By Darren Parkin

The week in review

With Jason Deane

Greetings from the Leonardo Royal Hotel in London!

I’ve been staying here for the last few nights attending, MCing and speaking at the City Am Summit and Awards. And what an experience it has been.

The conference is noticeably quieter than previous events I’ve attended and the mood is very subdued, all a sign of the times I guess. However, it was good to see the state of the market openly acknowledged rather than glossed over and the speakers and panels maintained their usual high quality and professional approach.

My view is that the people who chose not to attend did themselves a disservice – it may be understandable, but times like these are precisely when you double down, learn and network as much as you can. I’ll wager those who attended are now best placed to do exactly that.

My opening keynote on Thursday morning had, as you would expect, a much broader macro economic view point than my fellow speakers who tended to focus on their specialist niches and projects, but I did feel it appropriate to address the elephant in the room – the crypto industry as whole.

The theme of my talk was that crypto is going through its “dot com bubble” phase. In my view, the comparison is a valid one. In 1999, for example, 457 internet related IPOs hit the market just in time for the NASDAQ hit an all high in March 2000. By October of that same year, however, it had lost 80% of its value and wiped out most of the projects that had been artificially supported by investors’ money.

Many of those ideas were daft (Digiscents anyone?) or pure scam companies like Cyber Rebate, Pixelon and Pseudo or simply copycats of existing services like Excite, Infoseek, AltaVista, Askjeeves or Kibu, Myspace and The Globe. All received substantial funding during the heady, crazy days of the boom as anything that added “dot com” to its product offering was immediately funded by over eager investors.

We’re seeing the same thing now. How many coins claim to do the same thing as another coin? How many are complete scams? How many are ridiculous ideas that simply don’t have longevity? The market is clearing out the dross, paving the way for the next round of growth in the same way the early, experimental days of internet development did. There is pain ahead, but there is also opportunity.

Bitcoin, of course, remains entirely unaffected in all but the headline metric of price as adoption continues, lightning network capacity increases and wallets holding more than one Bitcoin reaches a new all time high, now at almost a million wallets. Meanwhile, hashrate creeps mercilessly up, even though there may be trouble ahead for some large miners who carry large debt loads and were mostly funded during the boom.

Core Scientific, responsible for up to 10% of global hashrate, released a report this week that made chilling reading. The prolonged lower Bitcoin price has meant that they are having to use all reserves to pay the bill and they don’t have enough to get them to the end of 2022, let alone beyond. The company also failed to pay some debt obligations in October and they are far from being alone. Just like crypto and the dot com boom, we will almost certainly see a short term shakeout of miners.

It all seems as depressing as the economy itself is, but, like everything in life, it’s how you react to it and how you move forward. There is more opportunity than despair in the air – it’s simply up to us to find it.

Want to learn more about what’s going on in our global financial system and how Bitcoin fits in to it? Come to my next free webinar on December 14 at 6pm to find out, ask any questions, and grab some free Bitcoin .* Click here to register.

Yesterday’s Crypto AM Daily in association with Luno

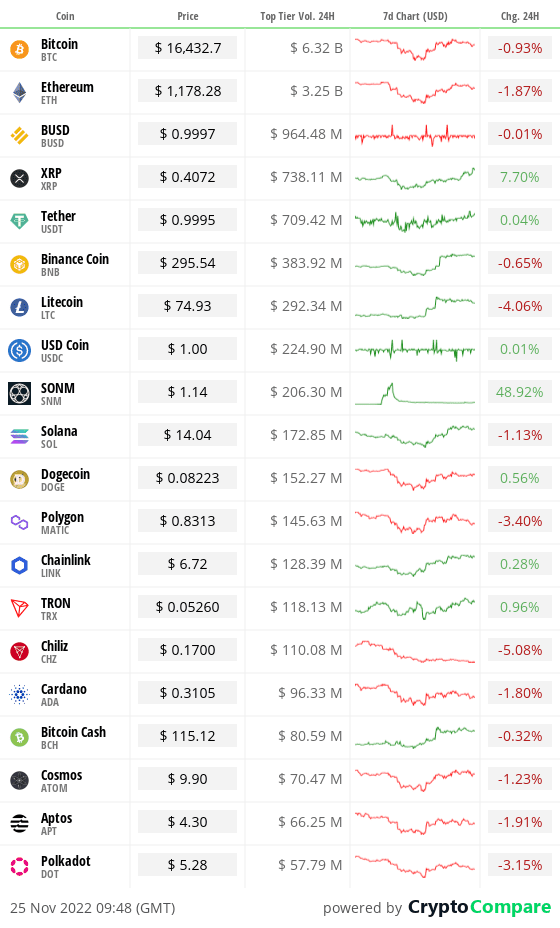

In the markets

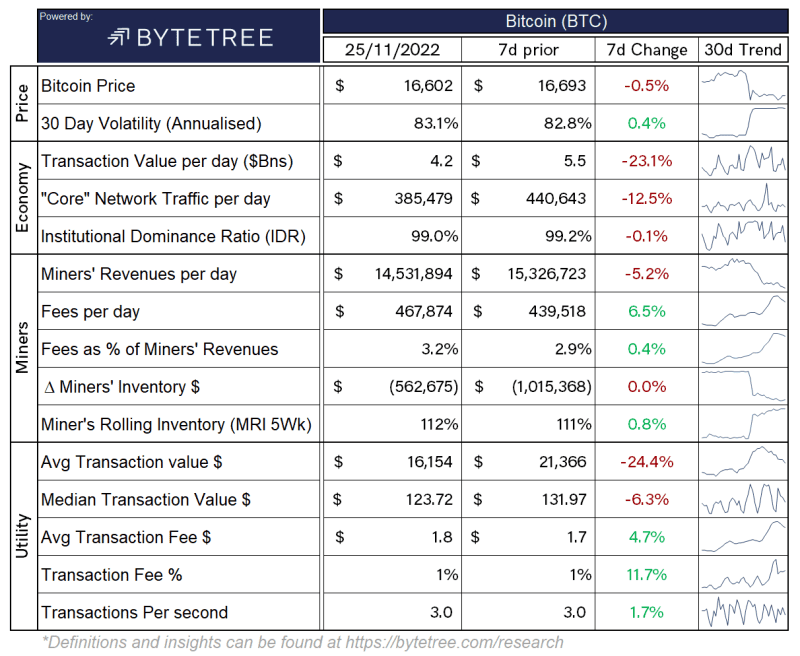

The Bitcoin economy

*Data can be found at https://terminal.bytetree.com/

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently$827.520 billion.

What Bitcoin did yesterday

We closed yesterday, November 24 2022, at a price of $16,604.47 The daily high yesterday was $16,771.48, and the daily low was $16,501.77.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is$316.33 billion. To put it into context, the market cap of gold is $11.563 trillion and Tesla is $569.93 billion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $23.364 billion. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 52.84%.

Fear and Greed Index

Market sentiment today is 20, in Extreme Fear.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 40.35. Its lowest ever recorded dominance was 37.09 on January 1 2018.

Relative Strength Index (RSI)

The daily RSI is currently 32.64.Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“A country’s decision to embrace cryptocurrency may boost its resilience to economic shocks.”

Matthew Ferranti — a fifth-year PhD candidate in Harvard’s economics department

What they said yesterday

Be thankful for Bitcoin 🙏

Do you?

Good reminder

Would you like to help spread the adoption and education of Bitcoin in the UK and even stack some Sats while you’re doing it? Well, now you can!

The Bitcoin Pioneers community, backed by Barry Silbert’s Digital Currency Group, was created to introduce Bitcoin to a mainstream audience in a meaningful way and now has members right across the UK.

We share tips, stories and ideas on how to encourage others to try Bitcoin for the first time. And, thanks to support from Luno, each Pioneer gets £500 of Bitcoin a month to share with beginners, helping them get started.

So, if you’re passionate about Bitcoin, why not join today? Click here to find out more!

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com 🙏🏻

Crypto AM: Editor’s picks

Three-in-four wealth managers are gearing up for more cryptocurrency exposure

Crypto.com granted FCA licence to operate in UK

Q&A with Duncan Coutts, Principal Technical Architect at IO Global

Jamie Bartlett – on the trail of the missing ‘Cryptoqueen’

MPs are falling silent over potential of cryptocurrency

Erica’s ‘Crypto Wars’ handed honours in Business Book Awards

‘Let people invest’: Matt Hancock makes case for liberal crypto rules

Explained: Why the Treasury is so sold on stablecoins

Fears crypto is used to avoid sanctions ‘misplaced,’ says Matt Hancock

The cryptocurrency fundraisers behind Ukraine’s military effort

Crypto crazy couple name baby after favourite digital asset

Crypto AM: Features

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Contributors

Crypto AM: In Conversation with James Bowater

Crypto AM: Tomorrow’s Money with Gavin S Brown

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Visions of the Future, Past & Present with Alex Lightman

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Taking a Byte out of Digital Assets with Jonny Fry

Crypto on the catwalk

Crypto AM: Events

For those of you who missed the Crypto AM DeFi & Digital Inclusion online summit 2021 – you can now watch the event in two parts via YouTube

Part One

https://www.youtube.com/watch?v=dvqNMNZTIDE

Part Two

https://www.youtube.com/watch?v=WXhX_-Tr5j0

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:00 BST

The post Opportunity is still in the air if we address the state of the markets head-on appeared first on CityAM.