By Jack Barnett

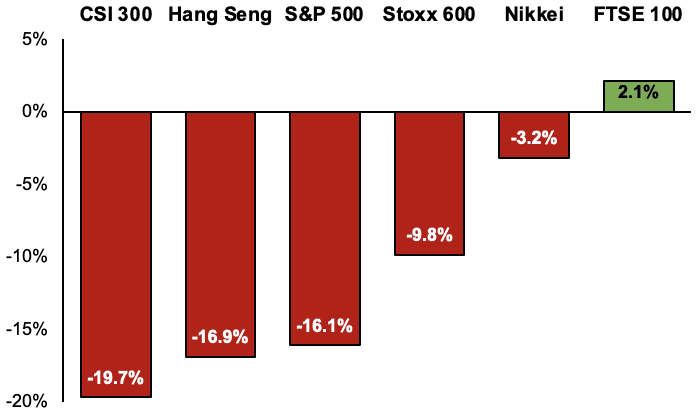

London’s FTSE 100 has breezed past its major international rivals to emerge as the only blue-chip index to squeeze out a gain so far this year, research by City A.M. shows.

The capital’s premier index has climbed 2.1 per cent over 2022 and is on track to end the year as the only collection of big stocks to avoid plunging into the red.

Analysts said the FTSE 100’s gains demonstrate it has been a more effective shield from raging inflation across the developed world this year compared to budding global stock indexes.

Wall Street’s blue-chip, the S&P 500, has shed 16.1 per cent, while the pan-European Stoxx 600 has tumbled nearly 10 per cent.

Germany’s Dax and France’s Cac 40 have declined around nine per cent and six per cent respectively this year.

The “FTSE 100 has acted as a good inflation hedge this year,” analysts at BNP Paribas Markets 360 told City A.M..

A large chunk of this year’s inflation crisis has been driven by energy prices surging after Russia’s invasion of Ukraine jolted international oil and gas markets.

While soaring prices have heaped pressure on households and smaller businesses, commodity giants have reaped windfalls, prompting investors to pile into the sector.

A large proportion of the FTSE 100 is made up of these firms, sending the index higher.

FTSE 100 has beaten all its major rivals this year

“It’s clear that the winners have benefitted from high energy and commodity prices as well as inflation concerns where commodities are in demand for inflation hedging,” Gerry Fowler, head of European equity strategy, UBS Investment Bank, told City A.M.

Oil majors and FTSE 100 listed Shell and BP have advanced 38 per cent and 35 per cent respectively so far this year.

Miner Glencore has skyrocketed 41 per cent, while Rio Tinto has leapt more than 16 per cent.

Critics of London’s stock market have slammed it for housing few tech firms, which have propelled US and global bourses higher since the financial crisis, and being overly reliant on so-called “old economy” stocks.

However, a paucity of tech companies “has been a blessing in disguise” this year, Fawad Razaqzada, market analyst at City Index, told City A.M.

Wall Street listed and the world’s most valuable company Apple has lost nearly 20 per cent this year. Google’s owner Alphabet has collapsed more than 30 per cent and Microsoft has lost over a quarter of its value.

Experts also attributed the FTSE 100’s outperformance to the pound’s torrid year. Lots of companies listed on the index earn income in other currencies, meaning they have booked solid gains when converting their cash into sterling.

“A weak GBP tends to benefit FTSE 100 stocks due to the index’s high level of foreign revenue exposure, one of the key drivers of its strong earnings performance this year,” BNP Paribas Markets 360 added.

FTSE 100 exporters have also benefited from a fragile pound as it has raised demand for their products.

The post FTSE 100 only major index to swerve loss this year appeared first on CityAM.