For weekend reading, Gary Alexander, senior writer at Navellier & Associates, offers the following commentary:

The Hurricane Season Is Coming To An End

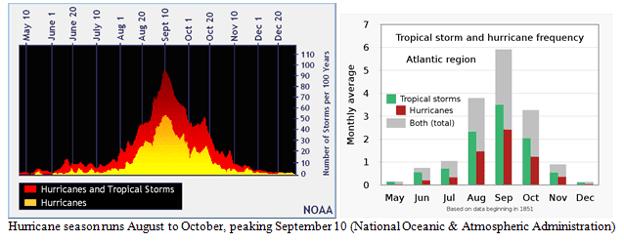

The official “hurricane season” runs six months, from June 1 to November 30, but that’s like giving “participation” trophies to three underperforming months – named June, July, and November. In reality, the hurricane season is a classic bell curve, peaking in mid-September.

Q3 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Stock market risks run in a similar pattern, with September as the worst-performing month in recent history, delivering several market hurricanes in recent years, followed by hefty fourth-quarter recoveries.

I’ve just returned from New Orleans, a city noted for its hurricane (drink) and horrid winds with sweet names like Betsy and Katrina. My family lived in New Orleans in the 1960s and 1980s and lived through two or three big ones.

We left before Katrina hit in 2005, but my parents lived through Betsy in 1965, while I was away at college, and they showed me the waist-high water lines in their home in the Gentilly region, which was very hard hit.

At the time, Betsy was the costliest hurricane ever to America, so she was called “Billion Dollar Betsy.” She flooded approximately 164,000 homes, including ours, killing 76.

Since 1981, I’ve attended the New Orleans Investment Conference, serving as MC and moderator of several panels each year since 1985. We all skipped the Katrina year, so 2022 marks my 40 edition.

The conference always features a stellar array of superb speakers, with a focus on gold and monetary economics. There is generally a “gloomy” outlook on the inflation and deficit front, and a skeptical view of stock market valuations, but they present all sides of the question and leave it up to the listener to decide.

Brien Lundin, who has been the Conference President and CEO since 1999, led off the festivities last Wednesday evening by saying that the Federal Reserve is “trapped,” with markets now “addicted to easy money.”

There have been at least four rounds of quantitative easing, the last one dubbed “QE4-ever,” so markets not only expected easy money “forever,” but they never expected the Fed to raise rates at the fastest pace ever while also reducing its balance sheet (available money) by a huge $95 billion per month.

In his talk, titled “The Endgame: When Easy Money Meets Hard Reality,” Lundin identified one of the hardest realities as our cumulative federal debt, which is projected to reach $35 trillion by March 2024, when current projections are for interest rates to reach 4% to 5% along the bond maturity range of two to 30 years.

That means the Treasury must spend $1.4 trillion to $1.75 trillion each year just to service the national debt, vs. just $300 billion when the debt was $30 trillion at 1% in short-term rates last year.

Lundin also cited the undeniable fact that the Fed and the Treasury created the very problem they are now trying so desperately to solve. He showed quotes from Treasury Secretary Janet Yellen and Federal Reserve officers from early 2021, when they said that inflation was not yet high enough (2% on their favorite measure, the PCE price deflator on the GDP).

One such quote he showed was from Janet Yellen on April 5, 2021, when she said: “The problem for a very long time has been an inflation that’s too low.”

“We have struggled for a decade…to get inflation up to our 2% goal…. We always have the tools to pull inflation down if it gets too high.” - Mary Daly, San Francisco Fed President, Barron’s, April 8, 2021

“The problem for a very long time has been an inflation that’s too low, not inflation that’s too high.” - Treasury Secretary Janet Yellen, April 5, 2021

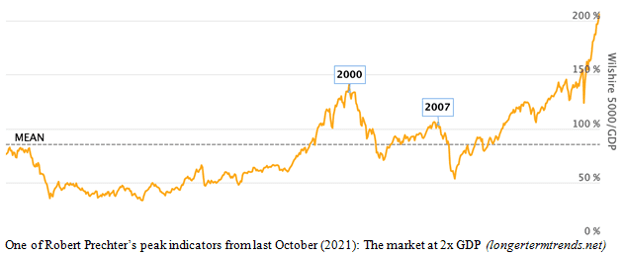

Last Thursday morning, Robert Prechter, CEO of Elliott Wave International, presented a stunning series of charts from his New Orleans speech last October, titled, “The Top of Everything,” when he predicted a peak in stocks, bonds, bitcoins, and several other markets.

He called it “a top for the ages,” in which stocks reached three times sales, two times GDP, all on record margin debt, in which hedge funds averaged a record low 2% in cash. He noted that the peak in bitcoin came soon after, on November 8, 2021, and NASDAQ’s peak came two weeks later.

I’ll just include one such peak chart – the so-called Buffett Indicator (named after Warren Buffett), measuring stock market capitalization vs. U.S. GDP.

These talks are enough to give an investor pause, but there are “silver linings” and a “critical path” of safety, even in down markets, as Louis Navellier has long counseled us. Mike Larson, Editor in Chief of the MoneyShow, reminded us that the S&P Energy sector ETF is up 50% this year while all the other 10 sectors are in the red – and Louis Navellier has made a big bet in energy stocks this year.

The Best Stock Market In The World

Also, I reminded investors in my closing panel that the U.S. has been the best stock market in the world over the last decade, by a wide margin, and the U.S. is the second-best market (#1 is Australia) over the last 30 years, since the fall of the Soviet Union, and over the last 125 years since the Dow was born.

Brent Johnson, CEO of Santiago Capital agreed, saying that the U.S. dollar may appear unsound on the surface, compared to gold, but it is the best paper money to hold vs. all the other “pretenders” out there.

He also said that, in case of any global monetary or economic meltdown, any collapse will “start on the periphery, and end at the core – and America is the core.” America remains the world’s premier oasis.

I was most impressed with those advisors with a solid track record in both bull and bear markets. Jim Stack, President of InvesTech Research, was one. He still thinks we have a way to go to hit the bottom of this bear market, but when we do, it will be “one of the great buying opportunities of our lifetime.”

One of the key indicators he looks for is a washout of the housing bubble, which may be evident in today’s NAHB/Wells Fargo Housing Market index, since this housing bubble is worse than in the early 2000s.

One of the most impressive speakers each year in New Orleans is Peter Boockvar, Chief Investment Officer at Bleakley Financial Group and Editor of the Boock Report (a great title). He broke down the elements of inflation in a very helpful way.

Inflation in services tends to be persistent and sticky, while the inflation in goods can be wild and volatile, but temporary. Think of lumber prices, going way up, then way down, while wages – once offered and accepted – seldom go back down. The latest increase in goods is +7.1%, which he said might fall soon, but the 6.6% increase in services could last a lot longer

Boockvar pointed out that wage growth averaged 2.5% per year from 2007 to 2019, then doubled to 5.0% in the last three years, yet businesses can’t find enough workers, even with higher pay. As a result, the Fed is raising rates at a rapid pace and velocity, which he called their “shock therapy” to the markets.

We don’t know which speaker will have the most bragging rights next October, but it may be significant that this conference usually meets in October or early November, at the end of hurricane season, when the market is often down, so sentiment is often low, but elections are just three weeks away and the historical record shows a solid track record of large market gains now through next July in mid-term election years.

Gray skies are going to clear up.