What’s New In Activism – George Norcross At Republic First Bancorp

George Norcross and his allies made a new proposal to Republic First Bancorp Inc (NASDAQ:FRBK), offering to invest $75 million in exchange for three board spots and the CEO position.

Q3 2022 hedge fund letters, conferences and more

In March, the dissidents offered to make a $50 million investment and expressed interest in becoming majority shareholders in Republic First through a subsequent transaction. At the time, the community lender was headed by former CEO Vernon Hill, who left during the summer after losing a board fight against Republic First founder Harry Madonna.

It comes about a month after Braca, a former top executive at TD Bank, was rejected as the group's director candidate for Republic First 2022's annual meeting on January 26, 2023. The bank said in November that Braca's nomination documents breached the company's bylaws.

Activism chart of the week

So far this year (as of December 8, 2022), globally, 34 investors who disclose activism as part of their investment strategy have publicly subjected at least three companies to an activist demand. That is compared to 30 in the same period last year.

Source: Insightia |Activism

What’s New In Proxy Voting - | European Banks Lag On Biodiversity

New research from climate activist ShareAction found that Europe's largest banks are falling short of internationally agreed standards to manage the global climate and biodiversity crisis.

The research, published yesterday, was conducted on Europe's top 25 banks and studied their approaches to tackling climate change and protecting the world's natural habitats.

ShareAction stated that despite all 25 banks committing their businesses to a net-zero by 2050 target, they are still not doing enough and found that fossil fuel policies are "full of loopholes that make them unfit for alignment with 1.5°C goal."

Peter Uhlenbruch, director of financial sector standards at ShareAction, said, "despite important steps forward, the leadership of Europe's top banks are not moving fast enough to drive the change needed to protect people and the planet."

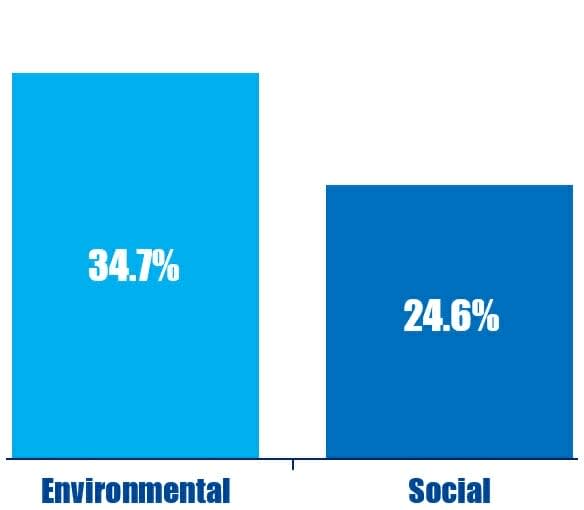

Voting chart of the week

So far this year (as of December 9, 2022), environmental shareholder proposals at U.S. companies have received an average of 34.7% support. Social proposals, meanwhile, have averaged 24.6% support.

Source: Insightia |Voting

What’s New In Activist Shorts - Energy Vault Holdings V Bleecker Street

Gravity-based energy-storage company Energy Vault Holdings Inc (NYSE:NRGV) pushed back against Bleecker Street Research's allegations that it misled investors about its technology and projects.

Last Thursday, Energy Vault said that the 440 MWh award announced earlier this year has not been canceled and that it will provide more details about the project in the coming days. Bleecker Street said in a short report last week that it believed the project was canceled due to months of silence on the subject.

Bleecker Street accused Energy Vault of making multiple misleading claims about its involvement in various projects. The short seller suggested this was part of a strategy to prop up the stock.

However, Energy Vault in its rebuttal slammed the short seller for mischaracterizing several of its press releases with the aim of creating controversy about its projects. It also rejected claims by Bleecker Street that its technology is nothing more than "a middle-school science fair project."

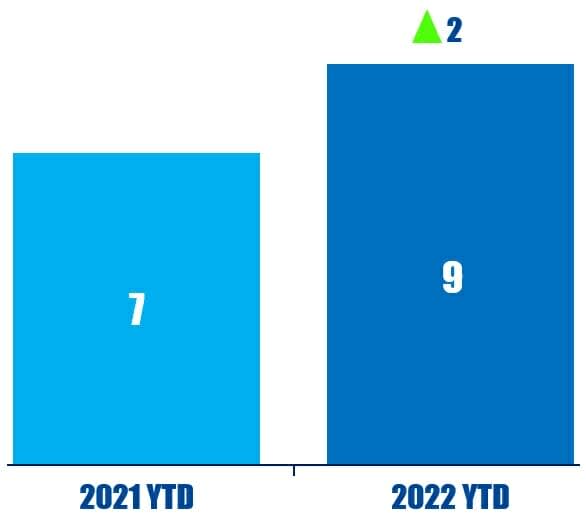

Shorts chart of the week

So far this year (as of December 9, 2022), nine Europe based companies have been publicly subjected to an activist short campaign. That is up from seven in the whole of 2021.

Source: Insightia | Activist Shorts

Quote Of The Week

This week's quote comes from Thunderbird Entertainment Group accusing Voss Capital of not trying hard enough to reach common ground after the activist claimed that roughly 37% of the company's share capital is backing its six director nominees. Read our reporting here.

“The fact that the markets are unstable, alone, is a good reason not to push for a transformative transaction which will almost certainly fail.” – Thunderbird Entertainment Group