By Darren Parkin

Data from CryptoCompare shows the price of Bitcoin traded sideways throughout this past week, dropping from around $17,300 to $17,000 throughout it after seeing lows of $16,700.

Ethereum’s Ether, the second-largest cryptocurrency by market cap, traded in a similar way, seeing lows of $1,220 after starting the week close to the $1,300 mark. ETH is currently trading at $1,255.

Headlines in the cryptocurrency space over the past week focused on how contagion from the collapse of several high-profile cryptocurrency projects, including hedge fund Three Arrows Capital, blockchain ecosystem Terra, and exchange FTX, is still affecting those invested.

Notably, Wall Street giant Goldman Sachs is looking to spend tens of millions of dollars to buy or invest in distressed cryptocurrency companies. FTX’s collapse heightened the need for more trustworthy players in the space like Goldman Sachs, and its head of digital assets, Mathew McDermott, has said the bank is now doing due diligence on various crypto firms.

McDermott commented on FTX’s collapse, saying: “It’s definitely set the market back in terms of sentiment, there’s absolutely no doubt of that. FTX was a poster child in many parts of the ecosystem. But to reiterate, the underlying technology continues to perform.”

According to McDermott, the number of financial intuitions wanting to trade with Goldman Sachs increased after FTX’s collapse. Goldman Sachs, it’s worth adding, has invested in 11 digital asset companies to date.

Over the week, the CEO of Nasdaq-listed cryptocurrency exchange Coinbase, Brian Armstrong, confirmed the exchange’s revenue for this year will be around half of what it was in 2021. Armstrong cited the impact of the sharp drop in cryptocurrency prices and multiple bankruptcies in the space as reasons for the drop.

Coinbase’s shares are down more than 83% year-to-date as investors are increasingly moving away from crypto companies.

Meanwhile, GameStop has announced it will no longer focus any efforts on cryptocurrencies, after posting $94.7m in net losses for the third quarter of 2022. CEO Matt Furlong said on a recent earnings call that the company had “proactively minimised exposure to cryptocurrency” over the year, and “does not currently hold a material balance of any token”.

Going forward, GameStop will shift its focus to collectibles, gaming, and pre-owned items. However, it has not ruled out pursuing other business and strategic initiatives related to digital assets and blockchain technology.

Moreover, cryptocurrency lender Nexo is planning to gradually cease operations in the United States, according to a post in which the firm says the decision to leave the country is “regrettable but necessary”.

Nexo said it has been in contact with US regulators for 18 months in an attempt to determine how to comply with US financial laws, but the talks haven’t led to an agreement.

Bitcoin mining difficulty drops 7.2%

Bitcoin’s mining difficulty has recently decreased by 7.2%, its largest decline since July 2021, and is likely due to the economic challenges that mining companies have faced, such as rising power costs and falling BTC prices.

The previous drop in mining difficulty was likely caused by China’s crackdown on mining, which forced miners to relocate and caused the network’s hashrate to decrease. The recent decrease is likely to be the result of miners unplugging older machines that are no longer profitable.

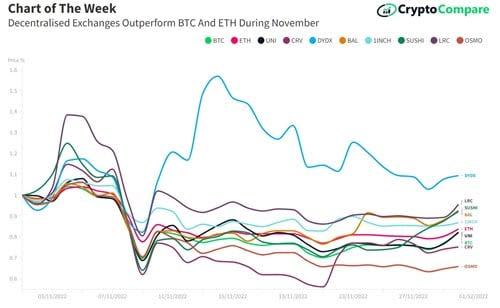

As Bitcoin’s price drops and users move to custody their own funds over the collapse of FTX, decentralised exchange tokens have been outperforming both BTC and ETH.

The price of decentralised exchange tokens DYDX, LRC, and SUSHI recorded returns of 9.35%, -4.4%, and -7.38%, respectively in November, compared to BTC and ETH’s returns of -16.2% and -18%, respectively, according to CryptoCompare data.

Price action hasn’t stopped payments giant PayPal from rolling out its cryptocurrency services. The company’s customers in Luxembourg are set to soon be able to buy, sell and hold Bitcoin, Ethereum, Litecoin, and Bitcoin Cash in their accounts.

The company said that the move is an “important step in PayPal’s mission to make digital currencies more accessible”.

Ethereum developers prioritize staked ETH withdrawals

While contagion has kept on taking its toll on cryptocurrency businesses, developers in the space kept moving forward over the week. Ethereum’s developers have said they are going to prioritise Beacon Chain withdrawals for the network’s next major upgrade, Shanghai, while delaying the implementation of The Surge, the network’s sequel to The Merge.

The Shanghei update is expected in the first half of next year. The Surge, which is being delayed, is expected to help Ethereum process financial transactions faster by changing the way the blockchain manages its workload. It’s believed it could pave the way for significant improvements in Ethereum’s transaction fees and Layer 2 rollups.

Blockchain oracle network Chainlink has also kept developing and launched its staking feature to help increase the economic security of its oracle services. The new feature is an integral part of Chainlink’s Economic 2.0 effort.

Francisco Memoria is a content creator at CryptoCompare who’s in love with technology and focuses on helping people see the value digital currencies have. His work has been published in numerous reputable industry publications. Francisco holds various cryptocurrencies.

The post Goldman Sachs eyes bargain crypto firms as contagion spreads appeared first on CityAM.