S&P 500 did slowly grind higher, and the lower volume isn‘t an issue as bonds confirmed amply. The risk-on turn continues, driven by value with tech still saving its bullets.

Anyway, the retreat in long-dated yields isn‘t creating headwinds, an no matter the deteriorating earnings, the time to turn really bearish on S&P 500 and Nasdaq hasn‘t come.

Q3 2022 hedge fund letters, conferences and more

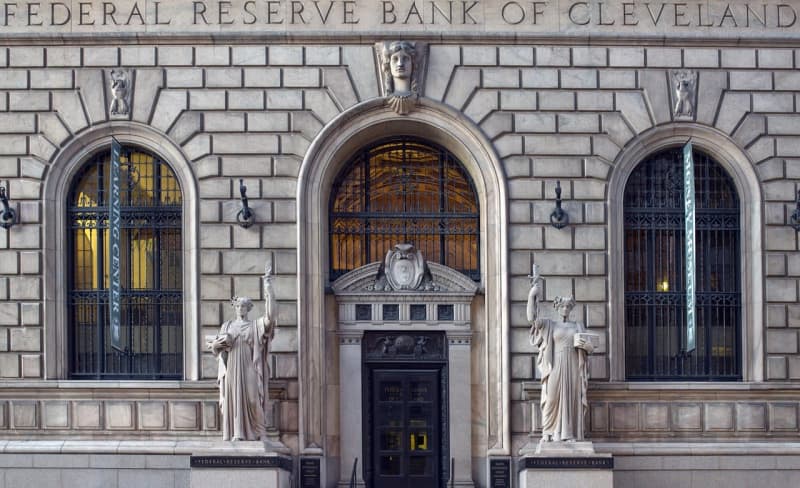

The Fed Minutes

Not even the array of events already in and still to culminate with the Fed minutes, is to throw the buyers off balance. Yes, fears of a significant downswing are there, but I‘m not looking for one to take us into 3,8xx values – it‘s actually about how fast we clear the 4,010s and especially 4,040 that would determine how far this Q4 rally can reach. Its best days are ahead, in Dec respecting seasonality patterns and enjoying the 50bp hike only.

The dollar is under pressure, long end of the curve down, yet commodities aren‘t firing on all cylinders. The price cap uncertainty is taking its toll on oil while natgas enjoys seasonally and fundamentally strong showing. Copper is likewise to reverse higher the way silver found easy to do.

Oil stocks and miners aren‘t panicking – quite to the contrary, and that‘s what counts most. Cryptos aren‘t making here a bottom – just working to suck in buyers before ultimately going lower – the adventurous and patient can act.

While at my homesite, you can subscribe to the free Monica‘s Insider Club for instant publishing notifications and other content useful for making your own trade moves on top of my extra Twitter feed tips. Thanks for subscribing & all your support that makes this great ride possible!

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice.

Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind.

Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make.

Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.