What’s New In Activism – TCI Fund Management At Alphabet

Google’s parent company Alphabet Inc (NASDAQ:GOOGL) faces pressure from activist TCI Fund Management to take action to cut costs.

Q3 2022 hedge fund letters, conferences and more

"The company has too many employees and the cost per employee is too high. Management should publicly disclose an EBIT margin target, substantially reduce losses in Other Bets and increase share buybacks," the statement argued.

The activist stated Google's Search business has high operating leverage and is not labour intensive. It further highlighted total expenses grew by 18% year-over-year in the third quarter, while revenue grew by "only" 6%.

Activism chart of the week

So far this year (as of November 18, 2022), globally, activists have initiated 184 campaigns at financial services companies. That is compared to 141 campaigns in the same period last year.

Source: Insightia |Activism

What’s New In Proxy Voting - ACCR Criticizes MCA

The Australasian Centre for Corporate Responsibility (ACCR) urged institutional shareholders in major mining companies to "take a stand" against the Minerals Council of Australia's (MCA) recent threat to launch a political advertising campaign against "bad policies."

In last Friday's announcement, the ACCR criticized the MCA's "threat" to fund an anti-Labor advertising campaign against "bad policies" such as a potential windfall profit tax on coal exports, which would prevent companies from profiting from the war in Ukraine, among other things such as bringing down budget deficits.

The MCA argued in an October 11 statement that "a tax on mining will put Australia's economic recovery at risk, and hurt the very people the government is trying to help: Households and small business owners."

ACCR Climate Lead Harriet Kater argued that "this recent threat to the Government's policy agenda – which of course includes its climate policies – is brought to you by BHP, Rio Tinto, and South32."

Voting chart of the week

So far this year (as of November 18, 2022), U.S. companies have received an average of 89.7% support for their advisory pay votes. This compares to 94.1% for U.K. companies.

Source: Insightia |Voting

What’s New In Activist Shorts - J Capital Research v Lake Resources

J Capital Research doubled down on its claim that Australian lithium miner Lake Resources N.L. (ASX:LKE) has been misleading investors in order to pump up its share price.

The short seller issued its first report on Lake on June 7, accusing the company of paying financial advisory businesses to produce favorable research to boost the stock as company insiders sold shares.

In an update last Thursday, J Capital said it made a Freedom of Information Act (FOIA) application to the U.K. government to verify Lake's claim that it has "confirmed" funding from UK Export Finance (UKEF), United Kingdom's export credit agency.

"These documents seem to reveal that Lake has made statements that are incorrect about the expression of interest (EOI) from UKEF," J Capital wrote. "UKEF says that Lake is just at the start of the application process."

Shorts chart of the week

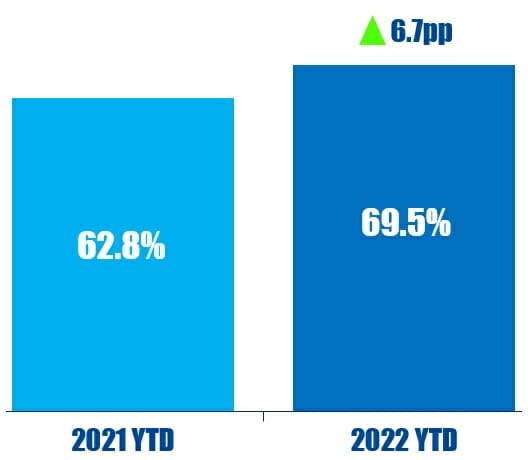

So far this year (as of November 18, 2022), 69.5% of public activist short campaigns have been at U.S.-based companies. That is up from 62.8% in the same period last year.

Source: Insightia | Activist Shorts

Quote Of The Week

This week's quote comes from Jeff Sanders, vice chairman and co-managing partner of the global CEO & Board of Directors Practice, after Heidrick & Struggles released its Route to the Top report. Read our coverage here.

“As the pandemic wanes, boards, and companies are looking beyond the traditional steppingstone roles of COO and CFO for their next leader.” – Jeff Sanders