The Group of 20 major economies agreed to work to avoid "spillovers" of monetary policy tightening as central banks move to tackle inflation, the chair said Thursday, amid concerns that higher interest rates will hit debt-saddled countries.

To achieve price stability and avoid spillover impacts, the G-20 is "committed to calibrate the pace of monetary policy tightening appropriately," G-20 chair Indonesia said in a press release following a two-day meeting of the group's finance ministers and central bank governors in Washington.

Indonesia Finance Minister Sri Mulyani Indrawati told a press conference after the meeting that the shift toward increasing interest rates and tightening liquidity is creating "a huge risk" for countries that are already in debt distress.

"We should not dismiss the possibility of an increased risk of recession," she said.

At a time of complex global economic challenges, she also called for "strong leadership and collective action" from the G-20, even as a united response from the group -- which involves members such as the United States, Japan and Russia -- has been largely overshadowed by a rift over Moscow's invasion of Ukraine that began in February.

The G-20 finance chiefs failed to adopt joint statements at their April and July meetings. Instead, papers summarizing the talks have been released by the chair.

The latest gathering, held on the sidelines of the fall meetings of the International Monetary Fund and the World Bank, took place amid growing concerns over the slowdown in global growth, with inflation, on the back of the war and coronavirus pandemic-linked supply chain disruptions, remaining stubbornly high.

The U.S. Federal Reserve has been aggressively raising interest rates since earlier this year to tamp down elevated prices, making the dollar more attractive to investors seeking yield and pushing the value of the currency sharply higher.

A strong dollar helps hold down domestic inflation as it will lower the costs of importing goods from other countries, but it is feared to hit developing nations in particular, through higher costs for imports and by increasing the size of dollar-denominated debts.

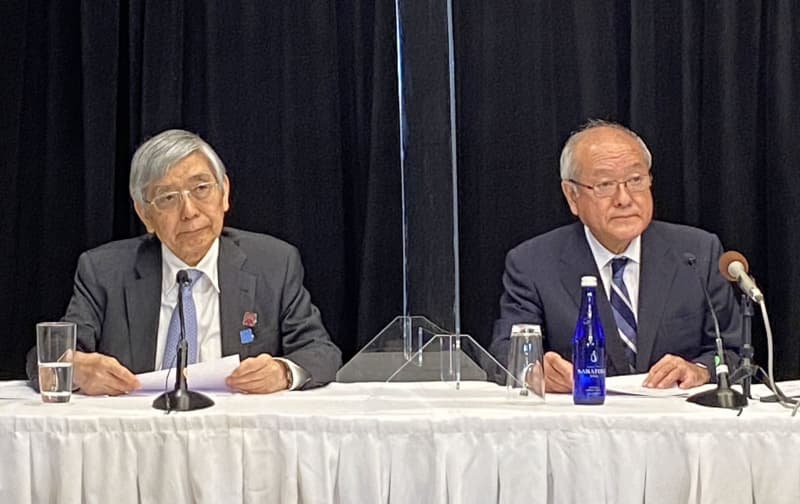

Japan, a resource-poor country, has also been casting a wary eye on the rapid depreciation of its currency. The yen has been under selling pressure over widening divergence in monetary policy between the Fed and the dovish Bank of Japan, where inflation has been relatively low compared to other advanced countries.

Apparently reflecting Japan's concerns, finance chiefs of the Group of Seven industrialized nations acknowledged "increased volatility" in many currencies and the need to keep an eye on the markets during a meeting on Wednesday prior to the G-20 gathering.

In September, Japanese authorities intervened in the foreign exchange market by buying the yen, the first such intervention in 24 years.

The G-20 groups the G-7 members -- Britain, Canada, France, Germany, Italy, Japan and the United States, plus the European Union -- as well as Argentina, Australia, Brazil, China, India, Indonesia, Mexico, Russia, Saudi Arabia, South Africa, South Korea and Turkey.