Jack Barnett

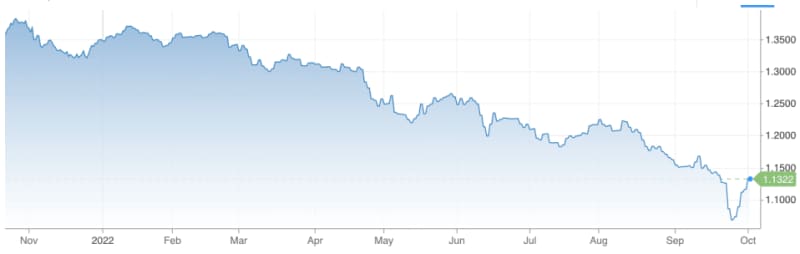

The pound today climbed to its highest level against the US dollar in two weeks despite chancellor Kwasi Kwarteng trashing market expectations of a sooner-than-expected fiscal plan.

Sterling surged 0.78 per cent against the greenback to buy $1.141. It has now regained all its losses since Kwarteng’s mini-budget rocked the currency last month.

UK borrowing costs also fell sharply today. The 2 and 10-year gilts – a government bond – dropped around 10 basis points.

Last week, yields on the 30-year gilt surged to their steepest level in over 20 years as investors demanded a higher return to swallow more government borrowing. Yields and prices move inversely.

The capital’s premier FTSE 100 index climbed 2.57 per cent to close at 7,086.46 points. It had started the day below the 7,000 point mark.

Meanwhile, the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, sky-rocketed over three per cent to finish at 17,804.83 points.

Pound/USD exchange rate

Late last night, Tory MP Mel Stride, head of the treasury committee, welcomed prime minister Liz Truss and the chancellor committing to providing more details on their growth plan and publishing the Office for Budget Responsibility’s (OBR) forecasts earlier than 23 November.

Expectations of an earlier OBR report and fiscal statement from Kwarteng seemingly boosted markets for most of the day.

However, in an interview with GB News, the chancellor said the fiscal statement and OBR report will in fact be published on the original slated date of 23 November.

Truss and Kwarteng were being seen as trying to soothe markets’ fears over the UK’s fiscal credibility by giving investors early access to the OBR’s assessment.

Yesterday, Truss and Kwarteng rolled back on ditching the 45 per cent top rate of income tax in their first U-turn of the day.

Financial markets have been rocked by the government launching £45bn of unfunded tax cuts and a multi-billion pound energy support package without releasing independent forecasts breaking down how they would pay for the support.

Scrapping plans to get rid of the top income tax rate will yield little revenue for the Treasury, meaning Truss and Kwarteng are still on course to borrow billions, according to the Institute for Fiscal Studies and Resolution Foundation.

According to reports in The Sun, chairman of the Conservative 1922 Committee, Graham Brady, told Truss last night she did not have enough support from MPs to get ditching the top income tax band through parliament, forcing her into the U-turn.

Truss is seemingly on course for another bout with her party over benefit upgrades.

Speaking to the BBC, the prime minister did not rule out not raising benefits in line with inflation. Penny Mourdant, a cabinet member, told Times Radio this morning welfare payments should rise in line with inflation, which is running at a 40-year high of 9.9 per cent.

The post Kwarteng trashes market bets on earlier OBR report and fiscal plan appeared first on CityAM.