By Darren Parkin

Data from CryptoCompare shows that the price of Bitcoin kept on dropping over the past week

after testing the $17,000 mark. The cryptocurrency’s price steadily dropped to now trade at $16,000.

Ethereum’s Ether, the second-largest cryptocurrency by market cap, traded in a similar way.

The cryptocurrency’s price kept on dropping from around $1,250 to $1,100 at the time of writing as sellers keep adding pressure.

Headlines in the cryptocurrency space this week focused heavily on FTX’s collapse and potential contagion affecting other cryptocurrency firms. In court filings, the embattled cryptocurrency exchange said it owes almost $3.1 billion to its 50 largest creditors, and around $1.45 billion to its top 10 creditors, without naming any.

The exchange, which filed for bankruptcy earlier this month, collapsed after a leaked balance sheet

of its sister firm Alameda Research revealed that it relied heavily on the exchange’s FTT tokens. After leading exchange Binance announced it was divesting its FTT stake, a bank run on the exchange led to its bankruptcy.

FTX’s previous filings reveal the exchange has more than one million creditors, and a court hearing before a US bankruptcy judge has been set for Tuesday. The exchange said over the weekend it launched a review of its global assets, and was preparing for the sale or reorganisation of some businesses. In the wake of FTX’s collapse, cryptocurrency users have started moving their funds on-chain, away from centralized custodians.

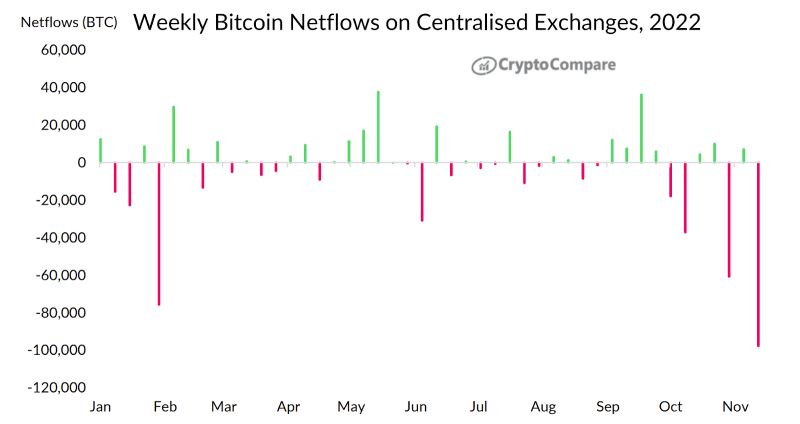

Data from CryptoCompare’s latest Exchange Review report shows that weekly Bitcoin net flows from centralised exchanges recorded their largest outflow, with 97,805 BTC moving off of trading platforms in the seven-day period ending on November 13.

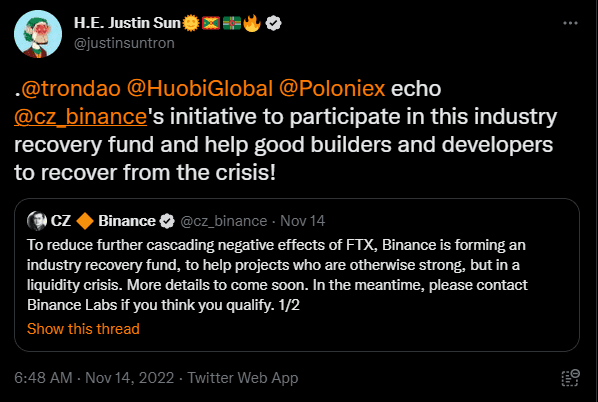

Various cryptocurrency exchanges have since moved to offer users proof of reserves, including BitMEX, Binance, and Kraken. In a bid to help the cryptocurrency industry recover, leading exchange Binance has said it’s forming an industry recovery fund, with more details on it set to come in the near future.

Tron founder Justin Sun quickly reacted, saying Tron and cryptocurrency exchanges Huobi Global and Poloniex will support Binance in its initiative.

Meanwhile, FTX has said it’s investigating “unauthorised transactions” flowing from its wallet, with around $600 million having been stolen. The funds were first converted into ETH, and over the weekend the ETH has started being converted into renBTC, a tokenized version of BTC on other blockchains linked to Alameda Research.

Genesis suspends client withdrawals for lending arm

Over the week, full-service digital currency prime broker Genesis Trading, announced to its clients that it would be temporarily halting withdrawals from its lending arm (i.e. Genesis Global Capital), citing unprecedented market turmoil” as a result of the insolvency of FTX.

In a series of tweets, the firm wrote that in consultation with its professional finance advisors and council, it made the decision to halt redemption and new loan originations. Genesis reportedly has over $12.5 billion worth of outstanding loans, and processed over $130 billion throughout 2021. The firm had some exposure to FTX.

Genesis Trading’s parent company, Digital Currency Group (DCG), has recently stepped in to provide it with $140m in equity. DCG also said that Genesis’ “temporary action has no impact on the business pperations of DCG and our other wholly owned subsidiaries.”

Regulators in the European Union have debated how upcoming crypto regulation would have influenced the collapse of FTX. Whilst some EU officials believe the Markets in Crypto Assets (MiCA) regulation — expected to be implemented by 2024 — would strongly protect EU citizens from events similar to FTX, others are less certain.

St Kitts and Nevis looks at making Bitcoin Cash legal tender

Cryptocurrency adoption has nevertheless seemingly kept on growing. The Caribbean nation of St Kitts and Nevis is exploring the possibility of declaring Bitcoin Cash (BCH) legal tender as part of the process of introducing cryptocurrencies into the country’s economy.

During the Bitcoin Cash 2022 Conference, the country’s Prime Minister, Terrance Drew announced: “I welcome the opportunity to dialog further with a view to exploring opportunities for Bitcoin Cash mining and making bitcoin cash legal tender in St Kitts and Nevis by March 2023 once the safeguards to our country and our people are guaranteed.”

Drew added his country was aware of the possible advantages of adopting a cryptocurrency as legal

tender, and that various businesses on the island already accept BCH as a payment method.

Meanwhile, members of the US banking community have launched a proof of concept (PoC) project that will explore the viability of an interoperable digital money platform known as the regulated liability network (RLN).

The proposed platform would look to utilize distributed ledger technology (blockchain is a type of DLT) to create innovative opportunities to improve financial settlements. Central banks and commercial banks of various sizes are looking to participate, alongside regulated non-banks.

Francisco Memoria is a content creator at CryptoCompare who’s in love with technology and focuses on helping people see the value digital currencies have. His work has been published in numerous reputable industry publications. Francisco holds various cryptocurrencies.

The post Centralised exchanges see record Bitcoin outflows as FTX contagion spreads appeared first on CityAM.