By Jack Barnett

The US Federal Reserve has tamed the pace of its aggressive interest rate hike campaign tonight, but signalled borrowing costs will eventually peak much higher than previously expected.

Chair Jerome Powell and the rest of the federal open market committee (FOMC) backed a 50 basis point rise in the world’s most important interest rate, climbing down from four successive 75 basis point jumps.

That move took the federal funds rate to a target range of between 4.25 per cent and 4.5 per cent.

The slowdown was sparked by the Fed’s series of jumbo rises finally cooling US inflation and concerns that tightening financial conditions too much could deal unnecessary damage to the world’s biggest economy.

The rate of price rises across the pond fell to 7.1 per cent in November, much lower than Wall Street’s expectations, building on October’s downside surprise 7.7 per cent increase.

Fed officials, including Powell himself, signalled in the run up to the latest FOMC meeting they would shift gear to avoid tipping or deepening a recession in the US and achieve a so-called “soft landing”.

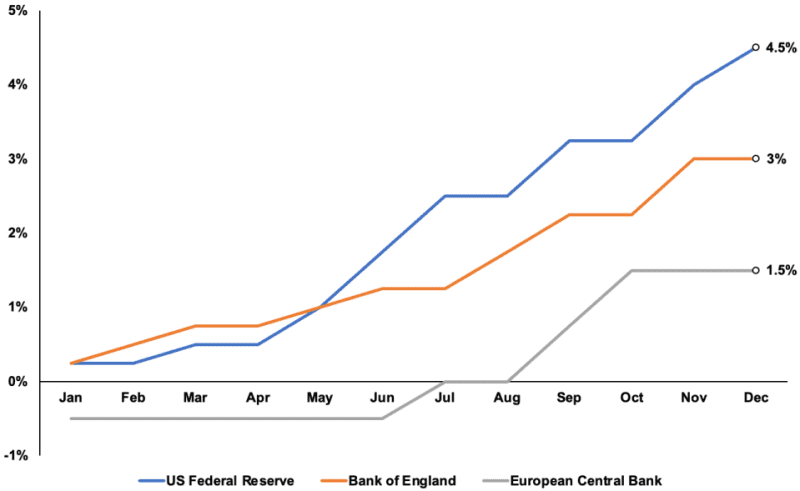

Rates have risen sharply this year

However, the average expectation among rate setters – the so-called “dot plot” – is to send US rates above five per cent next year and keep them over four per cent in 2024, meaning borrowing costs will be running much higher than they have since the financial crisis.

The slow down likely marks the start of the world’s biggest central banks scaling back the severity of increases as they try to find rate levels that are able to manage inflation without heaping too much pressure on businesses and households.

Bank of England Andrew Bailey and his team of rate setters are expected to climb down from November’s 75 basis point rise – the biggest in 33 years – to 50 basis points tomorrow after new figures today indicated inflation may have passed its peak.

Prices in the UK climbed 10.7 per cent over the year to November, down from a rate of 11.1 per cent in October.

Similarly, investors are betting the European Central Bank will also drop from 75 basis point hikes to a 50 point move tomorrow. Eurozone inflation is also running at eye watering levels.

The post US Federal Reserve ushers in global rate hike slow down with 50 point rise appeared first on CityAM.