By Jack Barnett

The European aviation industry took centre stage last week, with low-cost carriers Easyjet and Wizz Air posting their financial results for the final three months of last year.

Both were encouraging, with each firm reporting revenue rises driven by Brits returning to the skies after pandemic travel restrictions.

Easyjet’s income jumped to £1.5bn after traveller numbers scaled to 17.5 million, while a near 60 per cent rise in passengers lifted Wizz Air’s revenues to €911.7m (£802.1m) revenue.

So why did Easyjet shares skyrocket but Wizz Air’s nosedived?

The pair’s results provide clues on how other airlines could fare, beginning with Ryanair tomorrow.

- Low-cost carriers are well-equipped to navigate the current macroeconomic environment

The first thing that pops out is that low-cost carriers are well-equipped to weather the current market conditions. They offer cheaper options, demand for which tends to rise during a recession.

Easyjet reported a 36 per cent increase in revenue per passenger seat to £68.47, as losses shrunk to £133m. Wizz Air, on the other hand, reported a €33.5m quarterly net profit, up from last year’s loss of €267.5m.

According to Easyjet’s chief executive Johan Lundgren, the positive results were engineered by people continuing to spend on holidays despite the cost of living crisis.

“We see a strong booking momentum, as customers prioritise spending on their holidays,” Lundgren told journalists on Wednesday. “And in this high cost of living environment, customers are looking for value.”

Both Easyjet and Wizz Air have a strong pipeline of bookings.

The former said Easter demand is currently 24 per cent higher than 2019 levels. The summer season is already at 60 per cent on the same measure.

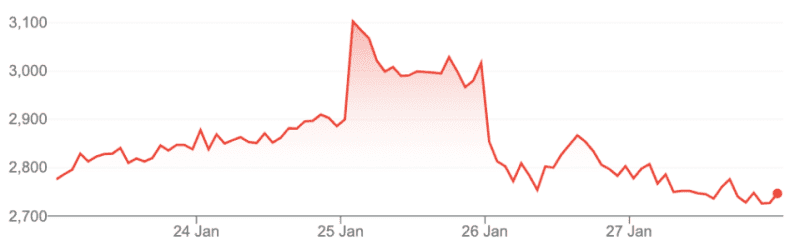

Wizz Air’s share price dropped nearly two per cent last week

Wizz Air will increase its capacity by 35 per cent in response to “booking volumes coming in ahead of 2022, which is in line with expectations.”

- Low-cost airlines are increasing ticket prices but people don’t seem to mind

According to Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown, airlines have hiked prices “without denting demand.”

“Overall, European short and medium haul aviation is holding up significantly better than feared and it appears consumers aren’t as spending-shy as thought,” she said.

Wizz Air said it continued to see evidence of a “solid fare environment as average fares are trading above 2019 and 2022 levels.”

“We remain very upbeat,” chief executive Jozsef Varadi told investors on Thursday. “We see that demand is there,” he added.

According to the chief executive, there was no sign of spending slowing down throughout the wider Wizz Air network as people are prepared to sacrifice “on other consumer items… other than travel.”

Varadi’s comments echoed Lundgren’s, who a day earlier said that, despite an increase in prices, people continue to purchase his airline’s tickets.

“People wouldn’t be buying tickets unless they thought it was great value for money,” he added.

- The future remains nevertheless uncertain

Despite their positive outlook, low-cost carriers are not fully insulated from the global economic downturn.

“The market does remain jittery to forward-looking estimates though, with Wizz Air’s valuation facing a knock as investors questioned how long this elevated demand can be sustained,” Lund-Yates said.

“The distance left on the runway before sentiment reverses is yet to be seen and could cause upset,” she added.

The post Three things we learnt from Easyjet and Wizz Air’s results appeared first on CityAM.