Discusses the new capital management initiatives and gives a view from analysts

Shares of mexican-style grill restaurant chain El Pollo Loco (NASDAQ:LOCO) received a nice boost on Wednesday after management announced that they had declared a one-off special dividend and a new share buyback program.

El Pollo Loco’s Shares Jump

LOCO shares opened 14% higher on the news and reached a gain of 17.6% over the day before closing 15.7% higher at $10.53.

Q3 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

El Pollo Loco’s Board declared that they will pay a special dividend of $1.50 per share to shareholders who hold LOCO at the closing of the record date on October 24th.

In addition to the special dividend, the Board authorised a new on market share buyback worth up to $20 million and is approved to begin immediately.

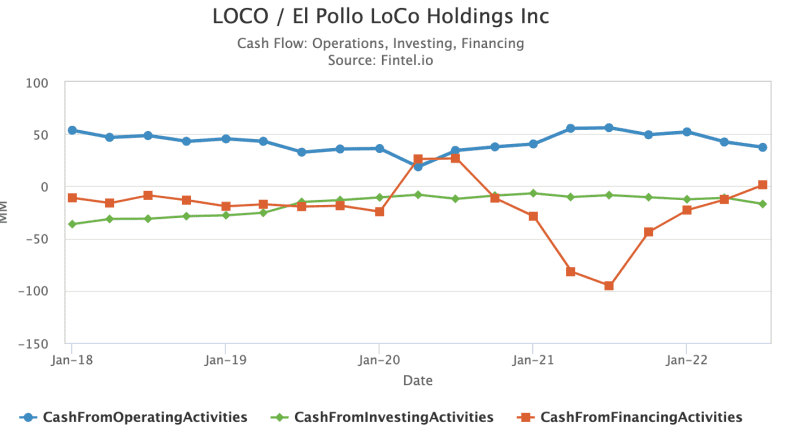

Chairman of the board Michael Maselli expressed his confidence in the company stating: “Despite the challenges over the last couple of years we have continued to build our balance sheet and believe it is time to once again return capital to our shareholders reflecting our low leverage, asset light growth strategy and anticipated positive cash flow in the coming years”

Maselli believes the company is currently in a great position to begin the initiatives and he is probably right.

While the special dividend will reward investors with a one off cash boost from the balance sheet, the buyback will take advantage of the cheap share price that is still trading -27% lower year to date.

LOCO is not usually a dividend paying stock, however, the $1.50 dividend equates to a yield of 14.2% to investors based on the $10.53 closing price.

Fintel’s value score of 83.88 ranks LOCO in the top 19% of companies that are showing the most attractive stock valuations. LOCO is currently trading on a price-to-earnings ratio of ~15x.

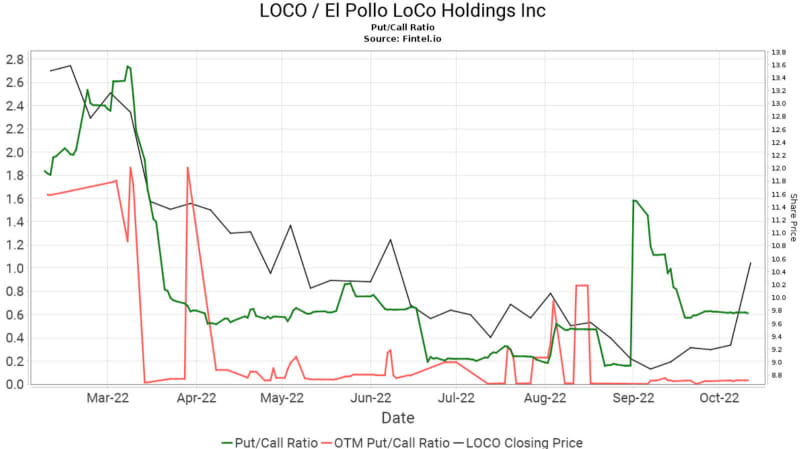

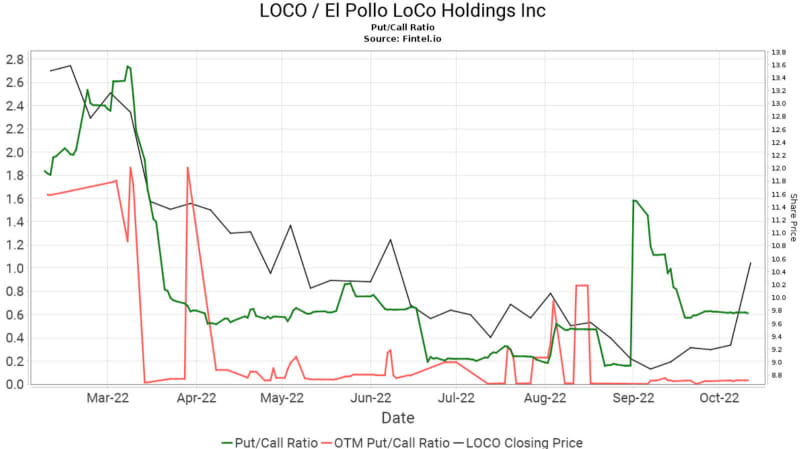

The platform also analyses sentiment in the options market for a stock by assessing the open put and call interest in the market over time. The Fintel platforms put/call ratio of 0.37 is bullish on the stock as it means call demand for LOCO is outweighing put demand.

Sentiment for LOCO has swung from bearish to bullish several times in the last 6 months.

This is shown in the chart to the right that illustrates the put/call ratio against the LOCO share price.

Analyst Andy Barish from Jefferies discussed how the initiative highlights the power of LOCO’s asset-lite growth model, strong free cash flow generation and balance sheet. Barish viewed the actions as reflective of management and the Board’s confidence in the business.

Barish highlights that expectations in the market may be overly conservative and hence Jefferies stays ‘buy’ rated on the stock with a $15.50 target.

LOCO has a consensus ‘hold’ recommendation an average target price of $12.50.

While the stock looks fairly valued, El Pollo continues to experience significant cost inflation and the economy-wide slowing of consumer spending.

The chart below from the Fintel financial metrics and ratios page for LOCO shows the stock’s rolling cash flows from various sources over the last 5 years.

The company is next scheduled to update investors around the 3rd of November when they release third quarter results.

Article by Ben Ward, Fintel