By Jack Barnett

The government has put a windfall tax on the UK’s largest banks on the table, sending their shares plummeting today.

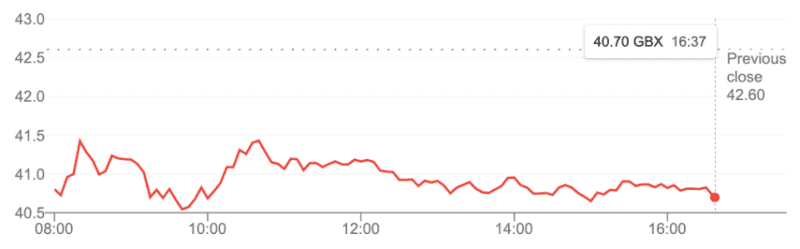

London-listed Lloyds Bank, which is Britain’s biggest mortgage lender, plunged to the bottom of the FTSE 100 index today, shedding 4.11 per cent.

Previously state-owned NatWest trailed closely behind on the biggest losers’ table, dropping 2.92 per cent.

Chancellor Jeremy Hunt is considering imposing a temporary tax on UK banks’ profits in a bid to raise revenue for the countries’ depleted public finances, according to the Financial Times.

A treasury spokesperson said Hunt and prime minister Liz Truss “have been clear that difficult decisions will be required to restore economic stability, and no options are off the table”.

A treasury source highlighted to City A.M. Hunt’s new economic advisory council includes people from City giants JP Morgana and Blackrock, showing he “understands the importance of the financial services” sector.

Hunt has been forced into trying to grab cash from all sources to plug an around £30bn hole in the treasury’s coffers.

He shredded nearly all of prime minister Liz Truss’s botched mini-budget, in which she would have widened thedeficit to around £70bn in a few years’ time by permanently cutting taxes by £45bn.

Lloyds share price has tanked today

Barclays also fell 2.07 per cent today, while HSBC, the UK’s largest bank, actually rose over one per cent.

UK banks’ profits have dipped this year due to the release of billions of pounds of reserves set aside during the Covid-19 crisis boosting their bottom lines dropping out of their earnings reports.

Lloyds after tax profits fell 27 per cent over the six months to June to £2.8bn. Barclays profits also shrank 30 per cent over the same period to £2.9bn, while NatWest’s dropped.

However, analysts reckon their profits are set to be boosted by rising interest rates, which allows banks to charge more on loans.

Banks’ have been subjected to an effective windfall tax of eight per cent, called the bank surcharge, on top of their corporation tax liabilities.

Corporation tax is set to rise to 25 per cent from 19 per cent in April after Hunt reversed plans to ditch the hike.

In October last year, former chancellor Rishi Sunak reduced the surcharge to three per cent to avoid creating an overly punitive banking tax regime. Hunt has not committed to those plans.

David Postings, chief executive of UK Finance, the banking lobby group, said: “The banking and finance industry is the engine of the economy, providing jobs and investment up and down the country.”

“Two thirds of those jobs are outside London. The industry pays a higher rate of taxation overall than any other sector because of the bank surcharge and the bank levy.”

The post Government puts bank windfall tax on table to help plug fiscal hole appeared first on CityAM.