By Jack Barnett

The US Federal Reserve today hoisted the world’s most important interest rate 75 basis points for the fourth time in a row and signalled the borrowing cost peak will be higher than previously thought, scrapping any bets on a so-called “Fed pivot”.

The Washington headquartered central bank hiked rates to a target range of 3.75-four per cent in its latest attempt to prevent inflation baking into the US economy.

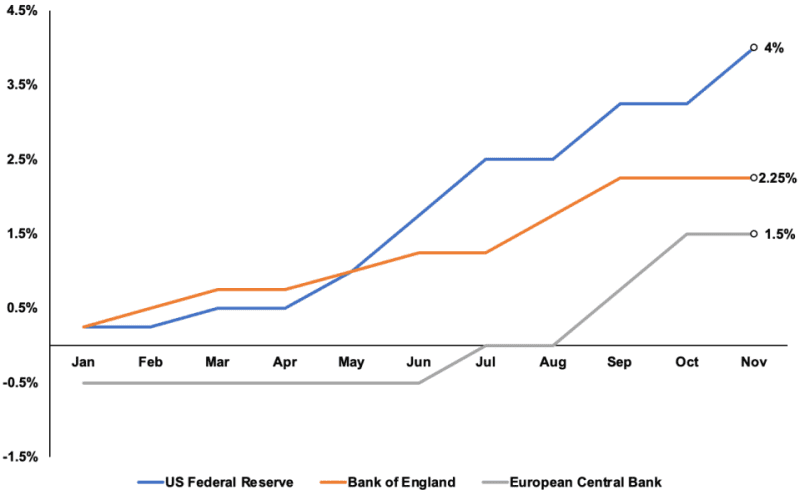

Chair Jerome Powell and the rest of the federal open market committee (FOMC) have now pulled far ahead of their central banking counterparts in the race to chase down rising prices.

Cumulatively, the Fed has now tightened financial conditions 375 basis points since its first move in March, the quickest rate hike cycle since the 1980s when Paul Volcker led the US monetary authority’s fight against a massive inflation surge.

Governor of the Bank of England Andrew Bailey – and the rest of the monetary policy committee – is tomorrow expected to gain some ground on Powell by hiking UK borrowing costs 75 basis points to three per cent.

That would be the biggest move in the Bank’s 25 years of independence and since 1989. It would also mark the eighth successive rate rise.

The Fed indicated it could slow the pace of rate hikes, likely to 50 basis points, but Powell said the final rate level will top projections by the central bank in the summer.

“The ultimate level of interest rates will be higher than previously expected,” he said.

The Fed’s statement, issued at 6pm UK time, suggested a slowdown in rate rises, known as the Fed pivot, could be on the cards.

But Powell’s remarks, which came after the statement was released at a press conference, seemingly pierced those bets.

Wall Street closed sharply lower.

Central banks around the world have been forced to ditch rock bottom interest rates and mass bond buying that supported the global economy after the financial crisis and during the pandemic due to inflation returning viciously.

Prices are 8.2 per cent over the last year in America and 10.1 per cent in the UK, the fastest acceleration in around 40 years.

On the continent, inflation has climbed to 10.7 per cent, the highest since the creation of the euro in 1999.

Fed, BoE and ECB have raised rates quickly this year to tame inflation

While rate rises tame prices, they send a chill through economies by disincentivising household and business spending. Higher rates also make it costlier to borrow.

There are early signs of tighter financial conditions weighing on the US, UK and eurozone economies.

Mortgage rates in the US and UK have topped seven per cent and six per cent respectively, the highest levels in years, cooling housing demand.

That economic slowdown has prompted investors to bet on the Fed flattening its hike to 50 basis points – the so-called central bank “pivot” – beginning at its meeting next month.

However, the Fed’s strategy now seems to be lower, but more rate rises to higher plane its officials thought previously.

The Wall Street Journal’s US dollar index, which measures the greenback against a basket of currencies, fell sharply before Powell’s press conference on signs a pivot was coming. However, after his comments, it climbed around 0.3 per cent.

The post Federal Reserve hikes rates 75bps again and Powell signals higher peak appeared first on CityAM.