By Nicholas Earl

Energy bills could fall even further than expected next winter – with the price cap dropping below £2,000 per year – saving the government billions of pounds in support packages for households and businesses.

Cornwall Insight has lowered its predictions for the price cap again amid plummeting gas prices – which have recently dropped to levels not seen since before Russia invaded Ukraine last February.

Its latest forecasts suggest the quarterly price cap – which establishes the maximum price for average energy usage – will fall to £3,208 per year from April, and then decline further to around £2,200 per year in the second half of the year.

The energy specialist expects the cap to slide to £2,201 per year in July, before rising slightly to £2,241 per year in September.

This means Cornwall Insight has slashed £600 from its winter price cap predictions in less than two weeks, when it predicted the mechanism would fall to £2,800 per year.

Reflecting market volatility, Cornwall Insight has also opted to include a 10 per cent swing in its cap predictions – with an upper and lower range.

This shows the cap potentially dropping to £1,981 per year in the third quarter, but also that it could rise as high as £2,421 per year.

Cornwall Insight’s predictions follow Investec’s estimates last week that the cap would slide to £2,500 per year – and its forecast that the Government could enjoy a £15bn saving in support costs.

The Office for Budget Responsibility priced in an £18bn cost for both support packages this year – however, this is now expected to be considerably lower – with Investec recently calculating a £2-3bn cost to the taxpayer.

Winter heat to ease price cap and energy bills

Mild winter weather and the European Union’s topping up of gas storage has eased concerns of a supply crunch, after previous fears of rolling blackouts across the continent.

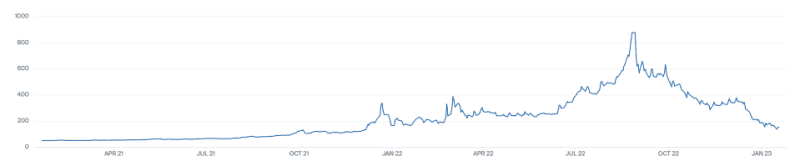

UK gas prices have been on sustained slide August when they peaked at a whopping £8.75 per therm, falling as low as £1.36 per therm this week.

For context, this is still above pre-crisis prices, with gas trading at 45-50p per therm two years ago – but is a huge fall on previous expectations.

It does also mean prices will dip below the maximum threshold for support – which will rise to £3,000 per year for support in the back half of the year – under the extended Energy Price Guarantee.

However, Cornwall Insight did highlight an upcoming difficult period for households in April, when the threshold will rise to £3,000 but the cap will be set at £3,200 per year.

This is because gas is typically bought on season-ahead contracts by suppliers, which are expected to hedge months in advance – meaning discounts take longer to kick in for customers than on the spot market.

Without the £400 discount from the Energy Bill Support Scheme, this will mean households will be coughing more to pay off their energy bills before the cap eases in July.

Prior to the energy crisis, the price cap hovered around £1,000-£1,200 per year for average use, with the £1,971 per year cap in April last year representing a record energy bill at the time.

The cap will above this level, even in the latest predictions.

In its analysis, Cornwall Insight said: “We anticipate a particular emphasis on what this means for lower income and lower middle-income households. Of course, by this stage the government may have developed more enduring reforms to tariffs to address these challenges.”

It also noted summer remains a “fair distance away” and that wholesale prices remain volatile, meaning the factors driving prices down could be offset by future headwinds.

Dr Craig Lowrey, principal consultant at Cornwall Insight, argued “some perspective must be maintained” with challenging headwinds remaining in the market.

He said: “As our price cap forecasts fall yet again, it is only natural that people will begin to assume our predictions will stay on a downward trajectory. But we really don’t have a precedent to look at to work out how the market will evolve in 2023.

…we really don’t have a precedent to look at to work out how the market will evolve in 2023.

“Wholesale gas prices in particular are searching out a floor and a ceiling level in novel circumstances where we in the UK and Europe are going to be more dependent on liquified natural gas than ever before.”

Jess Ralston, energy analyst at the advisory group Energy and Climate Intelligence Unit urged the government to spend any surplus funds on boosting energy efficiency which would drive down bills in the long-term.

She said: “The Energy Price Guarantee is now predicted to cost the Government nothing in the second half of this year, so there may be a pot of cash available that could be spent on making our leaky homes cheaper to run in the long term.

“Helping people to put in loft and wall insulation now could help to shield households from future gas price volatility, which is a feature of gas markets, while lowering bills.”

The post Energy bills could drop under £2,000 a year as Cornwall Insight slashes price cap prediction again appeared first on CityAM.