By Darren Parkin

The week in review

with Jason Deane

Perhaps one day we’ll have a quiet enough week that I have a hope of summarising everything that’s happening in a paragraph or two.

But this is not one of those weeks.

Usually, news that Meta has laid off11,000 employees as it scales back on various projects, including its Metaverse investments, would make headlines and be the talk of the town for days, but, frankly, it barely made any column inches. There have been bigger fish to fry.

The big news, of course, is the debacle around Sam Bankman-Fried (SBF), the FTX exchange and its associated token FTT. There is already plenty of analysis and discussion on pretty much every platform and network, so I see little value in simply repeating that here, but there is, perhaps, an argument to look at what this might mean going forward.

Names like Celsius, Voyager, 3AC and Terraform Labs are already synonymous with scams, rug-pulls or poorly managed operations that, for the most part, are operating in a completely unregulated environment. FTX and SBF are merely the latest additions and, as of this morning, focus has shifted to BlockFi who have announced they can no longer operate as normal. Others will follow.

Undoubtedly, a combination of contagion and market sentiment is exacerbating the situation, but make no mistake, the crypto industry as a whole is under immense pressure, affecting prices of all assets across the board.

Interestingly, Nexo has been spared from the focus of attention and appears to be quietly weathering the storm well, at least so far. This company has always had a very conservative approach to lending, asset management and security of client funds and out of all the lending platforms is the only one I have ever personally considered close to “safe” when I carried out some extensive analysis a while ago.

That said, if we’ve learned nothing else in the last few months, it’s that we can never be entirely sure what’s going on behind the scenes, so the same advice still holds true: not your keys, not your coins.

While I realise this is perhaps a controversial position, my view is that in the long run these sorts of “resets” are actually healthy for the industry. It’s all well and good to experiment with new ways of doing things and push the boundaries, but some of these concepts were simply flawed to begin with. Many cryptos have no value at all and the industry has, for now, become a total mess.

The dot.com bubble burst sorted the wheat from the chaff for the internet industry in the early noughties which ultimately led to clarity and solid growth, maybe this is crypto’s moment to do the same?

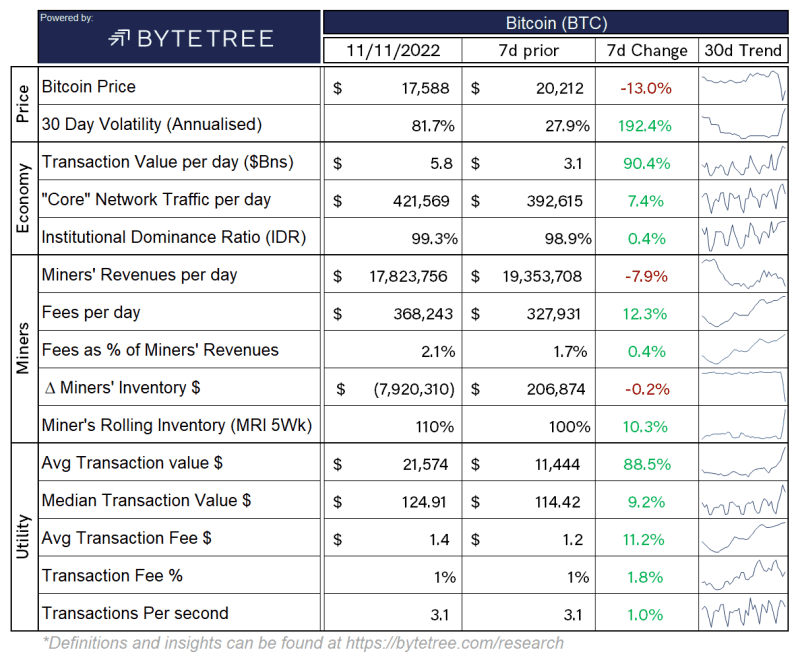

However, Bitcoin appears to be (finally) decoupling from the hysteria that’s going on in the world of crypto. Not in terms of pricing, as many traders still (incorrectly) lump “crypto” and “Bitcoin” together, but in terms of underlying data. On-chain activity has been immense as record amounts aretransferred to private wallets (probably partly due to exchange withdrawals) and Bitcoin’s hashrate is STILL increasing, indicating miner confidence remains high even in terrible market conditions.

Bitcoin will, of course, ultimately emerge unscathed, but the rest of the industry will probably look very different in the future.

Have a great weekend!

Want to learn more about what’s going on in our global financial system and how Bitcoin fits into it? Come to my next free webinar on November 16 at 6pm to find out, ask any questions, and grab some free Bitcoin .* Click here to register.

Have you booked your tickets for the Crypto AM Summit and Awards? Click here… Crypto AM Summit & Awards 2022 – CityAM

Yesterday’s Crypto AM Daily in association with Luno

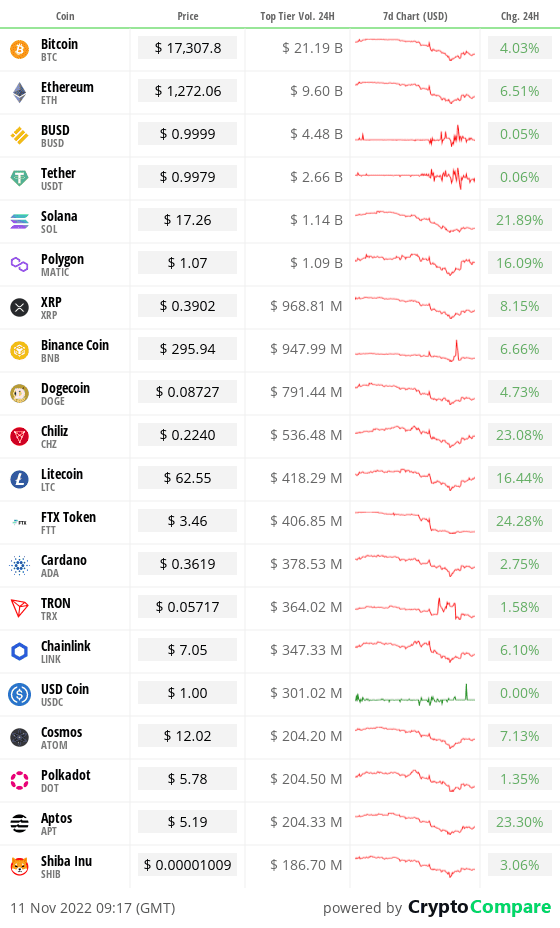

In the markets

The Bitcoin economy

*Data can be found at https://terminal.bytetree.com/

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently$874 billion.

What Bitcoin did yesterday

We closed yesterday, November 10 2022, at a price of$17,586.77. The daily high yesterday was $18,054.31, and the daily low was $15,834.02.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $333.17 billion. To put it into context, the market cap of gold is $11.659 and Tesla is $593.32 billion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was$72.569 billion. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 56.33%.

Fear and Greed Index

Market sentiment today is 25, in Extreme Fear.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 40.15. Its lowest ever recorded dominance was 37.09 on January 1 2018.

Relative Strength Index (RSI)

The daily RSI is currently 32.02.Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“There will be steps backwards and more steps forward. And then one day it will be boring because it will simply be part of the tapestry of everyone’s life, its wonders barely noticed.”

Steven Boykey Sidley, Professor at JBS, University of Johannesburg and Author

What they said yesterday

Will we learn from it?

Important lesson

Another positive step for Bitcoin

Would you like to help spread the adoption and education of Bitcoin in the UK and even stack some Sats while you’re doing it? Well, now you can!

The Bitcoin Pioneers community, backed by Barry Silbert’s Digital Currency Group, was created to introduce Bitcoin to a mainstream audience in a meaningful way and now has members right across the UK.

We share tips, stories and ideas on how to encourage others to try Bitcoin for the first time. And, thanks to support from Luno, each Pioneer gets £500 of Bitcoin a month to share with beginners, helping them get started.

So, if you’re passionate about Bitcoin, why not join today? Click here to find out more!

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com 🙏🏻

Crypto AM: Editor’s picks

Three-in-four wealth managers are gearing up for more cryptocurrency exposure

Crypto.com granted FCA licence to operate in UK

Q&A with Duncan Coutts, Principal Technical Architect at IO Global

Jamie Bartlett – on the trail of the missing ‘Cryptoqueen’

MPs are falling silent over potential of cryptocurrency

Erica’s ‘Crypto Wars’ handed honours in Business Book Awards

‘Let people invest’: Matt Hancock makes case for liberal crypto rules

Explained: Why the Treasury is so sold on stablecoins

Fears crypto is used to avoid sanctions ‘misplaced,’ says Matt Hancock

The cryptocurrency fundraisers behind Ukraine’s military effort

Crypto crazy couple name baby after favourite digital asset

Crypto AM: Features

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Contributors

Crypto AM: In Conversation with James Bowater

Crypto AM: Tomorrow’s Money with Gavin S Brown

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Visions of the Future, Past & Present with Alex Lightman

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Taking a Byte out of Digital Assets with Jonny Fry

Crypto on the catwalk

Crypto AM: Events

For those of you who missed the Crypto AM DeFi & Digital Inclusion online summit 2021 – you can now watch the event in two parts via YouTube

Part One

https://www.youtube.com/watch?v=dvqNMNZTIDE

Part Two

https://www.youtube.com/watch?v=WXhX_-Tr5j0

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:00 BST

The post Harsh ‘resets’ are actually healthy for the cryptocurrency industry appeared first on CityAM.