By Nicholas Earl

Energy giant Shell does not expect to pay any further taxes under the Energy Profits Levy this quarter, as it has invested sufficient funds in North Sea oil and gas projects such as the Jackdaw, Pierce and Penguin fields.

This has triggered an investment relief mechanism that has largely offset the so-called windfall tax, explained chief financial officer Sinead Gorman.

Gorman said: “We simply are investing more heavily than we have, and therefore we don’t have profits which we can be taxed against.”

The windfall tax – which was unveiled in May – meant Shell wrote down around $360m, in the third quarter to reflect future tax payments.

However, it expects to start paying windfall taxes in the first quarter of next year.

Shell’s chief executive Ben van Beurden told reporters that Government interventions such as windfall taxes and support packages are a “societal reality” and that he recognised that the “many, many people in society were suffering very badly” a result of high energy prices.

He said: “We have to accept that Governments will raise taxes for that. We should be prepared to accept our industry will be prepared to accept that our industry will be looked at for raising taxes, to transfer funds to of those who need it most in difficult times.”

The European Union has recently unveiled its own measures to raise revenues from the profits of energy producers – reflecting the desire of countries to constrain profits fuelled by supply shortages and help fund support for vulnerable households.

Windfall tax is not a ‘surprise’ says Shell boss

The energy boss said producers should not be “surprised” to see windfall taxes rolled out across the world, and that operators should engage with Governments to help design the best policies.

He said: “We should be helping Governments design the right policies, and there are many different ways to design windfall taxes, special levies and contributions. We should be at the table to make sure these interventions are appropriate.”

This follows previous comments this month, where he expressed an open0mind to higher taxes.

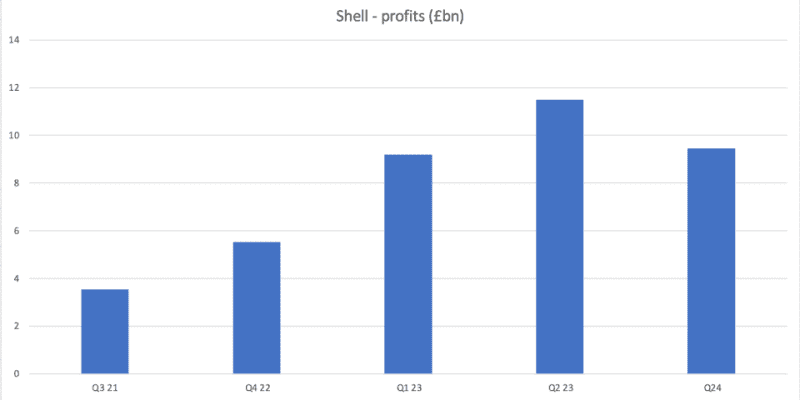

This comes as the energy giant unveiled another mammoth trading update – reporting hefty profits in its third quarter of £8.1bn ($9.45bn),

The headline numbers were below its record previous quarter earnings this year of £9.9bn ($11.5bn), but is still the second best result in the company’s history.

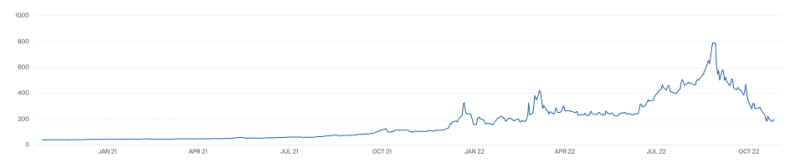

Shell recorded two consecutive quarters of record in the first half of the year – amid a Kremlin-fuelled commodities boom following Russia’s invasion of Ukraine.

The latest results have reignited calls from the Labour Party to expand the windfall tax.

The opposition has called for the Government to backdate to windfall tax to January 2022 and to remove investment relief from the levy.

Earlier this month, Chancellor Jeremy Hunt refused to rule out expanding the windfall tax, however he recognised that oil and gas companies typically had boom and bust years as part of their market cycle.

The Government recently unveiled a cap on revenues from renewable generators – to constrain earnings from companies benefitting from soaring wholesale costs dictated by gas prices.

Industry body Offshore Energies UK has warned against further destabilising the investment climate for new projects – which it regards as crucial to maintaining the North Sea’s role in producing oil and gas.

It has calculated that the Britain produces around 45 per cent of its gas domestically – and relies on Norway as its chief overseas partner, which meets 38 per cent the country’s gas needs.

The Climate Change Committee, Westminster’s independent advisory group, predicts half of the UK’s energy requirements between now and 2050 will still be met by oil and gas, and as much as 64 per cent of UK energy needs between 2022 and 2037.

The post Shell will not pay any windfall tax despite booming profits appeared first on CityAM.