By Darren Parkin

by David F Carr of Similarweb

When Kraken CEO Jesse Powell announced in late September he was stepping down, it was natural to ask – as observers do after most every major leadership change – is this company in trouble? Powell is moving to a board seat but plans to remain active as an advocate for the company.

Of course, the cryptocurrency market as a whole has been under stress for most of 2022, with Bitcoin and other crypto assets suffering through a selloff and many crypto enterprises announcing layoffs – if not bankruptcies.

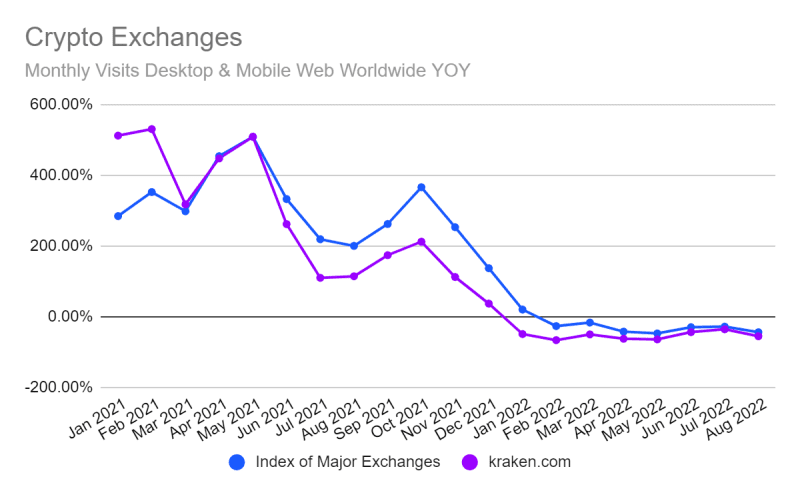

By the yardstick of web traffic – which reflects both engagement with current customers and interest from potential customers – kraken.com has been doing about the same as the rest of the market lately in terms of momentum. Well, maybe a little worse. On a year-over-year basis, traffic has been down between 35% and 66% every month since January, according to Similarweb estimates.

The index shown here is simply the sum of the traffic to 18 leading crypto exchange sites I’ve been tracking for other projects. It’s intended to give a clearer picture of how Kraken has been gaining or losing interest in its offering compared with the market as a whole.

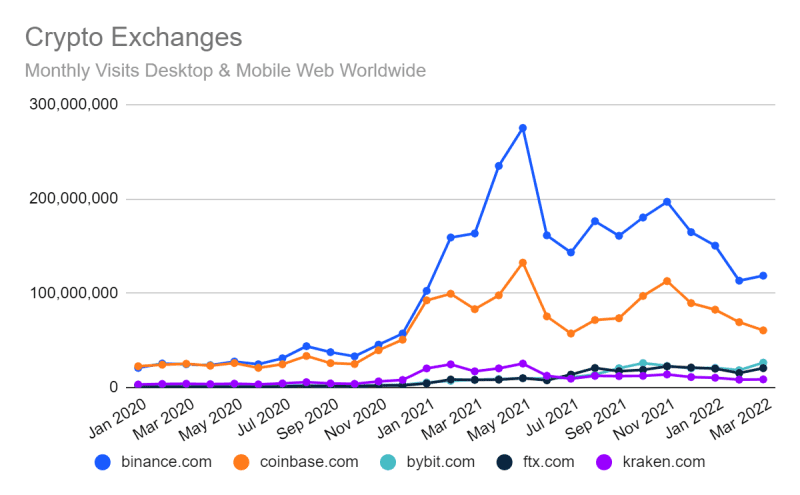

Total traffic numbers for kraken.com versus selected competitors look something more like this worldwide, where binance.com is dominant:

I’m not claiming that traffic numbers tell the whole story. Kraken remains #4 in CoinMarketCap’s global exchange ranking, which weights web traffic alongside trading volume (and confidence in the trading volumes reported by different players), behind Binance, FTX, and Coinbase. By web traffic alone, I count seven exchange web domains (not all of them shown above) that rank higher. For any business, little details like how many website visitors you can convert into customers and what margins you can make on that business are critical.

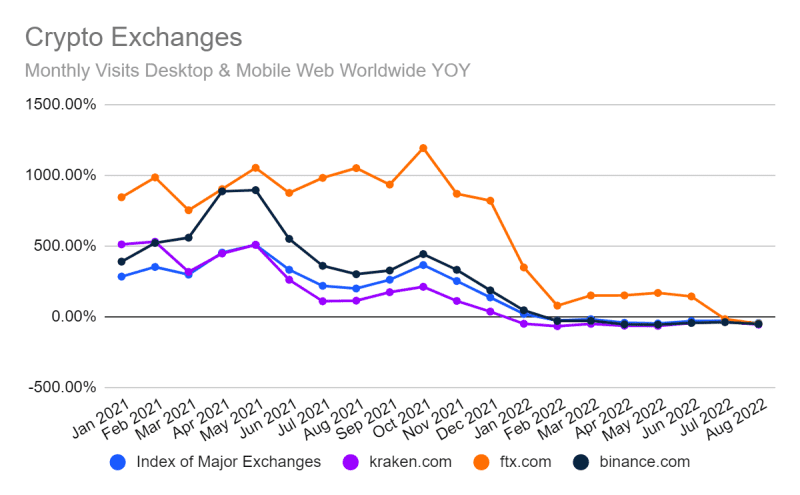

Where web traffic gets interesting is in the upside market momentum of these exchanges.

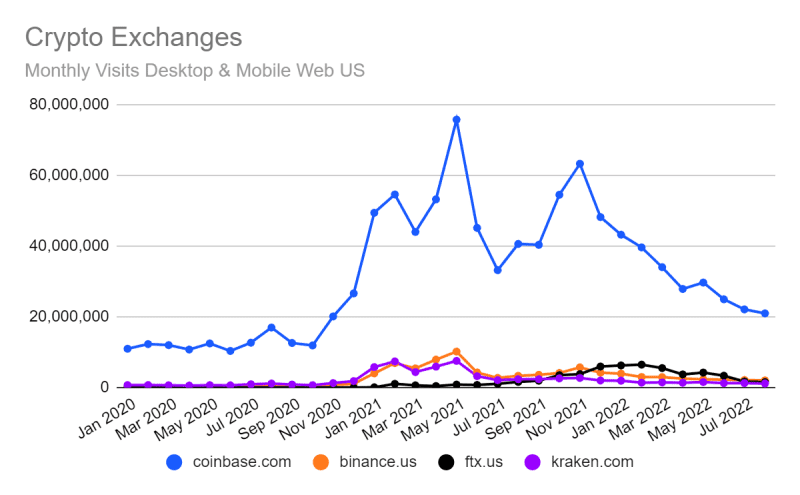

In the US, Coinbase comes out on top. Founded a year earlier, Kraken hasn’t gone public (although management continues to talk about that as a possibility) or achieved the mass-market recognition of Coinbase. Of course, Kraken hasn’t blown money on Super Bowl ads, either.

Kraken has been in the news but not necessarily the recipient of favorable coverage. The third paragraph about the New York Times story on Powell’s resignation focused on internal turmoil over his comments about race and gender – and his suggestion that anyone who didn’t like his views was free to leave the company.

With Dave Ripley, formerly Chief Operating Officer, taking over the CEO role, Kraken has the opportunity to recover from that particular unforced error.

But if we consider web traffic as a leading indicator of growth, Kraken has some work to do to catch up with, for example, FTX, which has one of the best growth stories in the industry. As recently as June, ftx.com traffic was up 144% year over year and its relatively new ftx.us domain was up 348%.

Doing about as well as the rest of the market isn’t good enough when the market as a whole is in trouble, and some of Kraken’s competitors are demonstrating they can do better.

David F Carr is a Senior Insights Manager at Similarweb who seeks out stories in the company’s web traffic data, with cryptocurrency and related technologies as one of his coverage areas.

The post Kraken traffic in decline, in line with the market appeared first on CityAM.