By Jack Barnett

The prospect of a rebound in Chinese tourism after Beijing dismantles its tough zero-Covid policy has sent luxury fashion firm Burberry to near top of the FTSE 100 index this morning.

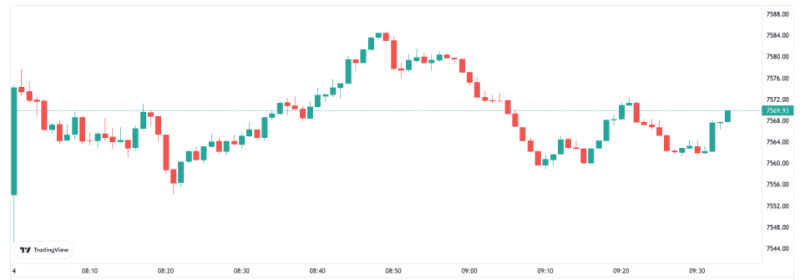

The more than three per cent share price kick dragged London’s FTSE 100 index up 0.12 per cent to 7,563.54 points.

Meanwhile the domestically-focused mid-cap FTSE 250, which is more aligned with the health of the UK economy, climbed 0.91 per cent to 19,308.12 points during opening exchanges in the City.

FTSE 100 nudged higher this morning

Burberry sources a large chunk of its income from Chinese tourists who travel around the world snapping out their premium products.

The checkered trenchcoat maker also has a large footprint in the country, meaning investors tend to pour into the company when demand prospects in China rise.

Beijing is in the process of gradually rolling back its tough reaction function – launching snap blanket lockdowns to tame virus cases – to the pandemic.

Positive China economic data out this morning also indicated consumers could unleash a wave of spending in the coming months.

“Commodity stocks like Glencore, BP, Shell, and Centrica are languishing at the bottom on the back of weaker oil and gas prices,” Victoria Scholar, head of investment at interactive investor said.

BP and Shell tumbled around three per cent apiece.

Oil prices shed around two per cent today due to a stronger US dollar making it more expensive to buy the resource.

Middle-class favourite and online supermarket Ocado topped the FTSE 100, adding 4.63 per cent, partly arresting last year’s decline caused by investors ditching the stock after households returned to physical supermarkets following the end of Covid-19 restrictions.

The pound strengthened nearly one per cent against the US dollar, while the yield on the 10-year UK gilt edged lower. Yields and prices move in opposite directions.

The post FTSE 100: Why Burberry is set to benefit from China’s zero-Covid policy u-turn appeared first on CityAM.