By Jack Barnett

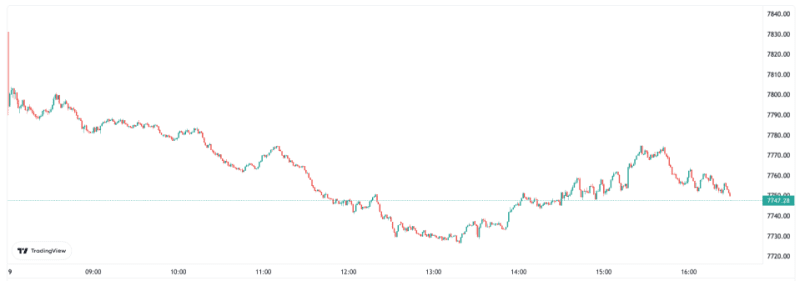

London’s FTSE 100 index registered one of its worst days since the turn of the year, pulling it away from its record high.

The capital’s premier index shed 1.07 per cent to drop to 7,747.28 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, fell 1.44 per cent to 19,605.38 points.

Interest rate and recession sensitive stocks dragged the FTSE 100 lower today.

House builders Persimmon collapsed 5.55 per cent, while Berkeley Group and Taylor Wimpey lost more than 3.8 per cent.

Worries over house prices tumbling intensified today after new figures from the RICS revealed demand is dropping in every region of England.

Interest rates have risen at the fastest pace in decades, climbing to 3.5 per cent from a record low in just under a year, pricing people out of the housing market.

FTSE 100 new year surge runs out of steam

Banks also dropped sharply due to concerns over an uptick in loan defaults and reserves to cope with failing loans amid a recession.

Similarly, the prospect of some of the globe’s biggest economies tipping into recession has clouded the outlook for oil demand, knocking BP and Shell in London today. The pair make up a big chunk of the FTSE 100, so movements in their share prices exert a strong influence on the index’s directions.

Demand for commodities tends to fall during recessions due to businesses reining in production.

Shell and BP fell despite a report from the International Energy Agency yesterday signalling 2023 could be the year world demand for oil hits its highest level ever, mainly due to China dismantling its zero Covid policy, suggesting oil prices may yet be on an upward march this year.

Richard Hunter, head of markets at interactive investor, said: “Markets succumbed to a bout of profit taking as fresh economic data reignited recessionary concerns.”

On the FTSE 250, cult boot maker Dr Martens shed nearly a third of its value after it said supply chain snarl ups have choked profits.

Greater optimism about the UK’s economic situation has propelled the FTSE 100 up more than three per cent so far in 2023.

That surge has lifted the index to near its highest level ever of more than 7,900 points set in May 2018. However, after falls yesterday and early today, the FTSE 100 is now around 1.5 per cent away from that milestone.

The pound strengthened nearly 0.2 per cent against the US dollar.

The yield on the benchmark 10-year UK gilt nudged lower despite investors betting the Bank of England will lift interest rates for the tenth time in a row on 2 February. Yields and prices move inversely.

The post FTSE 100 close: Persimmon and Taylor Wimpey pull index away from record high appeared first on CityAM.