By Darren Parkin

Data from CryptoCompare shows that the price of Bitcoin moved mostly sideways throughout last week, starting off at $23,000 and dipping to a $22,500 low before moving strongly upward to $23,500. The cryptocurrency failed to remain at that level and has since dropped to $23,200.

Ethereum’s Ether, the second-largest cryptocurrency by market cap, traded upward at the beginning of the week, close to the $1,650 mark. It soon dropped to below $1,550, but it quickly recovered to now trade at $1580.

Over the past week, it was revealed that cryptocurrency adoption in emerging markets has kept on rising throughout the past year, even as prices plunged and the sector was affected by a plethora of bankruptcies.

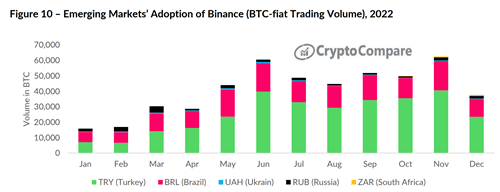

According to CryptoCompare’s 2023 Q1 Outlook report, Binance saw its market share grow over the past year as cryptocurrency adoption grew in emerging markets, where high inflation rates led to a rise in investments in digital assets in a bid to protect wealth from depreciating currencies.

Binance has been able to take advantage of this trend and is often the preferred choice for users in emerging markets. For instance, it has seen a significant increase in RUB and BRL volumes, with its BTC volumes on Binance rising by 232% and 72% respectively.

While people in these markets have kept on adopting digital assets, in the U.S. the Securities and Exchange Commission (SEC) has once again rejected a proposal to launch a Bitcoin spot exchange-traded fund (ETF) from Cathie Wood’s ARK Invest and global crypto ETF provider 21Shares.

The SEC said that ARK has not been able to show that the rules of its exchange are sufficient to protect investors from “fraudulent and manipulative acts and practices.” The SEC was this week criticized by the CEO of Grayscale Investments, Michael Sonnenshein, who said that he believes the regulator has been slowing down Bitcoin’s progress.

In a letter, Sonnenshein said he agreed with an assertion that the SEC was “late to the game” when it came to cryptocurrency regulation and preventing the collapse of FTX and criticized its “one-dimensional approach of regulation and enforcement.”

Another notable development came from credit-ratings giant Moody’s, which is said to be working on a scoring system for stablecoins as the asset class keeps growing. The system will include an analysis of up to 20 stablecoins based on the quality of attestations on the reserves backing them.

Tesla’s Bitcoin holdings remain unchanged

Over the week it was also revealed that the electric car market Tesla hasn’t bought or sold any Bitcoin in the last quarter of 2022, making it the second straight quarter in which the company’s BTC holdings remain unchanged. The value of Tesla’s Bitcoin holdings has dropped from $218 million to $184 million.

The decrease was caused by losses from the drop in Bitcoin’s value. At Q3 end, BTC was nearly $20,000, and at Q4 end, the crypto was around $16,500. Tesla didn’t alter its Bitcoin holdings during Q3 2022 but in Q2, it sold $936 million worth of BTC (about 75% of its holdings) to raise funds amid COVID-19 lockdown concerns in China.

Meanwhile, bankrupt cryptocurrency lender Celsius Network has revealed it’s considering issuing a token to repay creditors as part of a proposal to reorganize and exit bankruptcy as a regulated cryptocurrency firm.

During a video-court hearing, company attorney Ross Kwasteniet said that restructuring Celsius into a publicly-traded licensed company would generate more revenue for creditors, compared to selling its assets at current prices.

BlockFi, another bankrupt crypto lender, has been revealed to have had over $1.2 billion in assets tied to Sam Bankman-Fried’s FTX and Alameda Research, according to financials that were recently uploaded without the redactions.

The cryptocurrency lender filed for Chapter 11 bankruptcy in November, after the failure of FTX, which had planned to save the struggling company before its own collapse.

Ethereum developers bring staked ETH withdrawals closer to reality

Ethereum developers have moved closer to enabling withdrawals of $26 billion in staked Ethereum with the successful deployment of the first mainnet shadow fork for the Shanghai upgrade.

The Shanghai upgrade, set to launch in March, will allow stakers to withdraw their staked ETH on the network. It’s the first major update since the Ethereum Merge in September, which moved the network to Proof-of-Stake and allowed users to deposit ETH to become validators and receive rewards in newly minted ETH.

JP Morgan analysts believe this flexibility for stakers to withdraw funds anytime could mark a new chapter in staking for Coinbase, as locked staked ETH has been a disincentive to stake ETH in the past.

Francisco Memoria is a content creator at CryptoCompare who’s in love with technology and focuses on helping people see the value digital currencies have. His work has been published in numerous reputable industry publications. Francisco holds various cryptocurrencies.

The post Crypto adoption in emerging markets accelerates as SEC keeps rejecting Bitcoin ETFs appeared first on CityAM.