By Darren Parkin

The week in review

with Jason Deane

The Guardian’s rather sensationalist headline yesterday “Bank of England warns of longest recession in 100 years” summarised the current situation very nicely as it reported on the effects of the interest rate rise from 2.25% to 3%.

Of course, there are a host of other factors in play but even so, many of us have been talking about the coming storm for the last couple of years. Not because we’re savants, you understand, but because we can simply add numbers up. Or more precisely, are able to see that the numbers don’t add up. They haven’t for some time.

Interestingly, this was very much the theme of the fireside chat I had with Allen Farrington at the Bitcoin conference in Edinburgh a couple of weeks ago, some elements of which have suddenly become even more relevant than they were then. You cancheck out a recording here.

The UK’s economic plight is not unique of course. Figures from the USA are equally concerning and any simple Google search reveals headlines of a similar nature from pretty much anywhere in the world you care to mention. Except one notable outlier – El Salvador.

Having already achieved the impressive feat of moving from one of the most dangerous countries in the world to now one of the safest in a single year, the economic effects of the country adopting Bitcoin as its national currency are now creeping through. With anincrease in GDP of over 10% – largely thanks due to Bitcoin tourism – tax receipts have increased without affecting underlying productivity. There’s a long way to go, but the signs are solid for this tiny state.

Meanwhile, Rishi Sunak’s CBDC comments were picked up and completely ridiculed by Russell Brand inthis short video piece retweeted by Alex Gladstein. There’s no doubt that CBDCs are one of the most sinister inventions ever to be unleashed on the public and, worryingly, around 105 countries, or 95% of global GDP, are currently exploring them as can be seen from this digital map.

However, in one of the few places where a CBDC has actually been fully deployed, Nigeria, it simply hasn’t worked. The reasons for the eNaira’s spectacular failure are explored inthis fascinating article, but the bottom line appears to be that Nigerians were simply able to tell the difference between an elite issued centrally controlled coin – which they absolutely do not trust one iota – and Bitcoin, of which the country has the 11 highest adoption rate in the world. Why use the former, when you can use the latter?

Meanwhile, still in Africa, shoppers are now able to useBitcoin over Lightning to pay for goods at Pick n Pay, one of the larger shopping chains in the Western Cape area. While this is just the latest high-profile adoption, we also received a stark reminder of how much work is still to be done when a single Bitcoin transaction caused a glitch in some Lightning nodes this week. The issue, limited entirely to the second layer Lightning network and NOT the base layer, was quickly resolved.

Meanwhile asElon Musk starts charging $8 a month for a blue tick on Twitter, Putin is humiliated yet again in a u-turn over access to the Ukrainian ports via the Black Sea and giant baubles threaten the streets of London, Bitcoin keeps ticking, growing and building.

And in an uncertain world, I find that certainty incredibly reassuring.

Have a great weekend!

Want to learn more about what’s going on in our global financial system and how Bitcoin fits in to it? Come to my next free webinar on November 16 at 6pm to find out, ask any questions, and grab some free Bitcoin . Click here to register.*

Have you booked your tickets for the Crypto AM Summit and Awards? Click here… Crypto AM Summit & Awards 2022 – CityAM

Yesterday’s Crypto AM Daily in association with Luno

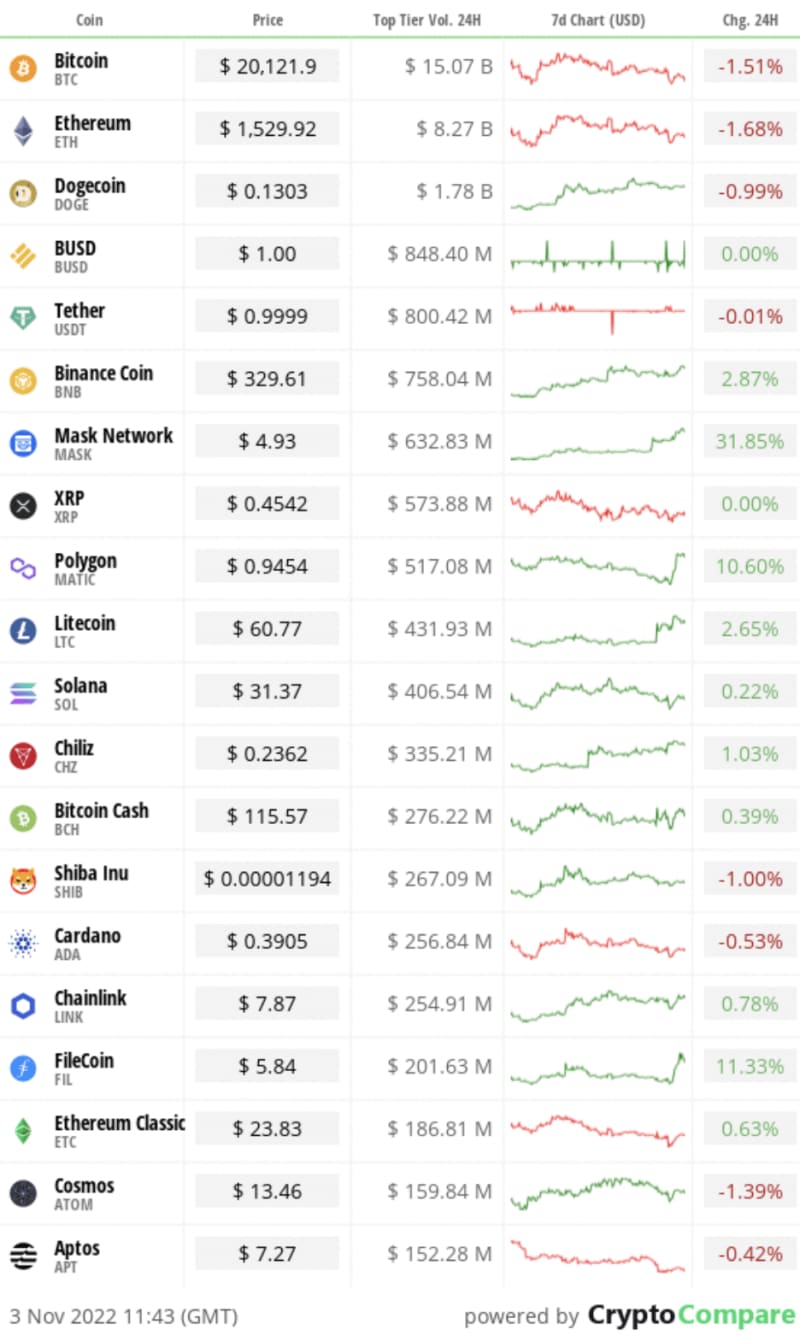

In the markets

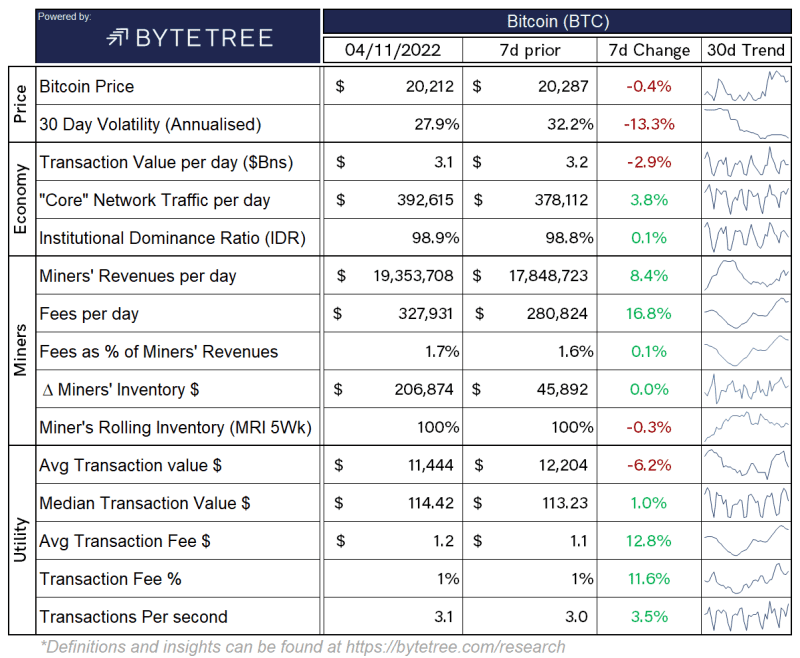

The Bitcoin economy

*Data can be found at https://terminal.bytetree.com/

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently$1.027 billion.

What Bitcoin did yesterday

We closed yesterday, November 3 2022, at a price of$20,209.99. The daily high yesterday was $20,382.10, and the daily low was $20,086.24.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $3.95 billion. To put it into context, the market cap of gold is $10.89 trillion and Tesla is $.6.69 billion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was$46.530 billion. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 26.92%.

Fear and Greed Index

Market sentiment today is 30, in Fear.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 40.30. Its lowest ever recorded dominance was 37.09 on January 1 2018.

Relative Strength Index (RSI)

The daily RSI is currently 65.83.Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“The live pilots led by industry participants demonstrate that with the appropriate guardrails in place, digital assets and decentralized finance have the potential to transform capital markets.”

MAS’ Chief FinTech Officer, Sopnendu Mohanty

What they said yesterday

A changing of the tide?

What’s good for the goose…

Worth another mention…

Would you like to help spread the adoption and education of Bitcoin in the UK and even stack some Sats while you’re doing it? Well, now you can!

The Bitcoin Pioneers community, backed by Barry Silbert’s Digital Currency Group, was created to introduce Bitcoin to a mainstream audience in a meaningful way and now has members right across the UK.

We share tips, stories and ideas on how to encourage others to try Bitcoin for the first time. And, thanks to support from Luno, each Pioneer gets £500 of Bitcoin a month to share with beginners, helping them get started.

So, if you’re passionate about Bitcoin, why not join today? Click here to find out more!

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com 🙏🏻

Crypto AM: Editor’s picks

Three-in-four wealth managers are gearing up for more cryptocurrency exposure

Crypto.com granted FCA licence to operate in UK

Q&A with Duncan Coutts, Principal Technical Architect at IO Global

Jamie Bartlett – on the trail of the missing ‘Cryptoqueen’

MPs are falling silent over potential of cryptocurrency

Erica’s ‘Crypto Wars’ handed honours in Business Book Awards

‘Let people invest’: Matt Hancock makes case for liberal crypto rules

Explained: Why the Treasury is so sold on stablecoins

Fears crypto is used to avoid sanctions ‘misplaced,’ says Matt Hancock

The cryptocurrency fundraisers behind Ukraine’s military effort

Crypto crazy couple name baby after favourite digital asset

Crypto AM: Features

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Contributors

Crypto AM: In Conversation with James Bowater

Crypto AM: Tomorrow’s Money with Gavin S Brown

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Visions of the Future, Past & Present with Alex Lightman

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Taking a Byte out of Digital Assets with Jonny Fry

Crypto on the catwalk

Crypto AM: Events

For those of you who missed the Crypto AM DeFi & Digital Inclusion online summit 2021 – you can now watch the event in two parts via YouTube

Part One

https://www.youtube.com/watch?v=dvqNMNZTIDE

Part Two

https://www.youtube.com/watch?v=WXhX_-Tr5j0

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:00 BST

The post CBDCs need kicking into the long grass to allow Bitcoin’s potential to flourish appeared first on CityAM.