By Jack Barnett

Around eight minutes is how long prime minister Liz Truss today allocated to explain why she sacked her chancellor for implementing her tax cuts and signed off her second mini budget U-turn.

She did neither.

She answered four questions and committed to her “mission” to boost growth in the UK at a Downing Street press conference.

Jeremy Hunt, the new chancellor, becomes the fourth person to enter Number 11 this year.

The markets did not respond well.

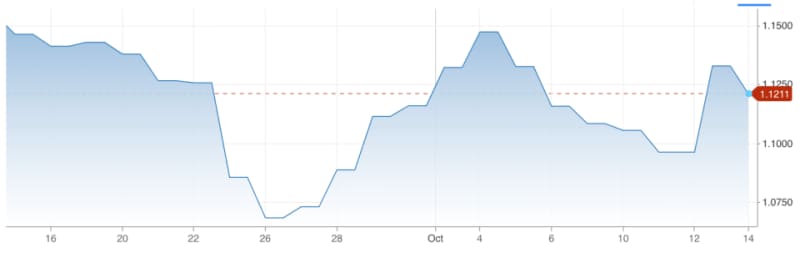

The pound’s losses against the US dollar accelerated after she left the stage. UK borrowing costs, which had been falling in the morning, nudged higher.

The FTSE 100 gave up strong gains.

The problem with the tax cutting mini budget is that it actually produced the exact opposite effect that it was trying to achieve.

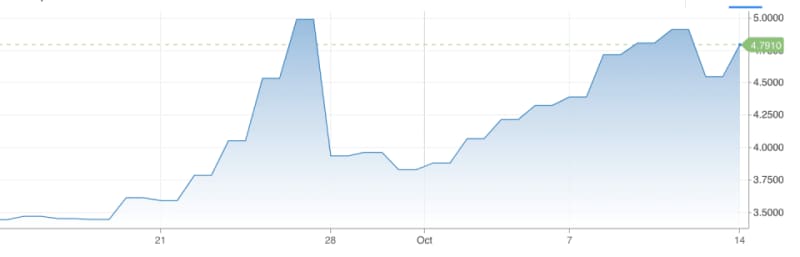

Yield on 30-year UK gilt

Truss and Kwarteng’s – who has today become the second shortest serving chancellor in history (the shortest died of a heart attack) at 38 days – pitch was: put money back into people’s pockets, give businesses incentives to invest and cut red tape and growth will come.

We will never know if their plan would have worked given its around three week shelf life.

The £45bn worth of tax cuts (now around £25bn) and borrowing splurge to fund the untargeted £2,500 two year typical energy bill freeze have sent investors frit.

This year’s borrowing bill is set to come in at £194bn, according to the Institute for Fiscal Studies.

There are other factors at play. The US Federal Reserve has been racing through the fastest rate hike cycle since the Paul Volcker days of the 1980s, sending the dollar on a tear against all the world’s major currencies.

Inflation is running at historic high levels.

But, the U-turn on the six percentage point corporation tax hike will not lower borrowing immediately as it does not apply to the current financial year.

The Resolution Foundation estimates Truss still needs to find between £20bn and £40bn worth of tax or spending cuts to shore up the public finances. That suggests more U-turns are coming.

Bond yields have been surging due to investors demanding a higher premium to park their money in the UK and take on more government borrowing.

Pound/US dollar exchange rate

That has lifted swap rates, meaning lenders have hiked mortgage rates, baking higher borrowing costs into the economy.

On top of inflation climbing to a 40-year high of 9.9 per cent (and on course to peak at 12 per cent) and businesses paying more to service their debt, higher mortgage rates are crushing the economy.

Several economists have forecast the UK will suffer a tougher recession than before the mini budget due to the worsening squeeze on household finances.

Truss’s measures do provide some respite for Brits. Reversing the 1.25 percentage point national insurance hike and bringing forward the 1p cut to the basic rate of income tax will boost finances. The energy bill freeze averts a living standards catastrophe.

But, what is really worrying is the pound’s slide. Usually, when rates rise, a currency strengthens due to the assets denominated in that currency offering a more attractive rate of return.

This may be due to traders paring back their bets on the Bank of England’s rate hike path after the second government U-turn. Markets now think borrowing costs will peak at 5.5 per cent instead of six per cent before today.

Monday could bring yet more volatility in the UK gilt market as it is the first day of trading without the Bank’s £65bn emergency bond buying programme. It only used around £14bn of that kitty, in the end.

Regaining investor confidence has to be the priority for Hunt and Truss now.

If they achieve this goal, “demand for UK assets would be stronger; mortgage rates should retreat from recent spikes, reducing the risk of a serious correction in the housing market; and credit conditions would loosen,” Andrew Goodwin, chief UK economist at Oxford Economics, said.

“Such an outcome could only be helpful for an economy that is showing increasing signs of frailty,” he added.

What is really driving all this turmoil is inflation. Both fiscal and monetary policy need to be aligned to scrape it out of the UK economy. Do that, and investors will warm to the government’s fiscal plans.

Growth is hard to achieve without financial credibility. Time to get to work.

The post Analysis: Truss can’t buck the markets appeared first on CityAM.