By Nicholas Earl

The UK’s leading onshore energy body has hammered the Government’s decision to chase a long-term liquefied natural gas (LNG) deal with the US, while re-imposing a moratorium on fracking.

Charles McAllister, director of policy, government and public affairs at UK Onshore Oil and Gas (UKOOG) blasted what he saw as the hypocrisy of Downing Street’s reported decision to take LNG supplies that originated from US shale sites, while effectively banning the process in the UK.

He told City A.M.: “This decision shows that the UK Government supports fracking as a technology, as long as it doesn’t take place in the UK. There is no justification for the UK onshore oil and gas industry to face such hypocritical treatment.”

The policy director also criticised the increased reliance on LNG, with its higher carbon footprint, costs and reliance on overseas vendors compared to domestically procured gas.

He noted that LNG is around four times as carbon intensive as UK shale, making it considerably less appealing than domestic supplies as the country scrambles to meet net zero carbon emissions targets over the next three decades.

McAllister said: “Imported shale gas does not offer the evident economic, geopolitical or environmental advantages offered by exploiting our own natural gas.”

Following Russia’s invasion of Ukraine and a Kremlin-backed squeeze on gas flows into Europe, the UK has turned its focus to boosting domestic energy supplies.

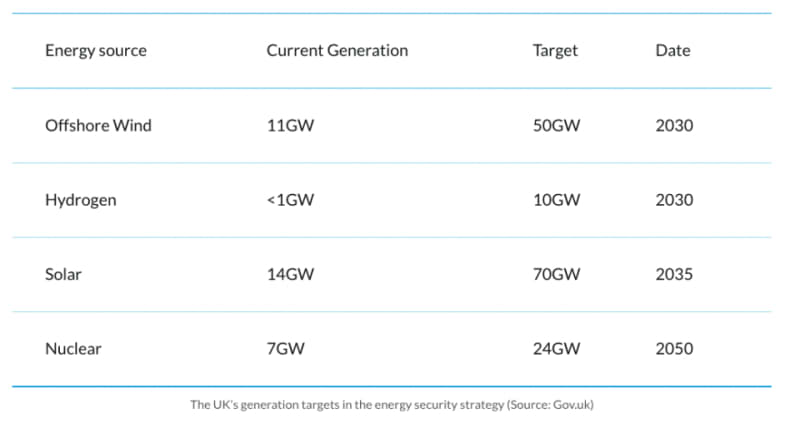

This includes ambitious targets for offshore wind, solar power, nuclear and hydrogen.

However, the new Government has no plans to revive fracking, with Prime Minister Rishi Sunak repealing former leader Liz Truss’ decision to scrap the moratorium – which had been in place since 2019 amid concerns over tremors.

LNG deal raises concerns for domestic energy

Instead of domestic fracking, the Government is chasing a long-term LNG deal with the US – as first reported by The Telegraph – which could provide 10bn cubic meters of gas.

The deal could be announced within the coming weeks, following the conclusion of the COP 27 climate summit in Egypt.

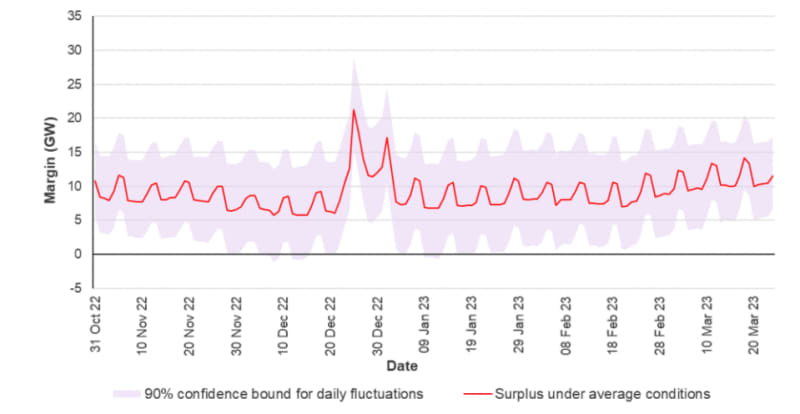

Such a deal would be a welcome boost with the country scrambling to stave off supply shortages this winter – with National Grid introducing the prospect of rolling blackouts in January.

There is also the challenging reality of ultra-high energy bills, with Cornwall Insight predicting the price cap will spike to £3,702 per year in April when the Government’s support package ends.

This is well above current rates of £2,500 per year for average use, which have been eased by eye-watering Government subsidies included in the Energy Price Guarantee.

However, it does contrast with Downing Street’s decisions concerning domestic energy generation.

Andy Mayer, energy analyst at free market think tank the Institute of Economic Affairs, said: “Banning UK fracking while striking deals to import US fracked gas prioritises climate posing over climate action. It reduces our energy security, risks higher bills, and deliberately undermines the public finances.”

It also raises questions over whether potential planning reforms for onshore wind will be scrapped and if there will be a clampdown on farmland solar panels.

Mayer said: “Wind, solar and nuclear power deserve to be treated like any other development, subject to reasonable and proportionate regulation for safety and impact, not special rules designed to appease opposition to all developments everywhere.”

The US LNG deal was further criticised by groups opposed to fracking, such as environmental think tank Green Alliance.

Dustin Benton, policy director at Green Alliance, shared Mayer’s criticism of the Government’s treatment of onshore wind and solar.

He also argued that more had to be done to reduce energy usage through cutting demand and insulation.

Benton said: “This is rearranging deck chairs in energy security terms. The UK securing more US gas simply means less gas available for other countries. The structural answer to securing cheap energy is reducing demand for gas through renewable energy like onshore and offshore wind, solar and insulating people’s homes.”

The Government has been approached for comment.

Fracking reversal leaves UK scrambling

If fracking had been revived in the UK, exploration and testing would have taken place at sites before before companies would engage with communities for local support.

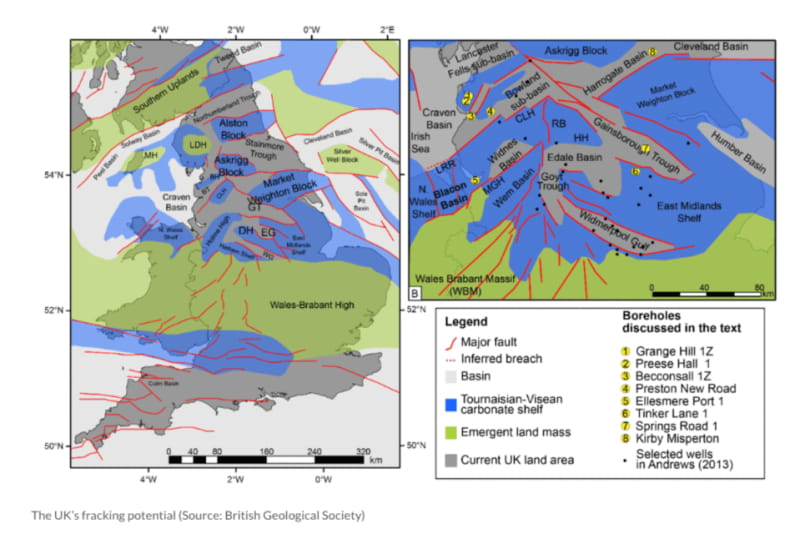

UKOOG has has previously cited data from the BGS forecasting there could be as much as 37.6tn cubic metres of shale gas under the ground.

However, fracking remains unpopular compared to other energy activities, such as onshore wind and solar power, with YouGov polling from May suggesting the people oppose the revival of fracking by a 46-29 margin.

The Government’s most recent polling – conducted last autumn – found just 17 per cent of the public supported fracking, compared with 87 per cent who backed renewables.

UKOOG had pledged to work with the Government and local communities over potential shale gas extraction sites.

This included potential compensation and community funding.

The UK facing growing issues over domestic gas production and ensuring its energy independence.

It produces around 45 per cent of its gas domestically – but increasing relies on Norway as its chief overseas partner, which currently meets 38 per cent the country’s gas needs.

The Climate Change Committee, Westminster’s independent advisory group, predicts half of the UK’s energy requirements between now and 2050 will still be met by oil and gas, and as much as 64 per cent of UK energy needs between 2022 and 2037.

However, the UK is a mature basin, the and the NSTA has warned in its resources report that without further exploration the UK faces a cliff edge in production decline and increased reliance on imports.

Offshore Energies UK recently published its economic report on the sector, which revealed that just five exploration wells were drilled last year.

This was the lowest total since the North Sea sector was opened up to development nearly 60 years ago.

The post Exclusive: Industry body slams UK-US LNG deal following fracking snub appeared first on CityAM.