By Jack Barnett

The UK is staring over a recession cliff edge, caused by soaring inflation and rising interest rates, that will be lengthened by turmoil in financial markets, official figures published today revealed.

The economy unexpectedly shrank 0.3 per cent over the month to August, according to the Office for National Statistics (ONS).

Economists had expected gross domestic product (GDP) to flatline over the summer.

The pound rose 0.7 per cent against the US dollar and London’s FTSE 100 was flat on the news.

Weaker than expected UK output was driven by consumers reining in spending in response to inflation, running at a 40-year high of 9.9 per cent, eroding their finances.

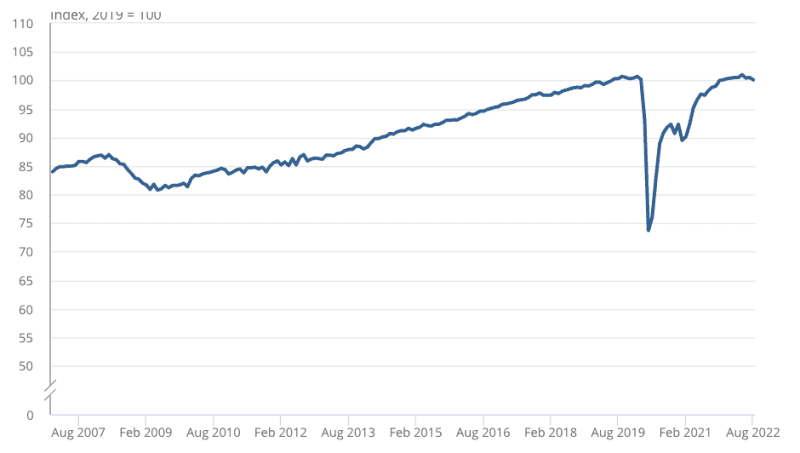

UK GDP has flatlined recently

Figures out yesterday from the ONS showed pay growth is being wiped by rising prices at one of the fastest rates on record.

Britain’s consumer-facing sectors contracted 1.8 per cent in August, “reflecting the intense real income squeeze on households,” Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said.

A fall in production and manufacturing activity also led GDP lower.

The worse than predicted ONS figures illustrate the UK economy may already be in the early stages of a recession, defined as two consecutive quarters of negative GDP.

The world’s top economic institutions, including the Bank of England and yesterday the International Monetary Fund (IMF), have forecast the economy is on course to slow markedly over the coming year.

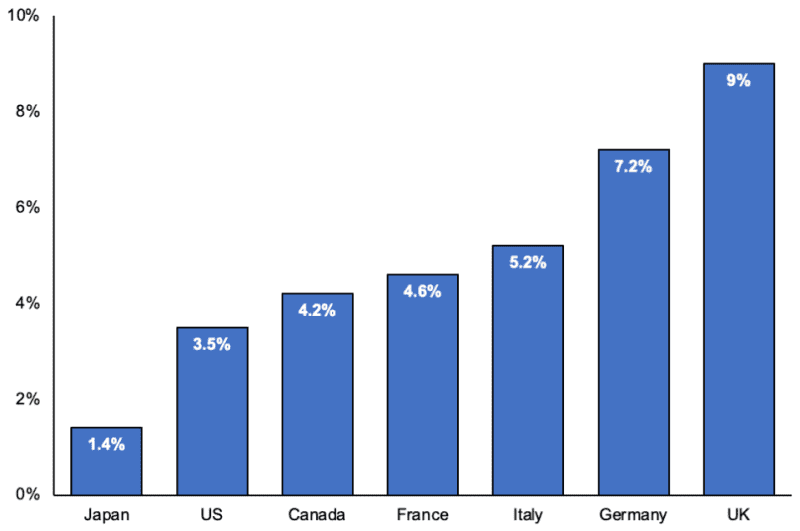

The IMF also said Britain’s inflation crunch will last longer than any other G7 nation, but noted GDP will grow the fastest in the group this year.

UK on course for tougher inflation bout than its peers

The “UK economy teetering on the edge of recession,” Yael Selfin, chief economist at KPMG UK, said.

Upheaval in UK financial markets will elongate the recession and deal a heavy blow to Brits’ budgets, analysts said.

“The combination of the protracted hit to real incomes from mortgage refinancing, the usual lags between changes in corporate sentiment and spending decisions, and the constraints macro policymakers now face suggests that the recession won’t end until late 2023 at the earliest,” Tombs added.

The Bank of England has been forced to unleash a £65bn intervention in the gilt market to tame rising rates. Governor Andrew Bailey said last night the package will end on Friday, as planned.

But, Bank officials have hinted to market participants that the package could be extended, according to the Financial Times.

UK gilt yields have surged, likely due to prime minister Liz Truss and chancellor Kwasi Kwarteng launching £43bn of unfunded tax cuts and stepping up government borrowing.

Yields and prices move inversely.

Higher gilt yields have filtered down into the mortgage market, meaning people who are set to refinance their loans soon will be forced to pay more monthly interest payments.

The two year £2,500 energy bill freeze has averted the worst living standards shock on record, however.

The chancellor linked the financial market volatility and weakening economy to Russia’s invasion of Ukraine.

“Countries around the world are facing challenges right now, particularly as a result of high energy prices driven by Putin’s barbaric action in Ukraine,” Kwarteng said.

The post UK economy on recession cliff edge as GDP unexpectedly shrinks appeared first on CityAM.