By Darren Parkin

The week in review

with Jason Deane

So, another week where just trying to prioritise stories is a challenge in itself!

A few days ago Rishi Sunak finally got his wish to be Prime Minister when his only major competitor, the relatively unknown Penny Mordaunt, realised she was not going to get the support of party members, so he awarded the position by default.

Of course, the fact that he himself didn’t have the support of the party the first time round has not gone unnoticed, nor the fact that we have an entirely unelected leader now sitting in the most powerful seat in the country. British politics has become the laughingstock of much of the world – something that was neatly highlighted by my favourite tweet this week: “Can’t believe it’s only 2 more PM’s until Christmas already”

Meanwhile, Elon Musk completed his purchase of Twitter and marked the occasion by walking into the main office with a kitchen sink in his typical off-the-wall style. Personally, I have mixed feelings about this; not so much the sink, but the fact that a free speech platform is effectively an impossible concept to govern, but perhaps that’s Musk’s very point? We’ll see.

One thing is for sure, the existing management team of CEO Parag Agrawal, CFO Ned Segal, and the firm’s top legal and policy executive, Vijaya Gadde, willnot be a part of that plan, being unceremoniously escorted from the building shortly after Musk arrived. Of course, we’re all hoping that the incessant bots on Twitter will be given the very same treatment.

“Crypto Twitter” is a key part of the communication channel for Bitcoin and alt coin news and chatter, so will Musk’s acquisition affect this? Will his strange obsession with the joke Dogecoin rear its head? It’s a genuine concern.

In Bitcoin related news, the prolonged effect of low Bitcoin price (in fiat terms) with increased hash rate and difficulty, has started to put even the biggest miners under pressure, with this disturbing report from Core Scientific yesterday which resulted in a 70% share price crash. Miners who over-extended during the bull market now find themselves exposed and there may well be more of a shakeout yet.

Meanwhile, Russia’s war against Ukraine has become an embarrassing, farcical mess that would be utterly hilarious if it wasn’t so inexcusably tragic. The Kremlin has pivoted its message yet again this week, moving from “Denazification” to “De-Satanization” backed by claims of all sorts of anti-religious sects operating in the country, debunked by, well, everybody with a brain cell.

Moscow’s pro-war pundits have started calling it a Holy War in increasingly bizarre rants on state TV, while the Kremlin claims that Ukraine is building a dirty bomb without any evidence. The war, of course, is over. Russia has lost – militarily, politically and economically. The draft has decimated what’s left of the economy better than sanctions ever could, so it’s now a question of how much social and economic damage Putin can inflict before he runs out of meat to put in the grinder.

Closer to home, I couldn’t finish this week’s column without mentioning the outstanding UK Bitcoin Conference held in Edinburgh last week. It was an honour to be part of it, sharing the stage with legends such as Greg Foss, Samson Mow, Natalie Brunell, Peter McCormack, Adam Back, Jeff Booth and so on. Without a doubt one of the best Bitcoin events I have ever been to, and you can see the video from the talks on their YouTube site here. Thank you Jordan and Jim for your incredible work, and I’m looking forward to seeing you in London next year!

Have a great weekend!

Want to learn more about what’s going on in our global financial system and how Bitcoin fits in to it? Come to my next free webinar on November 16 at 6pm to find out, ask any questions, and grab some free Bitcoin .* Click here to register.

Have you booked your tickets for the Crypto AM Summit and Awards? Click here… Crypto AM Summit & Awards 2022 – CityAM

Yesterday’s Crypto AM Daily in association with Luno

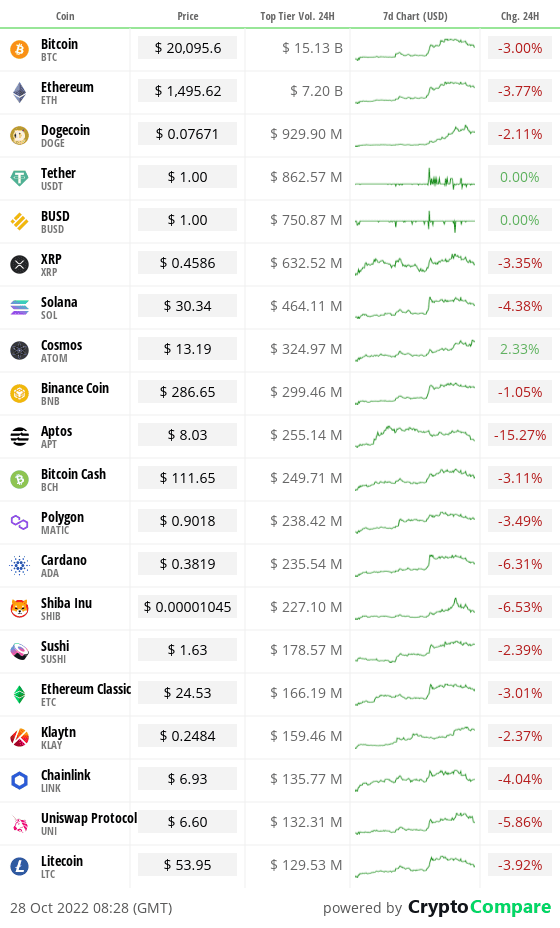

In the markets

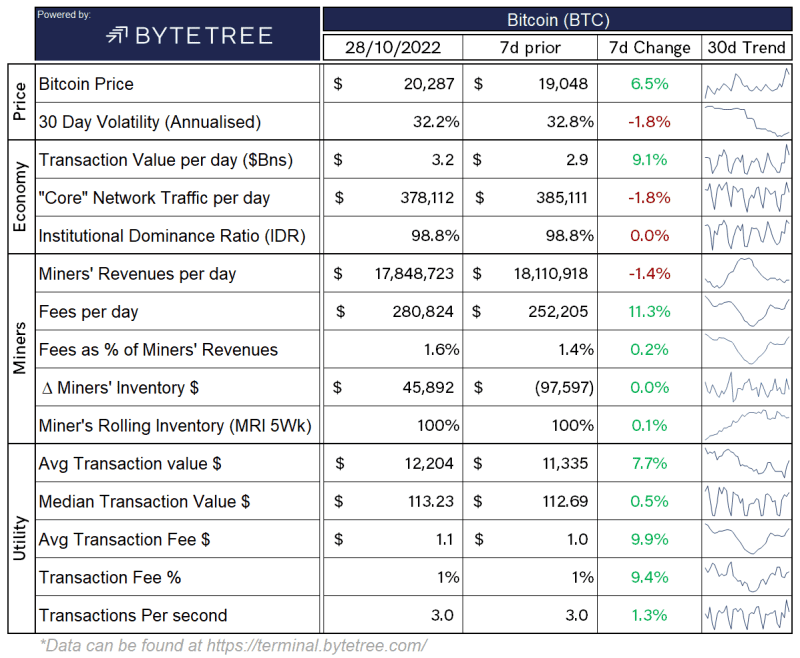

The Bitcoin economy

*Data can be found at https://terminal.bytetree.com/

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently$975.882 trillion.

What Bitcoin did yesterday

We closed yesterday, October 27 2022, at a price of$20,285. The daily high yesterday was $20,854, and the daily low was $20,255.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $385.65 billion. To put it into context, the market cap of gold is $10.915 trillion and Tesla is $700.25 billion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was$49.192 billion. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 30.27%.

Fear and Greed Index

Market sentiment today is 30, in Fear.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 41.39. Its lowest ever recorded dominance was 37.09 on January 1 2018.

Relative Strength Index (RSI)

The daily RSI is currently 52.97.Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“I’m incredibly bullish on this. I’m buying Bitcoin right now. I’ll bet you my Porsche Bitcoin gets back to $60,000”

President Obama’s deputy Chief of Staff, Jim Messina

What they said yesterday

Another fantastic use case…

Great explanation…

Onboarding the unbanked since 2013…

Would you like to help spread the adoption and education of Bitcoin in the UK and even stack some Sats while you’re doing it? Well, now you can!

The Bitcoin Pioneers community, backed by Barry Silbert’s Digital Currency Group, was created to introduce Bitcoin to a mainstream audience in a meaningful way and now has members right across the UK.

We share tips, stories and ideas on how to encourage others to try Bitcoin for the first time. And, thanks to support from Luno, each Pioneer gets £500 of Bitcoin a month to share with beginners, helping them get started.

So, if you’re passionate about Bitcoin, why not join today? Click here to find out more!

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com 🙏🏻

Crypto AM: Editor’s picks

Three-in-four wealth managers are gearing up for more cryptocurrency exposure

Crypto.com granted FCA licence to operate in UK

Q&A with Duncan Coutts, Principal Technical Architect at IO Global

Jamie Bartlett – on the trail of the missing ‘Cryptoqueen’

MPs are falling silent over potential of cryptocurrency

Erica’s ‘Crypto Wars’ handed honours in Business Book Awards

‘Let people invest’: Matt Hancock makes case for liberal crypto rules

Explained: Why the Treasury is so sold on stablecoins

Fears crypto is used to avoid sanctions ‘misplaced,’ says Matt Hancock

The cryptocurrency fundraisers behind Ukraine’s military effort

Crypto crazy couple name baby after favourite digital asset

Crypto AM: Features

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Contributors

Crypto AM: In Conversation with James Bowater

Crypto AM: Tomorrow’s Money with Gavin S Brown

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Visions of the Future, Past & Present with Alex Lightman

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Taking a Byte out of Digital Assets with Jonny Fry

Crypto on the catwalk

Crypto AM: Events

For those of you who missed the Crypto AM DeFi & Digital Inclusion online summit 2021 – you can now watch the event in two parts via YouTube

Part One

https://www.youtube.com/watch?v=dvqNMNZTIDE

Part Two

https://www.youtube.com/watch?v=WXhX_-Tr5j0

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:00 BST

The post It’s been a news rollercoaster, yet the crypto tracks have kept a straight course appeared first on CityAM.