By Jack Barnett

The US Federal Reserve needs “substantially more evidence” proving inflation is falling quickly from red hot levels before ending its aggressive interest rate hike campaign, minutes from its latest meeting reveal.

Officials at the world’s most influential central bank unanimously agreed to slow the pace of rate increases to 50 basis points in December from a series of jumbo hikes to avoid front-loading too much pressure on the US economy.

Their decision last month sent borrowing costs to a range of 4.25 per cent and 4.5 per cent and marked a roll back from four successive 75 basis point bumps.

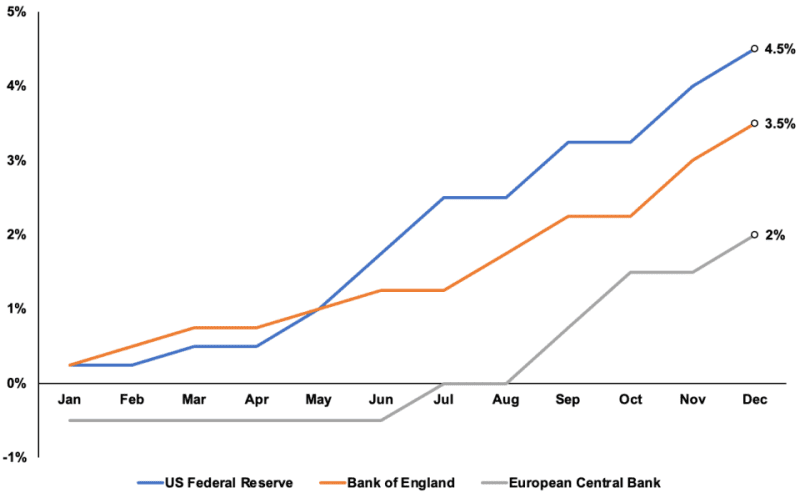

Cumulatively, the Federal Reserve has lifted rates at the fastest pace since the early 1980s since its first move last March.

Experts now think Fed chair Jerome Powell and the rest of the federal open market committee (FOMC) are finished with outsized rate hikes.

But, while traders suspect the Fed will take its foot off the accelerator, the eventual interest rate peak will be much higher than previously.

FOMC policy makers reckon they will nudge borrowing costs to a peak of between five per cent and 5.5 per cent in the first half of this year and keep them there until 2024, according to the so-called “dot plot” published last month.

Central banks have lifted rates rapidly

Today’s minutes also revealed rate setters are concerned markets are too confident the Fed will have to sharply slow the pace of hikes or even cut rates to offset the world’s largest economy tipping into recession.

“Because monetary policy worked importantly through financial conditions, an unwarranted easing in financial conditions, especially if driven by a misperception by the public of” whether the Fed reacts to new economic data loosely “would complicate the committee’s effort to restore price stability,” the minutes said.

Inflation in the US has likely passed a peak of more than nine per cent, a 40 year high, set last June, analysts think. It is now hovering just over seven per cent.

Wall Street’s main indexes – the S&P 500, Dow Jones and tech-heavy Nasdaq – all jumped on the news.

The Wall Street Journal’s US dollar index, which measures the greenback against a basket of the world’s major currencies, fell 0.25 per cent.

The post Federal Reserve signals more rate hikes to slay inflation and warns against market optimism appeared first on CityAM.