Vertiv Holdings Co (NYSE:VRT)

Rating UNDERPERFORM

Price (14-November-22): $14.93

Target price: $3.55

52-week price range: $7.76 – $27.97

Market capitalization: $5.6B

Enterprise value: $8.8B

Summary:

Vertiv designs, manufacturers and services critical digital infrastructure for corporate customers, data centers, and hyperscale customers like Google, Microsoft and Twitter.

VRT has booked almost $3B of unprofitable business in the last two years to project the optics of growth.

Q3 2022 hedge fund letters, conferences and more

Leverage has been increased aggressively to the point of financial distress due to lack of cashflow. There is documented evidence that management deliberately misled investors in order to help the PE owner reduce its stake in the company.

VRT missed 4Q21 earnings on February 23, 2022 by an unprecedented amount for an industrial company. The stock was down 37% on the day. Management increased guidance repeatedly prior to the event. It has since announced “corrective” measures, lowered guidance several times for 2022, but provided a very optimistic outlook for 2023.

The CEO resigned on October 3, 2022. Nothing has fundamentally changed. VRT’s structurally weak business model is caught on the wrong side of inflation with limited pricing power to customers while facing escalating input costs.

VRT will likely have to announce a capital raise in the near-term, and should discuss the allegations detailed in the amended class action lawsuit filed on September 16, 2022, which have yet to be addressed publicly.

A depleted product mix, excess leverage and management problems make us skeptical of the long-term viability of the business.

There are three key issues with the company: 1) Lack of cashflow and overleverage, 2) Credible allegations of fraud and 3) Structural problems with the business model.

Legal Disclaimer

After extensive research, we have taken a short position in shares of Vertiv Holdings Co. (NYSE:VRT). This report represents the summation of our opinions.

In no way should this report be taken as investment advice or constitute responsibility for investment gains or losses. The information in this report should not be relied upon for investment decisions.

All investors must conduct their own due diligence and consult their own investment advisors in making trading decisions.

Investors seeking investment guidance on VRT should consult resources with professionals licensed to provide investment advice. The investment banks Cowen & Co., Goldman Sachs, Deutsche Bank and JP Morgan are all listed as having securities analysts that cover VRT.

These institutions have significantly greater resources than Dalrymple Finance and the banks’ opinions may differ greatly from ours. We strongly encourage investors to consult these professionals for advice.

This is not a solicitation to transact in any of the securities mentioned.

The data herein has been obtained from public sources we believe to be reliable. However, the information is presented on an ‘as is’ basis and we make no warranty of any kind as to the accuracy, timeliness and/or completeness of any material contained in this opinion piece.

Employee Reviews

Oct 10, 2022 - Supply Chain Manager in Columbus, OH

Pros

I would say the people, but many of the good ones have left or are in the process of trying to leave

Cons

Seems like senior leadership was forced to bring all employees back to the office by the board chair. This strategy is slowly backfiring on them, however they continue to double down. I've never worked in a place where trust is so low towards senior leadership.

I knew it was time to go when part of my job required me to track badge swipes. No thank you. - Underlying data integrity and overall integration of past acquisitions is SO messy. Very difficult to run a business on multiple ERPs when nobody can agree on what the source of truth is.

Leadership strategy was quite confusing during my time there. Hopefully a new CEO in 2023 can turn the ship around ... or stop it from sinking entirely and becoming a business case study of what not to do.

Absolute Dumpster Fire

Aug 22, 2022 - Anonymous Employee

Pros

Some of the people that work there, but honestly not much.

Cons

Complete mismanagement by the executive chairman and CEO, terrible insurance, poor PTO policy, Johnson family in positions they’re not qualified for.

Ethics Are Laughable

Aug 3, 2022 - Senior Engineer

Cons

Unfortunately, those leaders will most likely never recognize their potential at Vertiv. Decisions are made in the company in a complete knee-jerk vacuum. They have an ethics policy that only applies to the pee-ons since family members in senior leadership positions report to each other.

I wonder how they square that up with the things they wrote in the "company handbook". The company has a philosophy of just buying stuff and not investing in people.

They have millions of dollars in software licenses and hardware devices sitting on shelves for years, but you can't get a backfill for someone who leaves because they are working 75 hours a week because they took over the duties of the last person that left.

Advice to Management

Get rid of the CEO, CFO, and their family members and start making decisions in the organization's best interest instead of a tiny nepotic circle.

Vertiv: The Trifecta of Trouble: Cash-strapped, Low-margin and Fraud Prone

Vertiv (VRT) sells power, cooling and racking hardware to data centers. It was taken public via a SPAC in early 2020 as a turn-around play in a growing sector where a legendary industrials manager, David Cote of Honeywell, would increase depressed margins driving profits and cash flows.

The reality is quite different. VRT is a cash strapped, low margin business operated by a conflicted management team currently working under the dark cloud of credible claims of fraud.

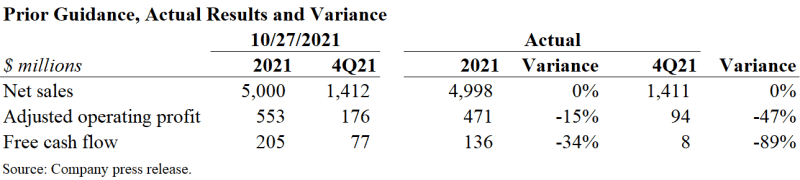

In 2021, management repeatedly provided detailed assurances to investors it was mitigating inflationary pressures with price increases that would create margin and drive cash flow later in the year. Instead, the company reported a catastrophic earnings miss in 4Q21.

Lawsuit allegations that management mislead investors to artificially inflate the stock price are corroborated by management’s own subsequent comments together with testimony from high-ranking former executives.

We believe nothing has changed in 2022. After lowering guidance several times, the stock is being held up by the prospect of a financial turnaround in 4Q22 and 60% operating profit growth in 2023.

The company is unlikely to meet either, in our view. Prior to reality hitting the stock, we expect management to conduct an equity offering to avoid a cash crisis. The offering, and a 4Q miss will kill faith in the 2023 narrative and catalyze stock’s ~70% decline to fair value of ~$3.50.

Key issues include:

- Management problems, credible allegations of fraud

The conflicted management team is heavily weighted with appointees from Platinum Equity, the PE sponsor, and the CEO’s family members.

Numerous former executives have provided convincing testimony supporting allegations that management misled investors and omitted material facts. The damning evidence is an ‘elephant in the room’ that needs to be publicly addressed.

- Financial distress and cash shortages

A $408M cash burn thus far in 2022, low cash balances, little credit availability and a distressed debt/EBITDA multiple of 8.3x make the company vulnerable to a cash crisis.

Distress is evident in VRT being put on “credit hold” - vendors refusing to fill orders - for non-payment of outstanding balances. We believe management will front-run the expected 4Q miss and avert a cash crisis with an equity offering.

- Post LBO structural issues

Asset sales to fund dividends and product discontinuances have left the company’s mix dominated with good quality, but lower margin products.

This combined with large hyperscale buyers flexing their market power by pressuring prices lower and payment terms longer, create a structurally sub-par business. We are skeptical of VRT’s long-term viability.

- A combined primary and secondary share offering

Platinum still owns 38M shares and the lock-up recently expired on 23M of insider shares from the acquired E&I Engineering. We expect an imminent offering of ~20M primary and ~40M secondary shares for a total of 60M, increasing the float ~20%.

Investment Thesis and Valuation

VRT is a broken business. It was a low margin division of its former corporate parent, Emerson Electric (EMR), and profitability eroded further after it was purchased in late 2016 in a $4B LBO by Platinum Equity.

Platinum sold VRT’s most profitable division and discontinued two well-regarded software lines to fund a $1B cash-out dividend in 2017. The LBO and subsequent mismanagement of the company left VRT with a depleted product mix of good, but low margin lines, and excessive levels of debt and weak cash flow.

The diminished and levered company was taken public in recapitalization transaction in early 2020 via a SPAC at a $5B valuation after failing to get support for a traditional IPO. VRT was sold to investors as a turnaround story.

Legendary industrials manager David Cote, credited with turning around Honeywell, was behind the SPAC. It was said, he would turn his skills to VRT, increasing margins to drive profitability and cash flow.

Platinum exited the transaction with 118M shares of VRT and an allowance of two registrations per year.

The de-SPAC’ed stock did well through 3Q21 even though the margin growth promised did not materialize. Between August 2020 and November 2021, the strong stock allowed Platinum to sell 80M shares at prices ranging from $15 to $25 for total proceeds of $1.55B.

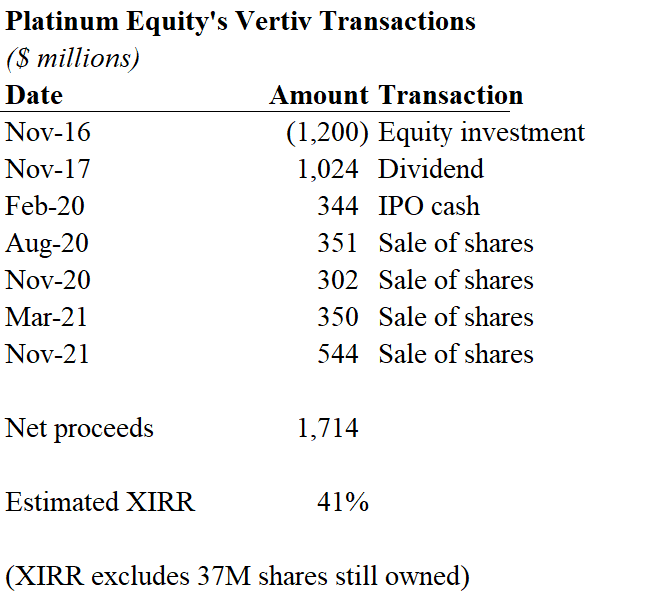

Including the earlier dividend and a cash payment received on the IPO, Platinum had collected approximately $2.4B in cash proceeds from its original $1.2B investment, and still has 38M shares remaining.

The handicapped business is made worse by a conflicted and ethically compromised management team. Senior management is dominated by Platinum appointees and family members of the CEO, who recently announced his retirement for health reasons. The board of directors contains two Platinum appointees.

Although the stock held well in in 2021, margins and profits did not materialize as promised. The stock was driven largely by management’s continued assurances to investors on conference calls, at industry conferences and in media that the company had taken pricing action and was making progress on improving margins. Increasing profits and cash flow would follow late in the year.

The stock fell apart on reporting a significant earnings miss in 4Q21, declining -37%, an unprecedented amount for typically staid reports of industrial companies. On the call, management admitted to being “behind the inflation curve all year” seeming to accept responsibility, while simultaneously pinning the failure on sales people for giving discounts.

The truth about the gap between management set expectations and actual results was revealed in an amended class action lawsuit filed in September 2022.

The testimony presents credible evidence of fraud committed by management, detailing how they wove a public narrative of taking pricing actions and reducing discounts to improve margins while touting a large and growing backlog.

In reality management took no pricing actions, directly approved discounts, and the backlog was “off the charts unprofitable” and would stay that way contrary to management statements, because, the company was contractually prohibited from raising prices on large orders.

The lawsuit alleges that management mislead investors and omitted material facts to artificially inflate the stock price. The testimony convincingly corroborates the allegations.

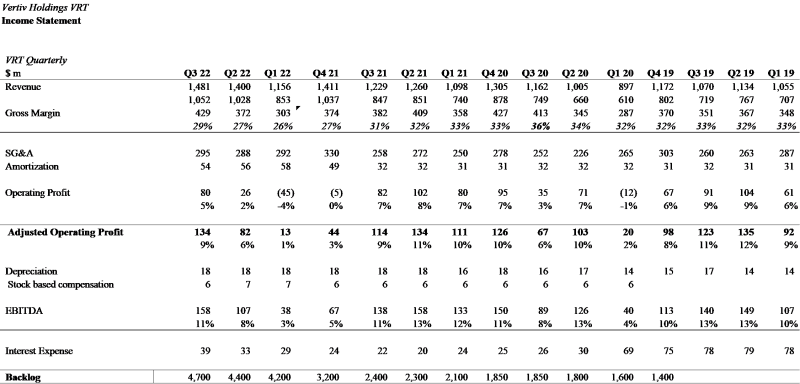

We do not think anything has changed in 2022. Management continues to over-promise and under-deliver. The two key metrics are adjusted operating profit (AOP), which is operating income plus intangibles, and free cashflow.

Near-term AOP guidance has been lowered significantly, while full-year expectations have come down less. Free cash flow guidance started at $150M and was lowered to $0 in August.

In early October as part of the announcement of CEO Robert Johnson’s retirement, the company lowered full-year AOP guidance to approximately $460M from $480M.

Free cash flow expectations were not addressed, but management proffered an exceptionally optimistic long-range guidance of 60% AOP growth to $740M for 2023. The strong forward guidance softened the blow of another near-term disappointment.

Just 3-weeks later on the 3Q22 call, free cash flow guidance was cut from $0 to ($125M). Management offered an explanation for the weak cash flow on the 3Q call. In our estimation, a management team keenly focused on driving free cash flow would have been aware of the problem earlier.

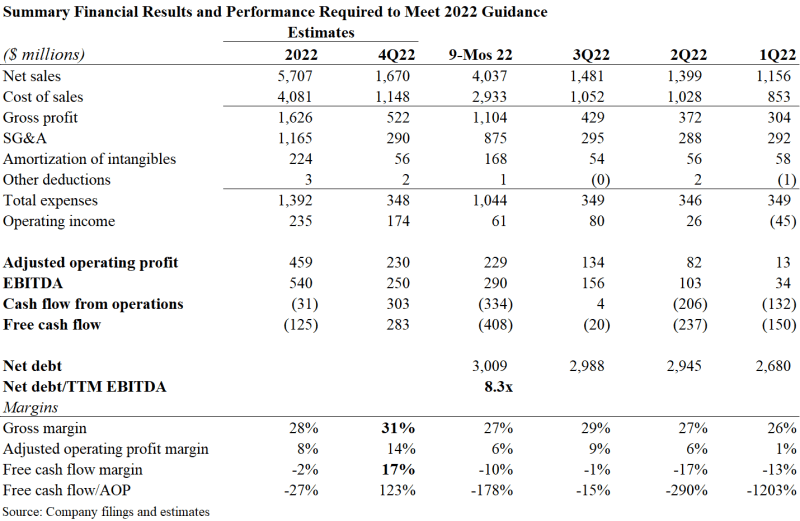

Changes in the contour of 2022 guidance mean 50% of annual AOP is now expected in 4Q22, and the large negative YTD free cash flow of ($408M) is to be mitigated by $283M of free cash flow generation in the quarter.

It is an unprecedented turnaround in financial fortunes we believe the company is unlikely to achieve. We think it’s questionable whether VRT can meet either 4Q22 or 2023 forecasts.

Management guidance making 2022 results entirely dependent on an unprecedented 4Q turnaround paving the way to 60% profit growth in 2023 carries a sense déjà vu. In our view, it is not credible.

The resurgent stock price is likely the result of investor focus on 2023 guidance, which creates the illusion of a cheap stock, and the recently announced 7% stake taken by an activist investor.

We don’t expect the enthusiasm for the stock to remain. VRT is still an excessively levered, cash-strapped, low margin business.

The high cash burn and inadequate liquidity make the company vulnerable to a cash crisis if 4Q22 free cash flow forecasts are not met or exceeded. We think it is highly likely that the company misses 4Q free cash flow guidance.

We don’t believe management will risk a cash crisis in this environment. More likely, in our view, is that they take advantage of the current stock price by conducting an equity offering while investors await strong 4Q22 results and anticipate a robust 2023.

We expect a combination primary and secondary offering and another 4Q profit miss to catalyze a steep decline in the stock.

Valuation

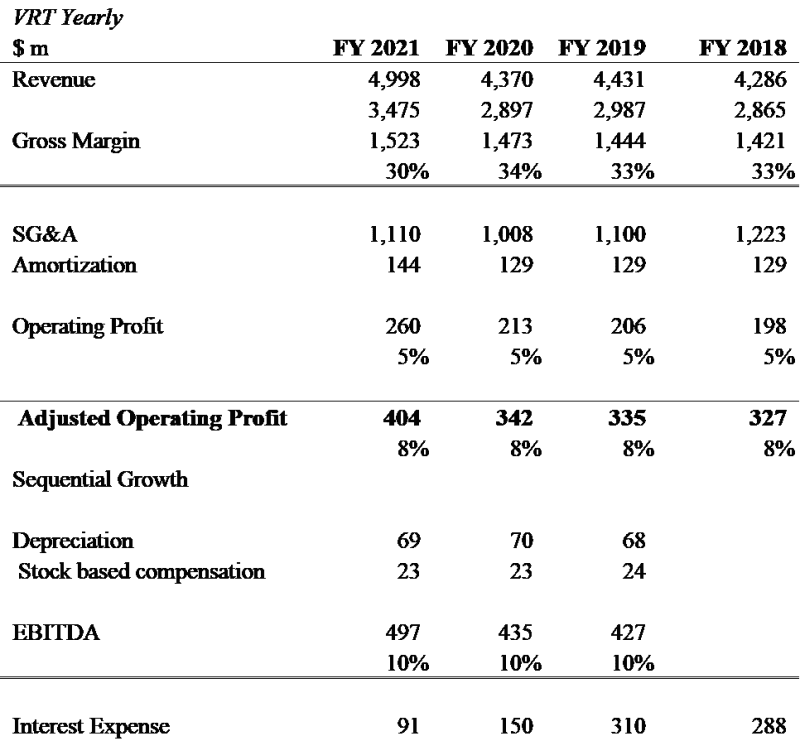

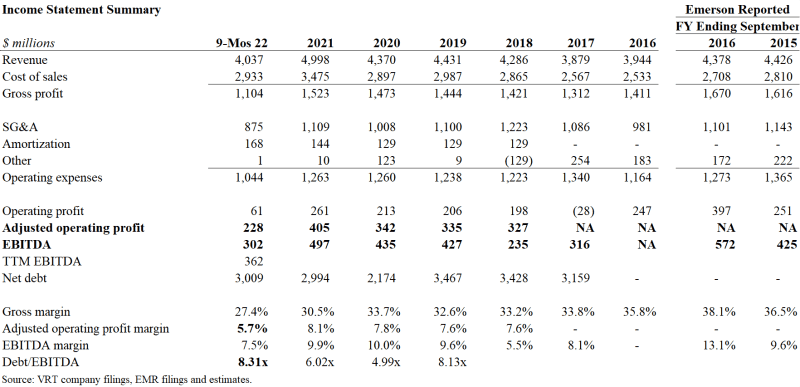

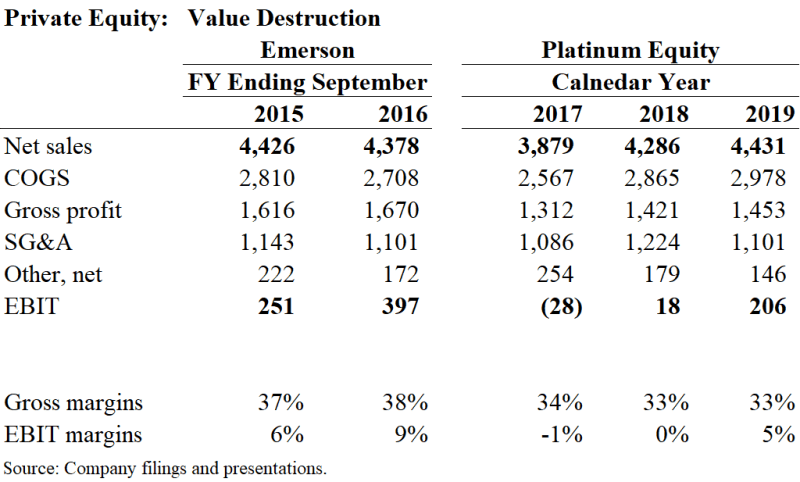

Platinum purchased Vertiv from Emerson Electric (EMR) in November 2016 at an enterprise value of $4B when the company generated $572M in EBITDA. In 2021, after 5-years of Platinum ownership, VRT produced $497M in EBITDA.

Despite the poor performance during the Great Data Center Boom, VRT currently trades at an EV of over $8B, twice the debt-free valuation at which it was purchased.

VRT’s stock got a boost recently when activist fund Starboard Value announced it took a 7% position in the company. The fund appears to be buying into the same margin expansion story management has been selling since the original SPAC presentation in 2019.

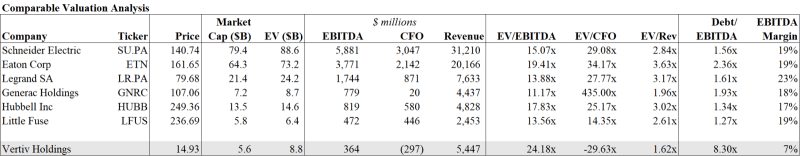

Starboard also maintains that VRT is undervalued relative to peers. That might be the case if using management’s forward guidance. Using actual financial performance shows the company to be the most highly valued among peers by most metrics.

Starboard was the SPAC sponsor of another discredited data center story – Cyxtera Technologies (CYXT), which we wrote about. A version is available on ValueWalk.

In the table below we show VRT’s comparative valuation with peers based on trailing 12-month performance.

VRT trades at an EV/EBITDA multiple of 24x compared to an average of 15x for the group. VRT is the only company in the group that has negative CFO for the period.

The long history of sub-par financial performance, the inability to generate cash, management’s high forecasting error, and financial distress lead us to conclude that the stock should trade at a discount to the group.

Using a multiple range of 10-14x TTM EBITDA, we arrive at an average target price range of $3.55, ~76% below current prices.

TABLE OF CONTENTS

1. Low Margins, Cash Shortages and Leverage

1. 2022: 9-months of disappointing results and more to come

2. Profit margin compression

3. A long history of cash shortages

4. The evolution of debt

2. A Broken Business Goes Public

1. Platinum Equity’s monetization: A failed IPO and successful SPAC

3. The 2021 Catastrophe

4. Management Problems and Legal Consequences: Allegations of Fraud

1. The legal fallout: testimony implicating management

5. 2022 and 2023: Continued (Mis)Guidance

Appendix

1. Timeline of events including the stock price

2. Platinum Equity’s Vertiv investment

3. Long-term financial statements

Vertiv was sold to investors in 2019 as a turnaround story. It was a company with strong sales, but weak margins.

Large competitors such as Schneider Electric (SU: Paris) and Legrand (LR: Paris) have average gross margins of 40% and 50%, respectively; and operating margins of 17% and 20%, respectively. This compares to 27-33% gross margins and 1.5-5.2% operating margins for VRT.

Problems with margins have been persistent since the company came public in 2020. We believe VRT has not been able to improve margins to industry levels partly due to the mismanagement detailed in the lawsuit as well as structural issues with the business.

Below we detail the current state of finances followed by a summary of VRT’s long history of sub-par performance. Our exhibits show summary results. Detailed models can be found in the Appendix

2022 has been a financial disappointment thus far. Guidance for adjusted operating profit (AOP), defined as operating income plus amortization of intangibles, was reduced to ~$460M from $525M. The 3Q22 financial report revised free cash flow guidance to ($125M) from $0 in august and an original $150M.

AOP and FCF expectations for 2022 are both below the disastrous 2021 results.

The table below shows summary financial performance on a year-to-date basis along with estimates of results required to meet management’s latest guidance. Key indicators including gross margins and free cash flow have been very weak thus far. Management guidance assumes material improvements in both in 4Q.

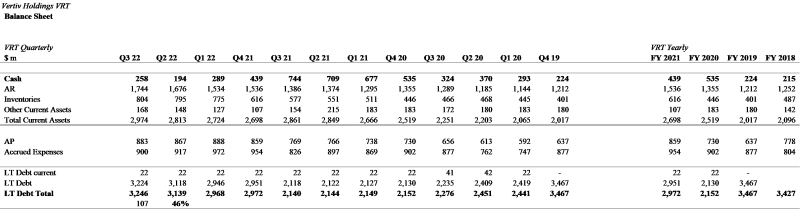

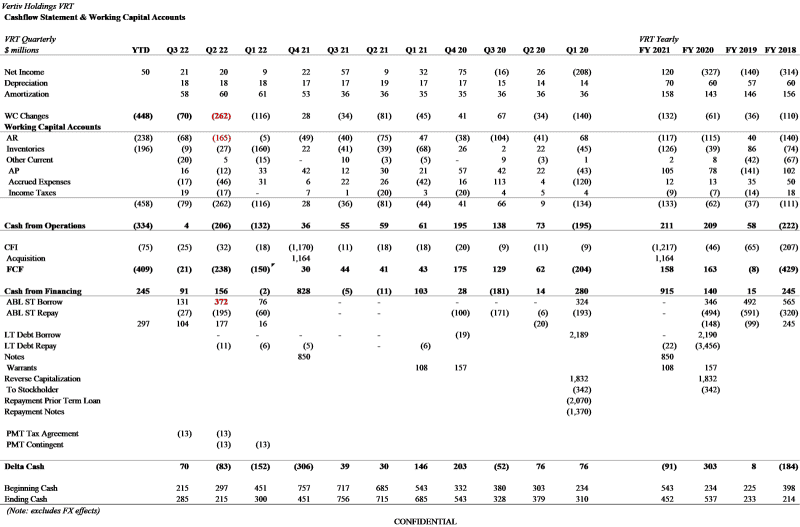

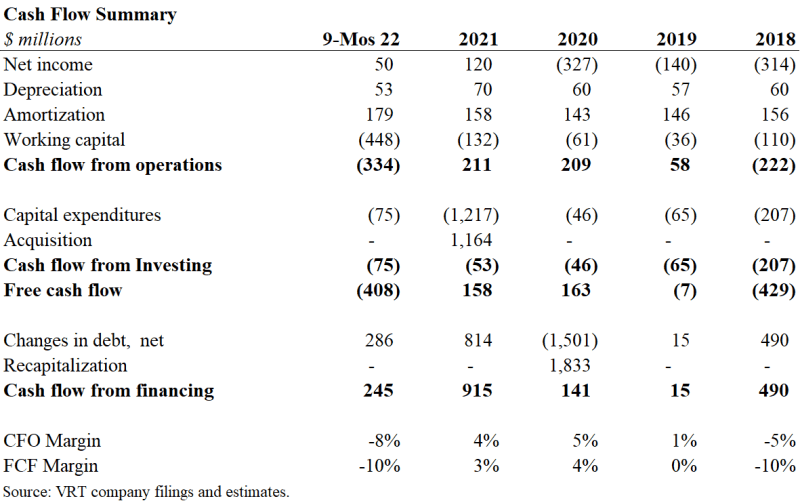

VRT has burned ($334M) in CFO and ($408M) FCF thus far in 2022. Working capital accounts absorbed $448M in cash with inventory and accounts receivable accounting for roughly 50% each.

On the 3Q22 conference call, management explained poor cash flow citing elevated levels of inventory necessary for high 4Q sales and delayed cash collections, including advanced payments on large orders.

We find it inconceivable that management was unaware of the impact of inventory and collections on cash flows until the 3Q call, begging the question as to why they did not cut FCF guidance on the October 3 business update?

Additionally, management’s explanation of the weak cash flow indicates VRT is being forced to finance customer purchases. It is yet another instance of the hyperscale data center operators flexing their buying power muscle at the expense of supplier margins.

In discussing pricing changes, management said it has clauses built into “some” contracts. These are pricing bands that can go up and down with changes in underlying materials pricing. This means that some price gain can be clawed back under certain circumstances. In our view, the terms suggest a continued long-term lack of pricing power.

Part of VRT’s profitability issues stem from the underperformance of E&I Engineering, which was acquired in 3Q21 for $1.8B and a hefty estimated 4.4x EV/revenue.

Discussion on the 3Q conference call indicate E&I’s current profit contribution is only ~ 20% of original expectations. In our view, E&I’s underperformance raises the possibility of a year-end impairment charge.

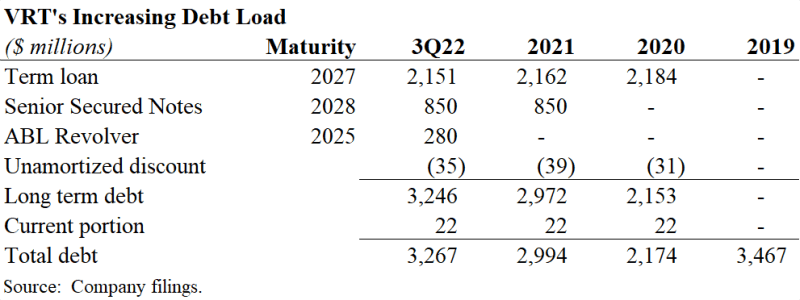

VRT’s total debt rose $273M to $3.3B since 4Q21. VRT negotiated an increase in the ABL facility by $115M on September 20, 2022, but the term of March 2025 was NOT extended, signaling an unwillingness of lenders to commit to longer-term funding even on the most secure level. ABL debt rose from $0 in 4Q21 to $280 in 3Q22.

The cash balance as of 3Q22 was $258M; the remaining $270M in ABL credit brings total liquidity to $528M. However, fully drawing all credit would represent a clear sign of distress, so practical liquidity is likely only ~$400M.That is not adequate cash and total liquidity for a company with nearly $6B in sales and $4B in annual cost of goods.

The company had more than twice the cash balance in 2020 when sales and COGS were 23% and 29% below expected 2022 levels, respectively. An equity offering is necessary.

20M primary shares at current prices would raise almost $300M for the company. Additionally, Platinum still has 38M shares to sell and the lock-up on E&I insiders for 23M shares ended on November 1, 2022.

We think there is a high probability that the company does a combination of primary and secondary shares for a total of 50-80M shares. Assuming 20M primary and 40M secondary, total shares outstanding and the float would increase ~5% and 20%, respectively.

As part of Emerson, VRT had ~$4.3B in sales with EBITDA margins of 10-13%. The financial profile deteriorated under Platinum Equity’s stewardship with declining sales, profits, and increasing leverage ratios, as shown below.

The trajectory of the P&L after 2016 reflects declining profitability associated with Platinum’s monetization through the sale of ASCO, the most profitable line in VRT’s portfolio, and focus on top-line growth rather than profitability.

The 8.3x EV/TTM EBITDA ratio signals distress. It declined briefly when debt was paid down with the recapitalization, but has reverted quickly due to the lack of profitability.

Gross margins for the 9-months of 2022 of 27.4% are 1000 bps below the average margin generated when the business was owned by EMR. Part of the margin issue stems from the $3B unprofitable backlog the company built during 2021.

In public forums, management asserted they were taking corrective pricing actions to improve margins in the face of raw materials inflation, but in actuality nothing was done. Lawsuit testimony revealed that the company was contractually prohibited from raising prices on large orders.

Financial distress compounded margin issues. Lawsuit testimony notes VRT gave 2-3% discounts in exchange for up-front payment at least up to the “big miss” reported in February 2022.

Supply chain issues were a significant problem in 2021 and linger today. Management frequently cited supply chain issues as the reason for making “spot” or “grey market” purchases of materials and higher prices. This was only partially true.

Lawsuit testimony states that vendors were ‘decommitting’ to orders and putting the company on “credit hold” because VRT was not current on its payments. Thus, the company’s problems were to some extent the result of financial distress and mismanagement.

VRT’s low profitability, inability to develop margin, and high leverage are particularly poor relative to peers. Legrand and Schneider navigated 2021 without losing margin and although Hubbell lost 200 basis points of margin in 2021, it built it back in 2022. In contrast, in the 9-months of 2022, VRT’s gross margins 630 basis points below 2020 levels.

Overall profitability problems evident on the P&L are shown in VRT’s long-term inability to generate cash flow, as shown below.

In the almost 5-year period shown, VRT has generated a aggregate of ($78M) in cash flow from operations and ($523M) in negative free cash flow. The company has raised a total of $1.8B largely from the SPAC recapitalization to fund the deficits.

2021 FCF of $158M looks merely lackluster in the financial context of the disappointing ($408M) thus far in 2022 and $163M for 2020. However, in the context of both the industry and management’s guidance, 2021 was a disaster.

VRT’s 2021 cash flow margin of 4% is significantly below industry averages. Companies such as Schneider Electric (SU:PA), Legrand (LR:PA), and Hubbell Inc. (HUBB: NYSE) had depressed CFO margins averaging 13.7% in 2021, down from an average of 17.7% in 2020.

Management’s original FCF guidance of $300M, which was valid through the 9/8/21 reduction, roughly $353M of CFO for the year. The actual result was 30% below at $211M. The magnitude of the cash flow miss in 4Q21 from recent guidance is highly unusual in the typically staid reporting conventions of industrial companies. It shocked investors.

Platinum put $3B of debt on VRT’s balance sheet when the LBO transaction took place, increasing to $3.5B, declining to $2.2B with the SPAC recapitalization transaction.

In 2021, the company increased debt by approximately $1B largely to cover the cost of the E&I Engineering acquisition. In 3Q22, the company increased the ABL facility by $115M to $550M and drew a total of $280M.

The interest rate on the ABL facility increases with utilization. At the current utilization rate of 49%, we estimate VRT pays 4% annually. If borrowing increases ~$88M to $368M, the interest rate will increase to 4.5%.

Interest expense is increasing along with debt levels and overall rates. In 3Q22, interest expense increased $5.4M or 16% sequentially to $38.8M; it increased 75% or $16.6M y/y from $22.4M.

We interpret the companies minor increase and rapid utilization of the ABL as another sign of distress. The lack of operational cash has forced the company to fund working capital needs with debt, leaving only $270M of available credit.

When Emerson put its Network Power division up for sale in 2016, the company first tried to find a strategic buyer at a $4B price tag and steep 18x EV/EBIT valuation. It was not an easy sale.

Revenues at the business had declined 28% from 2011 to 2014, and was one of Emerson’s least profitable lines. Dave Farr, EMR’s CEO at the time and responsible for building Network Power, noted that “he would not want that put on his tombstone”.

When interested strategics balked at the price and walked away, EMR filed a form 10-12B with the SEC for a spin-off to shareholders. The spin-off never took place. Private equity intervened.

Platinum Equity purchased Network Power, now Vertiv, in a $4B LBO financed with $1.2B of debt and $3B of company level debt.

The company had numerous good product lines including ASCO, the Automatic Transfer Switch (ATS) company, Liebert’s power and colling products, and two well-regarded software line. However, following the LPO, key products have been sold and neglected.

In November 2017, one year after purchasing the company, Platinum sold the ASCO Power division to Schneider Electric. ATS switches automatically transfer between base and back-up power sources. In the case of data centers, it is between the utilities and UPSs. It is a core power technology that ensures facilities remain online.

ASCO was critical part of VRT’s product portfolio.

According to VRT’s original presentation, the whole company generated $3.865B in revenue in 2016 with $472M of EBITDA and a margin of 12%. According to this article, in 2016, ASCO generated $468M of revenue with $107M of EBITDA and a margin of 23%.

ASCO was VRT’s most profitable business, generating 12% of the revenue but 23% of EBITDA.

The ASCO technology and strong market share in the U.S. catapulted Schneider to leadership position in key data center power chain.

The division was sold for $1.25B or 11.7x EBITDA.

While Platinum presented the sale as a “step forward in their evolution as the premier provider of digital critical infrastructure solutions”, we believe it was a known strategic error, a sacrifice made to private equity IRRs.

According to VRT filings, the company paid Platinum a $1.024B dividend in 2017, leaving the business burdened with the same debt, little equity and short the most profitable product line.

Platinum followed the ASCO sale with several small acquisitions. In December 2017, VRT acquired the private thermal management company Energy Labs for $149.5M. Two weeks later in January 2018, the company acquired data center equipment provider Geist.

Geist provided Power Distribution Units (PDUs), which control and distribute electrical power in data centers.

As noted in this article, the acquisitions appeared to signal VRT’s new direction. The purchases gave VRT access to reams of data that could be incorporated into the company’s data center infrastructure management product (DCIM), Trellis, which was an industry leader. That was not to be.

Vertiv’s leadership in software completely eroded when Platinum took over. The company’s popular Aperture Asset Management software was discontinued in 2017, and Trellis became an unwieldy behemoth of an application. It, too, was discontinued.

DCIM software has been a challenge and is in the process of evolving. That said, VRT management willingly gave up its market leadership position in the segment. The absence of a solution means customers will go elsewhere, and perhaps they will bring their hardware orders along with them.

Key competitor Schneider Electric has advanced where VRT has retreated. Schneider has continued to invest despite challenges in the data center software space. In June 2022, the company announced DCIM 3.0, a complete overhaul of their system.

Networks are becoming larger and more distributed, making them more complex and difficult to manage. This combined with the trend to automate data centers means that VRT abandoned key software products (and related R&D spending) at a time when automation will drive the toward increased reliance on software.

Customers operating large, distributed networks will need monitoring tools for asset tracking and predictive maintenance. As this article notes, management’s decision to discontinue its product lines leaves the company “under-invested in software”.

We think the company’s current product portfolio is wanting. Power products focused on Liebert’s uninterruptable power supplies (UPS) has been augmented with the recently acquired higher-margin E&I Engineering’s switchgear, but ASCO’s ATS line was a key pillar of the segment.

Liebert and Geist’s thermal lines are competitive as well. However, despite being well regarded in services, we believe the discontinued software products diminish the effectiveness of the portfolio as a whole.

Under Platinum’s stewardship, VRT’s most profitable, industry-leading division was sold to fund a dividend; important software products were discontinued, likely to cut costs in effort to cover the cost of leverage.

The long-term cost of product portfolio neglect, is the erosion of competitive positioning, margins and earnings power. We believe this is evident in the continued lack of pricing power. As noted in the lawsuit “no one would pay list price”.

In the table below we show VRT’s performance under EMR and the pre-IPO performance following Platinum’s acquisition.

As is evident in the numbers, VRT did not recover from the sale of ASCO, and despite the discontinuance of the software lines, and associated R&D, VRT’s financial performance never recovered to the modestly profitable levels when managed by EMR.

Just two years after purchasing VRT in 2H18, Platinum approached Goldman Sachs looking for strategic alternatives for Vertiv, including a potential IPO or sale. Moody’s rated the company’s debt Caa1 and Caa2, one notch above ‘default imminent’.

During the period, the company acquired the maintenance business of MEMS Power for an undisclosed sum.

We assume that Goldman could not offer Platinum an attractive alternative, as according to the proxy associated with VRT’s IPO, the discussions were soon ended.

Goldman soon found a suitable opportunity for Platinum’s exit. In March 2019, introduced Vertiv/Platinum to GS Acquisition Holdings Corp. (GSAH) a Goldman Sachs affiliated SPAC with David Cote, former CEO of Honeywell.

On December 9, 2019, GSAH’s board had approved the acquisition of VRT.

The initial investor presentation noted that “renowned diversified industrial executive” David Cote, would take the role of Executive Chairman. At the helm of CEO would be Rob Johnson, an industry veteran brought in by Platinum in 2016 from venture capital firm Kleiner Perkins.

The investment thesis on Vertiv was the management would improve margins and drive profitability and cash flow to industry levels.

The proposed transaction was for total SPAC and PIPE equity of $1.93B. The public SPAC holders were to hold 20% of the equity, the sponsors 5%, PIPE investors 37% and Platinum 38%. Including net debt of $1.94B the total enterprise value of VRT was expected to be $5.3B.

Upon consummation of the merger, Platinum received $342M in cash consideration allowing with the 118M shares.

At the time of the IPO Platinum had already extracted $1.34B in cash and held a stock position with $1.54B. Platinum had the right to register shares twice a year. The firm began selling immediately following the expiration of the 180-day lockup. In August 2020, Platinum sold 23M shares for $350M in proceeds; in November 2020, it sold 18M shares for $301M in proceeds.

2020 was a forgiving year. Overall, sales were down modestly, but EBITDA margins registered a slight increase. Most importantly, the stock price increased from the IPO merger price of $10 to $18 despite the lackluster results.

2021 would be quite different.

The first three months of 2021 was business as usual. The company reported 4Q20 and full-year results in February, characterizing them as ‘strong” despite widely missing the mark on adjusted operating profit and free cash flow projections shown in the initial SPAC presentation.

Management boasted of the growing backlog and Executive Chairman David Cote noted that there were “sales growth and margin rate expansion opportunities abound”. Further, guidance was promising with mid-single-digit sales growth, but 68% y/y growth in AOP.

The company expected $575M in AOP and $285M of free cash flow in 2021.

Three business days following the call, Platinum sold a large block of stock - 17.4M shares at new highs of $20.14, netting the PE firm $350M in cash.

Things began to change with the 1Q21 call in April. The company beat AOP guidance for the quarter, but there was a great deal of uncertainty in the industry. Inflation and supply chain problems were challenging margins of the industry as a whole.

This was particularly concerning for VRT, the investment thesis for which was centered on margin expansion. Despite the uncertainties, the company raised guidance for the year.

When an analyst questioned the company’s ability to raise prices, CEO Rob Johnson said we have “a good process to drive prices through with our customers on a global scale”. Regarding the $2B backlog, Chief Business Officer Gary Niederpruem stated that “we’re not saying there is nothing we can do there.” “We are taking action there as well.”

VRT beat AOP guidance once again in 2Q21 reported on July 28. The company also raised guidance for the second time. AOP guidance was raised to $595M and free cash flow to $300M for the year.

Despite the positive results and increased guidance, on the 2Q conference call, analysts continued to question management on pricing power. On the call, management assured investors that pricing actions would positively impact full-year results contributing $65M to profits.

The lawsuit notes that management claimed they were raising full-year AOP guidance to $600M because of “additional pricing action” and “pricing programs” that were “already underway”.

The narrative defined by rising profitability and cash flows began to fray only 5 weeks later. On September 9, VRT announced the acquisition of E&I Engineering for $1.8B, including $1.2B of cash and $600M of stock.

Management reduced 2H21 expectations in an update on business conditions as part of the release. Guidance for 3Q21 AOP was lowered -19% to a mid-point of $130, while annual AOP was lowered -10% to $540 from $600M. FCF guidance for the full-year was lowered -31% to $205M from $300M.

The stock wavered and declined from the upper $20s to the lower $20s, but swiftly recovered as the 3Q21 reporting date of October 27 approached.

The company met lowered guidance for 3Q21. On the conference call, management reiterated that they were making good progress on mitigation inflationary pressures. Analysts noted that the tone of the call was much better than that only 3-weeks earlier.

Management stated that 3Q would represent the inflationary peak and re-raised AOP guidance modestly from $540M to $553M. Annual free cash flow guidance which was lowered to $220M from $300M in September was maintained.

The stock held well and three days after the call, Platinum sold 21.9M shares at $24.83 for total proceeds of $544M.

Management’s narrative completely unwound on February 23, 2022 when the company announced a massive earnings miss, which we show below. The company missed quarterly AOP guidance by 47% and free cash flow by 89%.

The conference call was a combination of a seeming mea culpa and acceptance of responsibility for being behind the inflationary curve the entire year, and blame game, pinning the lack of margin in discounts given by sales people.

The stock closed at $13.20, down from $20.47 the previous day. Nigel Coe of Wolfe Research, who had queried management on pricing issues frequently and in detail stated “management’s credibility is completely shot” and “in our 17 years of covering industrials we can’t recall a drawdown of this magnitude.”

CEO Robert Johnson, CFO David Fallon and Chief Marketing Officer Rainer Stiller are all Platinum approved appointments having joined VRT in 2016 and 2017. Additionally, Platinum currently has two board members.

The firm’s right to appointments will cease when ownership declines below 10%. Platinum currently owns just over 10%.

The Platinum selected management team has been augmented with Mr. Johnson’s family members. Problems associated with the CEO’s family members as managers are a recurrent theme in Glassdoor reviews, as evidenced here and here.

The company’s proxy indicates that Mr. Johnson’s brother, Patrick, was hired in 2017 and currently serves as an Executive Vice President of Integrated Rack Solutions. Patrick’s total compensation was ~$1M in 2021 including stock grants, down from $3M in the prior year.

Another brother to Rob Johnson, Richard Johnson, was hired in 2018 and currently serves as Director of Global Strategic Clients. Richard’s total compensation was ~$500,00 including grants in 2021, up from $413,000 in 2020.

Two of Rob Johnson’s sons work at VRT. Alexander Johnson joined the company as Manager of Channel Accounts CDW in 2018. Alexander received total compensation in 2021 of $320,000 including stock grants, up from $232,000 the prior year. Michael Johnson serves as National Account Manager and received total compensation of $140,000 in 2021.

In our view, the concentration of allegiances to insider factions lends itself to the ethical lapses alleged and evidenced in the lawsuit testimony.

On October 3, 2022, VRT announced the that Robert Johnson was stepping down from his role as CEO for health reasons. Giordano Albertazzi, President of Americas was appointed CEO.

Mr. Albertazzi was formerly President of EMEA. He was likely behind the acquisition of the Irish firm E&I Engineering in 3Q21, which has been a material disappointment, adding $0.02 per share in profit when $0.10 was expected.

In the wake of disastrous 2021, VRT suffered two class action lawsuits, the first of which was voluntarily dismissed in May 2022. It was likely settled. The 2Q22 10-Q cites a legal settlement payment of $8.7M, which we assume to be for the lawsuit.

We suspect settlement of the second lawsuit will not be so easy. The complaint alleges that management committed fraud and “made false and materially misleading statements in a scheme to deceive investors” and “artificially inflate the stock price”.

The plaintiffs amended the complaint on September 16, 2022. The allegations and testimony details severe mis-governance and grave lapses of ethical behavior. Here is a link to the case.

VRT’s 3Q22 10-Q addresses the lawsuit, noting that the plaintiff’s filed an amended suit claiming the company made materially false and/or misleading statements.

It states that “while the company believes it has meritorious defenses against the plaintiff’s claims, the company is unable to predict the outcome of this dispute or the amount of any cost associated with the resolution”.

We consider this a material disclosure. Most times, companies note that they consider the case ”without merit”. The Public Company Accounting Oversight Board (PCAOB) notes that “without merit” and “meritorious defenses” have specific meanings in the context of accounting documents.

“Without merit” means that the likelihood of an unfavorable outcome is remote. The ability to provide “meritorious defenses” merely indicates that counsel believes that the company’s defense will not be summarily dismissed by the court.

It does not necessarily indicate counsel’s opinion that the company will prevail. It also implies that the possibility of a negative outcome is not remote.

Testimony focuses on several key points that management emphasized throughout the year:

- Emphasis of the large and growing backlog

- Continually assuring investors that price actions had been taken and would soon be evident on the P&L

- Frequent raising of guidance

- Supply chain issues, while persistent, had been effectively reworked

Raw materials inflation, supply chain problems and product pricing were key issues across the industry in 2021. All competitors discussed the problems on quarterly conference calls. VRT management comments were no different in topic, but very different in substance and outcome.

The narrative management wove throughout 2021 was that inflationary and supply chain issues were being dealt with effectively through both planning – sophisticated AI-driven order management software – and retroactively by working with customers to pass through price increases.

Management clung to the narrative throughout the year, even, as testimony indicates, they knew it was not going to happen. It was an elaborately constructed and well maintained narrative that had little if any basis in reality.

Mr. Johnson exemplified the position when he appeared on a DataCenterKnowledge podcast on July 21 and an associated article, a week before the company’s 2Q21 earnings release. In the interview, Johnson touted the company’s “sophistication” on pricing tools.

The system could tell sales people “at that price you will lose the order, at this price you are too cheap” The article quoted Johnson as saying “we’re just trying to recover what our costs are – that are going up – so we can take care of our share owners”, continuing, “our customers and partners are pretty good at understanding what’s happening on the market”.

The lawsuit shows a different reality. The CPQ or order system was a “disaster” and it was so bad there were “all hands meetings to calm the crowd”. One former sales person noted “CPQ stopped commerce.”

Testimony shows that Mr. Johnson’s on-the-record comments, in company conference calls and media appearances were categorically false. The AI, algorithms, sophisticated pricing models – were all non-existent from a practical business standpoint.

The large and growing backlog was cited in press releases and on conference calls as evidence of the company’s selling success. It was, in fact, a large backlog of unprofitable business.

Sales people were encouraged to target the large orders of hyperscale data center operators, such as Google, Amazon and Microsoft. “It was all slash and burn to get the stock price up as high as you can. That is why they targeted the large customers.”

It appears as if the point was to build a large backlog and reap the benefit of the optics, not book profitable business. An employee testified that orders were very competitive with “very strict RFPs with the prices they are paying”. In other words, the hyperscale data centers dictate pricing.

In addition to pursuing unprofitable contracts, in order to make the sale VRT gave customers significant discounts despite the inflationary environment. Management is on the record in numerous forums discussing how they were taking “pricing actions around list prices, multipliers and discounts” and “controlling discounts that our own sales people are able to have”.

Mr. Johnson said changes were being made to ensure “not just discounting to build backlog”. Yet that is exactly what they did.

Numerous former employees testified that management knew and approved of discounts. “the pressure to sell was so great that we had an inability to transfer those price costs to our clients”.

With respect to discounting, “Rob Johnson agreed to these deals without price increases. These exceptions were being approved and their recent quarterly miss was all self-inflicted”

The result of pursing unprofitable contracts and excessive discounting was a large unprofitable backlog. One former employee testified that the company was saddled with “an off the charts unprofitable” backlog.

Management touted the backlog to investors as a point of strength when they knew it was packed with contract terms that “were not good for Vertiv”.

Management also claimed that they were increasing pricing on booked orders to account for inflationary pressures. Chief Business Officer, Gary Niederpruem stated “we have other mechanisms…clauses in large contracts”. This was patently false according to testimony.

VRT’s contracts had no mechanism to increase pricing. The contracts locked in the discounted prices. One former employee testified “there was no mechanism to increase prices in those contracts, you had to eat it.”

All throughout 2021, management talked of the pricing actions they had taken, which would result in margin expansion in future quarters. Management even quantified the pricing actions, providing a slide in quarterly presentations with margin evolution.

Former employees testified that management never took any pricing actions: “Vertiv was not raising their prices like everyone else was”. According to another employee: “they were not issuing price increases in 2021.”

VRT’s 3Q22 results reported on 10/26 were sub-par despite lowering guidance in earlier in the month. Adjusted operating profit of $134.2M for the quarter was barely above the bottom of the $130M-$150M range.

2022 is the year management was supposed to rebuild the financial and ethical lapses that were exposed in 2021. It what appears to have been an attempt to rebuild trust and credibility on the conference call, numerous members of management noted that the results and discussion were “consistent” with what they have been telling investors from the beginning of the year.

The problem is that it has not been consistent and clear lapses associated with guidance, a key issue in 2021, remain.

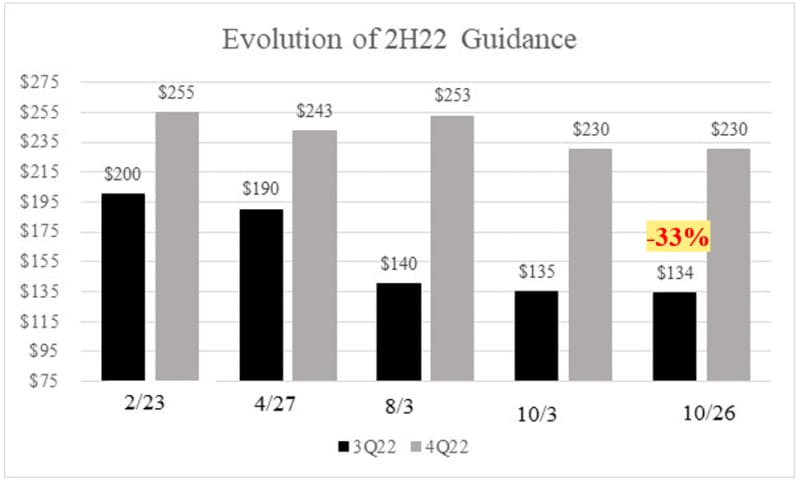

In the table below, we show management’s AOP guidance for 3Q22 throughout the year and the final reported figure. The 4Q22 figures in 2/23 and 4/27 are estimates.

Source: Company filings and estimates.

As is clear from the chart, guidance for the quarter was steadily reduced throughout the year, converging on the actual reported number of $134M, 33% below managements estimates from earlier in the year.

In contrast, reductions in 4Q22 guidance have been much smaller, declining only 10%. 50% of guided AOP for the year is expected in 4Q22.

2023 guidance is not credible

Management’s inability to explain how and why the company will increase AOP from ~$460M in 2022 to $740M in 2023 leads us to conclude it is not credible and should be discounted.

Management provides quarter to quarter bridges showing the contribution of various factors to explain the changes in profitability. On the 3Q22 conference call, VRT CFO Dave Fallon reconfirmed the 2023 $730-750M AOP guidance up from $450-470M in 2021.

However, when an analyst queried as to how that significant gap from $460M to $740M would be bridged, Mr. Fallon said “as it relates to kind of filling in the details, it’s probably too soon. And we’ll provide a more robust bridge from ’22 to ’23 in February”.

Let’s put this in context. On October 3, 2022 with the year nearly over, management allegedly did not know that FCF guidance for 2022 needed be cut from $0 to ($125M), though they confidently put out guidance for 60% AOP growth to $740M for 2023.

On October 27, with 1/3 of the quarter behind, they cut FCF guidance. However, the high-growth 2023 AOP guidance is reaffirmed, but management cannot explain how it will be achieved. We find the incongruity in behavior deeply problematic.

Were TS Eliot an equity analyst, he might say it takes a willing suspension of disbelief to take management’s guidance seriously.

APPENDIX

Platinum purchased Vertiv for just over $4B in a transaction that included $1.2B of equity and $2.958B of debt. Thus far, Platinum has made an estimated $1.7B from its Vertiv investment and an estimated IRR of 41%, excluding the value of the 37M shares it retains.