By Jack Barnett

Much attention has been devoted to the comings and goings at Number 10 Downing Street and the ailing economy in recent weeks, but the UK is not alone in wilting under the weight of soaring prices and interest rates.

The eurozone economy, made up of the 19 countries that use the euro, is on course to shrink 1.8 per cent next year as it is buffeted by elevated gas prices, according to Neil Shearing, chief economist at consultancy Capital Economics.

Russia’s invasion of Ukraine has upended the global energy market by sucking supplies out of the system.

As a result, countries are struggling to adapt to what economists call a “terms of trade shock,” a situation in which spending on imports soars far above income generated from exports.

Shearing said the eurozone is suffering from a “huge deterioration” in its trade position, mainly due to the bloc historically being heavily reliant on Russian gas supplies.

The shock “has been larger than what the region experienced during the twin oil crises of the 1970s, and it is manifesting itself in big falls in household real incomes,” Shearing said.

Shearing’s comments illustrate Britain’s slowing economy is indicative of a wider, global economic slowdown, sparked by inflation hitting historic high levels in the western world.

In the eurozone, prices are up 9.9 per cent over the last year, while in the US, they have risen 8.2 per cent. UK inflation is running at 10.1 per cent.

In response, central banks have been forced to pivot from over a decade of loose monetary policy to raising interest rates at the fastest pace since the 1980s.

The Bank of England has lifted rates seven times in a row, including two back-to-back 50 basis point rises, to 2.25 per cent. It will also begin reversing quantitative easing on 1 November.

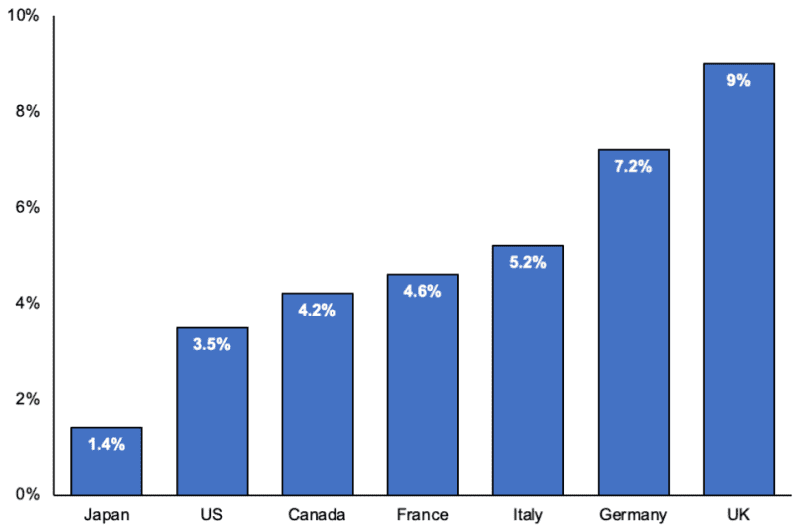

IMF predictions for average 2023 inflation

The US Federal Reserve has hiked borrowing costs to around three per cent, signing off three 75 basis point rises.

But, perhaps the starkest move yet, in the summer, the European Central Bank (ECB) also lifted rates 75 basis points. The monetary authority of the euro countries had left rates in negative territory for more than 10 years. It was a big deal.

ECB president Christine Lagarde and co are expected to back another jumbo move on Thursday. Shearing said there is a chance a 100 basis point hike is coming.

The sudden shift from cheap to more expensive money is sending a chill through Germany, Italy and France’s economies, weighing on the eurozone economy.

“There is already evidence that some interest rate-sensitive parts of the economy are starting to suffer. Housing markets are fragile, with residential construction activity turning down across the euro-zone’s major economies and house prices beginning to fall in those countries that previously experienced the largest increases (notably the Netherlands and Germany),” Shearing said.

Britain is certainly on course for a recession that is almost certain to be longer and deeper as a result of the financial market and political turmoil sparked by Liz Truss’s botched 44 day premiership.

But, the country is certainly not alone.

The post This is a global, not a UK specific, economic slowdown appeared first on CityAM.