Ahead of the World Economic Forum, some of today’s turbulent state of affairs are explained by S&P Global economists and analysts. We have identified six interconnected themes – energy security, climate and sustainability, technology and digital disruptions, supply chains, capital markets and geopolitical shocks – with the greatest potential for large-scale disruption.

Q4 2022 hedge fund letters, conferences and more

Global Debt Leverage: Is a Great Reset Coming?

__*Terry Chan, CFA, Managing Director & Senior Research Fellow, S&P Global Ratings

Alexandra Dimitrijevic, Global Head of Research & Development, S&P Global Ratings

*

Rising rates and slowing economies mean the world’s high leverage poses a crisis risk__

The world’s leverage is at a higher level than pre-global financial crisis (GFC) peaks. Yet demand for debt — to help consumers with inflation, mitigate climate change and rebuild infrastructure — will continue. To mitigate the risk of a financial crisis, trade-offs between spending and saving may be needed.

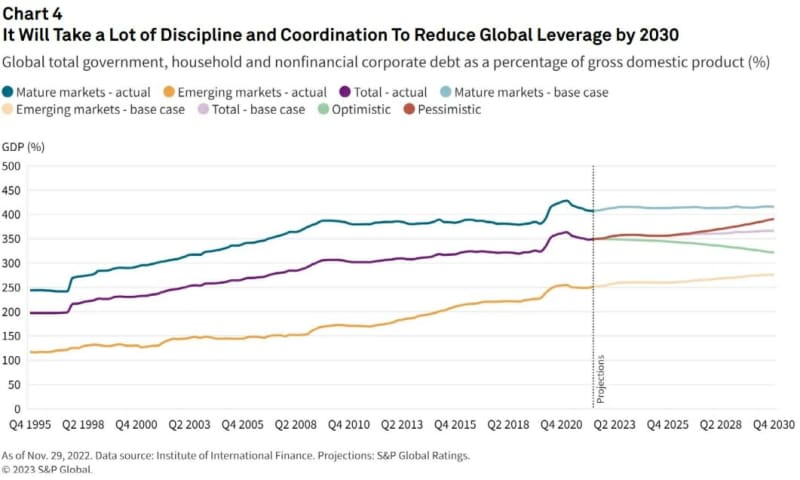

- Record leverage. Global debt has hit a record $300 trillion, or 349% leverage on gross domestic product. This translates to $37,500 of average debt for each person in the world versus GDP per capita of just $12,000. Government debt-to-GDP leverage grew aggressively, by 76%, to a total of 102%, from 2007 to 2022.

- The projected global debt-to-GDP ratio could reach 366% in 2030, above the 349% reached in June 2022.

- Higher interest rates. Debt servicing has become more difficult. Fed funds and European Central Bank rates were up an average of 3 percentage points in 2022. Assuming 35% of debt is floating rate, this means $3 trillion more in interest expenses, or $380 per capita.

- Great Reset. There is no easy way to keep global leverage down. Trade-offs include more cautious lending, reduced overspending, restructuring low-performing enterprises and writing down less-productive debt. This will require a “Great Reset” of policymaker mindset and community acceptance.