By Darren Parkin

According to CryptoCompare data, the price of the flagship cryptocurrency Bitcoin (BTC) moved up significantly over the past week, starting at around $17,000 and quickly rising to test resistance at $21,000.

Ethereum’s Ether, the second-largest cryptocurrency by market capitalisation, has moved in a similar way. After starting the week at around $1,300, the cryptocurrency surged to $1,550 where it’s currently trading.

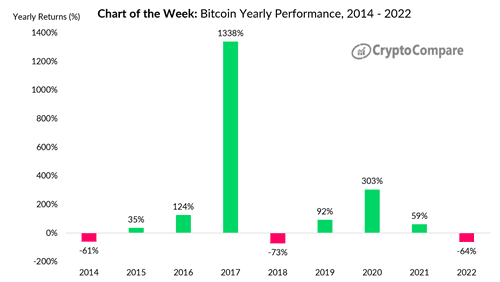

Bitcoin finished the year 2022 with its third negative annual performance in 14 years, closing at $16,531. While the 64.2% decrease in value for the year was not the steepest drop the cryptocurrency has ever seen, it was still significant.

In 2018, Bitcoin experienced a 73% drop in value, but then rebounded the next year with a 92% increase.

Headlines in the cryptocurrency space over the last week have focused on several developments, including those surrounding collapsed cryptocurrency exchange FTX. Its businesses have drawn interest from roughly 117 different parties, according to legal filings, with Embed, LedgerX, FTX Japan, and FTX Europe being prioritised for sale.

The cryptocurrency exchange has recovered $5 billion of liquid assets, including cash and digital assets. Landis Rath & Cobb attorney Adam Landis said on FTX’s behalf:

“We have located over $5 billion of cash, liquid cryptocurrency and liquid investment securities measured at petition date value. [It] just does not ascribe any value to holdings of dozens of illiquid cryptocurrency tokens, where our holdings are so large relative to the total supply that our positions cannot be sold without substantially affecting the market for the token.”

The recovery significantly increases the total assets FTX Claims it holds, and comes after its new leadership suggested it could only find $1 billion in December. While FTX has managed to recover some assets, its collapse greatly affected the cryptocurrency space.

SEC charges Genesis and Gemini

In November, cryptocurrency lender Genesis halted withdrawals and new loan originations, effectively barring over 340,000 users of cryptocurrency exchange Gemini’s Earn program, which as of October 2022 offered net interest rates to investors as high as 8%.

The US Securities and Exchange Commission (SEC) has now sued both Gemini and Genesis, stating Gemini’s cryptocurrency lending program wasn’t properly registered as a securities offering.

The SEC said that Gemini facilitated the transaction, taking agent fees as high as 4.29% that totaled roughly $2.7 million in the three months to March 2022.

Gemini terminated its Earn program earlier this week, saying in an email it will prioritize the returning of customer funds and “operate with the utmost urgency”.

Another cryptocurrency lender, Nexo, made headlines this week after Bulgarian prosecutors launched an investigation into alleged illegal activities it conducted, raiding more than 15 sites in the country’s capital Sofia as a result.

The move came after Nexo said in December it would phase out its products and services in the US over clashes with local regulators

Binance admits past problems with BUSD backing

Leading cryptocurrency trading platform Binance has acknowledged previous issues with managing the reserves that support its Binance-peg Binance USD (BUSD) stablecoin, resulting in over $1 billion in missing collateral at one point.

A Binance spokesperson has said the stablecoin’s peg is now secure after past issues were resolved. The spokesperson added that “despite variances in the data, at no point were redemptions impacted for users”. Data compiled by Jonathan Reiter, co-founder of blockchain analytics firm ChainArgos, suggests BUSD was often undercollateralized between 2020 and 2021. On three occasions, the gap surpassed $1 billion.

Binance-peg BUSD, it’s worth noting, is a version of BUSD issued outside of the Ethereum network. It’s backed by BUSD purchased from Paxos, which is used to mint Binance-peg BUSD on other blockchains.

Meanwhile, bankrupt cryptocurrency lender Voyager Digital has received initial court approval for the proposed $1 billion sale of its assets to Binance.US, and said it will seek to expedite a US national security review of the deal.

US bankruptcy judge Michael Wiles in New York, has permitted Voyager to proceed with an agreement to sell assets to Binance.US and also seek approval from creditors for the sale. However, the sale will not be completed until it is approved in a later court hearing.

Finally, the Legislative Assembly of El Salvador has passed a law enabling the issuance of digital assets, clearing the way for the creation of bitcoin bonds, which have been announced by President Nayib Bukele.

The recently passed law establishes a legal framework that provides clarity for the transfer of any type of digital asset used in public offerings in El Salvador. Additionally, it establishes a government agency to oversee the administration of digital assets in the country. The move toward creating bitcoin bonds has been under consideration since early 2022.

Francisco Memoria is a content creator at CryptoCompare who’s in love with technology and focuses on helping people see the value digital currencies have. His work has been

published in numerous reputable industry publications. Francisco holds various cryptocurrencies.

Featured image via Unsplash.

The post FTX recovers $5 billion of liquid assets, SEC charges Gemini and Genesis, and the crypto market bounces back appeared first on CityAM.