By Nicholas Earl

The Government should reform stamp duty to encourage Brits to boost the energy efficiency of their new homes, argued Kingfisher, the owner of household brands such as Screwfix and B&Q.

Nick Lakin, group director of corporate affairs for the British retail giant, told City A.M. that Downing Street should consider “long-term macro nudges” such as financial incentives to boost insulation during the first 12-18 months people own a new home – when they are most likely to renovate the building.

Commenting on potential options, he highlighted the possibility of a reimbursement scheme within a two-year window of stamp duty for people boosting the efficiency of their homes with cavity wall, loft insulation and, double glazing

Lakin said: “It requires redesigning the stamp duty system, but you could redesign it and still make it cost neutral.”

The Kingfisher director hoped this would be appealing to the Government, which would be able to drive down energy bills and ease the cost of future support by making homes less leaky.

He said: “The difference now is there is a fiscal burden on the Treasury from subsidising all the populations energy bills. This means that they’re going to want to take this stuff even more seriously, perhaps more than they might have done before.”

This follows reports from trade association UK Finance on net zero homes, where it called for reforms to stamp duty.

Stamp duty hiked in penny-pinching budget

Stamp duty is a tax paid by Brits when purchasing a property, with how much you pay depending on the property price and if you’re a first-time buyer.

At the autumn statement last week, Chancellor Jeremy Hunt unveiled a £55bn tax grab- where he confirmed the previously announced stamp duty cut will end in April 2025.

This means £250,000 threshold will recede back to £125,000, after his predecessor Kwasi Kwarteng doubled the rate in the mini-budget two months ago.

Kwarteng also hiked the limit at which the tax was paid by first-time buyers to £425,000 on house worth up to £625,000 – which is also now set to revert in three years’ time.

Meanwhile, the Government has committed afurther £6bn to ramp up energy efficiency measures, in a nationwide drive to boost the energy efficiency of people’s home and upgrade boilers, targeting a massive 15 per cent cut in energy demand this decade.

This is on top of £6.6bn the Government has allocated to boosting energy efficiency across UK households since the start of this Parliament in 2019.

However, the UK has among the leakiest housing stock in Europe, an increasing issue with household energy bills set to rise to £3,000 per year next April.

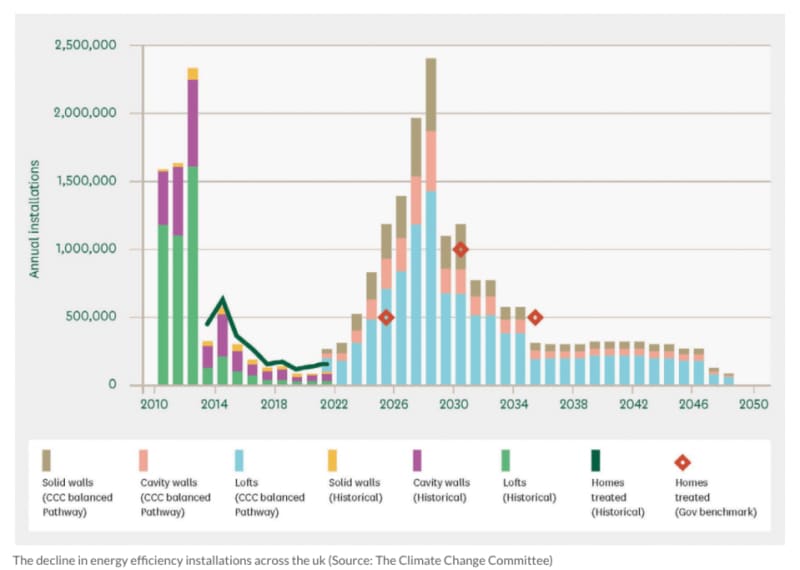

Installation rates across the UK have dropped sharply in the past decade from over two million homes per year to just tens of thousands after former Prime Minister David Cameron slashed previous efficiency schemes in the mid-2010s – as revealed in the BEIS Select Committee report on energy pricing earlier this year.

Currently just one third of UK homes have an energy performance certificate rating of C or above – the minimum standards the Government has set for domestic households by 2035.

This means an estimated 19m homes need retrofitting – with a study from EDF and Sprift earlier thuys year revealing the insulation age of UK homes to be at least 46 years old.

The energy giant surveyed 2,000 UK homeowners, which indicated more than than half (58 per cent) the country’s households only meet the insulation standards of 1976 or before.

The post Exclusive: Reform stamp duty to boost energy efficiency, urges Kingfisher appeared first on CityAM.